Home / Companies / KRO Profile

KRO Profile

|

|

| Price: | $0.150 | Open Rec: | No |  |

| Market Cap: | $15,584,337 | WC % of Mkt Cap: | 44% |

| Working Cap: | $6,843,657 | As of: | 12/31/2023 |

| Issued: | 103,895,580 | Insider %: | 32.4% | | Diluted: | 113,337,347 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Peter L. Gianulis (CEO), Gordon J. Bogden (Chair), Sean McGrath (CFO), Alan Roberts (VP EX), C. Warren Beil (Sec), |

SV Rating: Bottom-Fish Spec Value - as of December 27, 2023 SV Rating: Bottom-Fish Spec Value - as of December 27, 2023 |

| Last KRO Comment - Jul 7, 2023: KW Excerpt: Kaiser Watch July 7, 2023: Allegiant Gold Ltd (AUAU-V) |

| Recent News - Jan 17, 2024: To Commence Drilling On Three High Profile Targets In Eastside District |

|

![]() |

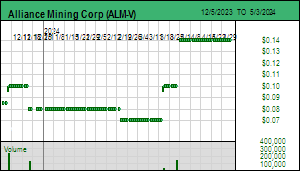

|

|

| Price: | $0.140 | Open Rec: | No |  |

| Market Cap: | $1,224,204 | WC % of Mkt Cap: | -243% |

| Working Cap: | ($2,979,421) | As of: | 9/30/2023 |

| Issued: | 8,744,316 | Insider %: | 4.9% | | Diluted: | 12,907,565 | Story Type: | Resource: Discovery Exploration |

| Key People: | Christopher R. Anderson (CEO), Scott Kent (CFO), Zeny Manalo (CFO), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Oct 16, 2020: 25:1 Rollback with no Name Change |

| Recent News - Mar 12, 2024: Corporate Update |

|

![]() |

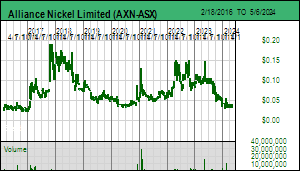

|

|

| Price: | $0.039 | Open Rec: | No |  |

| Market Cap: | $27,811,145 | WC % of Mkt Cap: | 23% |

| Working Cap: | $6,470,751 | As of: | 6/30/2023 |

| Issued: | 713,106,282 | Insider %: | 26.5% | | Diluted: | 796,106,282 | Story Type: | Resource: Producer |

| Key People: | Paul C. Kopejtka (MD), Peter R. Sullivan (Chair), Mark E. Pitts (Sec), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Jan 27, 2023: 1:1 Name Change from GME Resources Ltd (GME-ASX) |

|

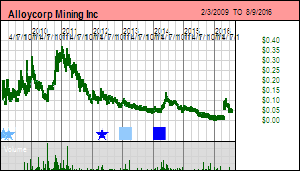

![]() |

|

|

| Price: | $0.175 | Open Rec: | No |  |

| Market Cap: | $36,402,998 | WC % of Mkt Cap: | 8% |

| Working Cap: | $2,923,000 | As of: | 6/30/2021 |

| Issued: | 208,017,134 | Insider %: | 32.7% | | Diluted: | 218,317,134 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Stephen Johnston (CEO), Anthony D. Lethlean (Chair), |

| Delisted: |

| Last Corporate Change - Jul 19, 2022: Takeover Bid at $0.18 - Acquired by Gandel Metals Pty Ltd for $0.18 per share. |

|

![]() |

|

|

| Price: | $2.250 | Open Rec: | No |  |

| Market Cap: | $459,716,432 | WC % of Mkt Cap: | 6% |

| Working Cap: | $26,053,000 | As of: | 12/31/2011 |

| Issued: | 204,318,414 | Insider %: | 30.2% | | Diluted: | 209,514,244 | Story Type: | Resource: Producer |

| Key People: | Mark Caruso (CEO), Randy Buffington (COO), Peter Torre (Sec), |

| Delisted: Allied Gold Mining PLC is an Australian gold producer that listed on the TSX on November 16, 2009. Allied's flagship is the 100-per-cent-owned Simberi oxide gold project which is situated on Simberi Island, the northernmost island of the Tabar Islands group located in the New Ireland province of eastern Papua New Guinea.The company has additional exploration project on the adjacent Tatau and Big Tabar Islands. In 2008-09, Allied Gold produced 80,000 gold ounces at cash costs of (US)$490, and forecasts production to increase to an 100,000 ounces for the fiscal year 2009-10. Allied Gold intends to ramp up total gold production to a further 200,000 ounces by 2013. Allied Gold consolidated its stock 6:1 effective June 30, 2011. In June 2012 the company agreed to be acquired by St. Barbara Ltd. For $1.025 (Australian) in cash and 0.8 St. Barbara share per Allied Gold share. At the time of announcement this represented roughly $2.18 per Allied share, around $450 million on a transaction basis, for the company's gold assets. |

| Last Corporate Change - Sep 7, 2012: Takeover Bid at $2.25 - In June 2012 the company agreed to be acquired by St. Barbara Ltd. For $1.025 (Australian) in cash and 0.8 St. Barbara share per Allied Gold share. At the time of announcement this represented roughly $2.18 per Allied share, around $450 million on a transaction basis, for the company's gold assets |

| Recent News - Mar 18, 2014: AIGOF Inactive, OTC Deletion Eff. 03/17/2014 |

|

![]() |

|

|

| Price: | $1.080 | Open Rec: | No |  |

| Market Cap: | $135,473,403 | WC % of Mkt Cap: | 128% |

| Working Cap: | $173,405,000 | As of: | 9/30/2014 |

| Issued: | 125,438,336 | Insider %: | 50.6% | | Diluted: | 136,438,336 | Story Type: | Resource: Producer |

| Key People: | Randy Buffington (CEO), Robert M. Buchan (Chair), David Flint (VP EX), |

| Delisted: Allied Nevada Gold is a spin-off of Vista Gold holding Vista's former Nevada properties, with the past-producing Hycroft Mine as its flagship. Allied Nevada listed on the TSX on May 10, 2007, and is led by Chairman Bob Buchan, formerly of Kinross Gold. Allied Nevada resumed production at Hycroft in 2009, with an initial mine plan calling for production of 100,000 gold ounces annually over a seven year mine life from a heap leach facility. During 2010 the company is considering milling Hycroft's oxide mineralizion, in an effort to increase recoveries from the historic 56% Au leach recovery. During 2011 Allied Nevada expects to complete a feasiblity study evaluating the potential to recover the sulfide mineralization at Hycroft. Sales in 2011 were 88,191 gold ounces and 372,000 silver ounces, with cash costs of $488 per gold ounce net of byproduct credits. For 2012 production has been forecast to be in the range of 180,000 to 220,000 ounces of gold and 750,000 to 850,000 ounces of silver, with adjusted cash costs expected to be in the range of $475 to $495 per gold ounce net of silver credits. |

| Last Corporate Change - Apr 16, 2018: Defunct Delisting - |

| Recent News - Jul 8, 2015: Suspends Mining Operations And Shifts Focus To Process Operations And Mill Demonstration Plant |

|

![]() |

|

|

| Price: | $0.054 | Open Rec: | No |  |

| Market Cap: | $178,519,623 | WC % of Mkt Cap: | 10% |

| Working Cap: | $17,109,377 | As of: | 6/30/2023 |

| Issued: | 3,305,918,943 | Insider %: | 3.9% | | Diluted: | 3,455,425,500 | Story Type: | Resource: Discovery Exploration |

| Key People: | John Main (CEO), |

SV Rating: Unrated SV Rating: Unrated |

|

![]() |

|

|

| Price: | $8.860 | Open Rec: | No |  |

| Market Cap: | $5,649,646,212 | WC % of Mkt Cap: | 12% |

| Working Cap: | $675,851,000 | As of: | 6/30/2023 |

| Issued: | 637,657,586 | Insider %: | 7.7% | | Diluted: | 641,627,146 | Story Type: | Resource: Producer |

| Key People: | Martin P. de Solay (MD), Peter Coleman (Chair), Robert Hubbard (Chair), Hersen Porta (COO), Rick Anthon (Sec), Neil Kaplan (Sec), |

| Delisted: Orocobre is an Australia-based lithium developer that listed on the TSX in June 2010. Orocobre's flagship is its Salar de Olaroz lithium potassium

brine project where in October 2009 the company reached a joint venture agreement where Toyota Tusho Corporation agreed to spend $4.5 million to complete a feasiblity study on the project, at which time it would have the option of acquiring a 25% interest in the project for a cash payment equal to 25% of the project's net present value and by arranging debt financing for a minimum of 60% of project capex requirements. In August 2012 the company announced it would be acquiring Borax Argentina from Rio Tinto, which has annual revenue of approximately $23-million (U.S.) and annual production of approximately 35,000 tonnes of boron-based products and mineral concentrates, for $8.5 million. |

| Last Corporate Change - Dec 21, 2023: Plan of Arrangement at $8.91 |

| Last KRO Comment - Aug 11, 2023: KW Excerpt: Kaiser Watch August 11, 2023: Allkem Limited (AKE-T) |

| Recent News - Dec 28, 2023: COMEX approval granted for James Bay |

|

![]() |

|

|

| Price: | $0.045 | Open Rec: | No |  |

| Market Cap: | $3,330,413 | WC % of Mkt Cap: | -5,138% |

| Working Cap: | ($171,104,635) | As of: | 3/31/2016 |

| Issued: | 74,009,172 | Insider %: | 333.1% | | Diluted: | 74,009,172 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | |

| Delisted: Avanti, led by President and CEO Craig J. Nelson and backed by Resource Capital Fund, is focused on developing the prefeasibility stage Kitsault molybdenum project in British Columbia. A December 2008 preliminary economic assessment completed at the past-producing Kitsault mine suggested a mine capable of producing approximately 25 million pounds of molybdenum per year over a 15-year mine life, at a cash cost of less than $6 per pound. Beyond its flagship project, Avanti has announced its intensions to acquire advanced molybdenum prospects and move them toward development, to purchase byproduct molybdenum production streams from copper producers, and to become a consolidator in the junior molybdenum market. |

| Last Corporate Change - Aug 9, 2016: Takeover Bid at $0.05 - Resource Capital Fund IV LP, owner of 90% of the stock and a major creditor privatized Alloycorp by paying $0.05 per share to minority shareholders. |

| Recent News - Mar 6, 2023: Appoints Peter Mah as Interim Chief Executive Officer |

|

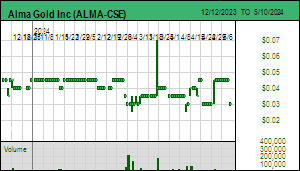

![]() |

|

|

| Price: | $0.030 | Open Rec: | No |  |

| Market Cap: | $391,187 | WC % of Mkt Cap: | -138% |

| Working Cap: | ($540,563) | As of: | 11/30/2023 |

| Issued: | 13,039,563 | Insider %: | 21.8% | | Diluted: | 19,948,263 | Story Type: | Resource: Discovery Exploration |

| Key People: | Gregory Isenor (CEO), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Jun 30, 2022: 10:1 Rollback with no Name Change |

| Recent News - Apr 3, 2024: Closes Debt Settlement |

|

![]() |

|

|

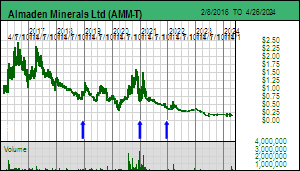

| Price: | $0.175 | Open Rec: | No |  |

| Market Cap: | $24,013,746 | WC % of Mkt Cap: | 20% |

| Working Cap: | $4,830,735 | As of: | 12/31/2023 |

| Issued: | 137,221,408 | Insider %: | 3.8% | | Diluted: | 158,585,254 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Morgan J. Poliquin (CEO), J. Duane Poliquin (Chair), Korm Trieu (CFO), Douglas McDonald (VP CD), |

SV Rating: Bottom-Fish Spec Value - as of December 14, 2021 SV Rating: Bottom-Fish Spec Value - as of December 14, 2021 |

| Last Corporate Change - Jul 31, 2015: Dividend in Specie - Spin out of Almadex Minerals Ltd on basis of 0.6 Almadex for 1 Almaden. |

| Last KRO Comment - Aug 17, 2010: Quick Note: Almaden Minerals Ltd (AMM-T) |

| Recent News - Apr 5, 2024: Confirms Delisting from NYSE American Stock Exchange and Listing on OTCQB Marketplace |

|

![]() |

|

|

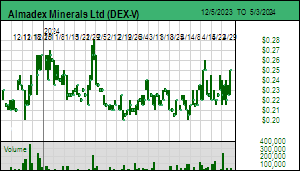

| Price: | $0.230 | Open Rec: | No |  |

| Market Cap: | $14,031,827 | WC % of Mkt Cap: | 130% |

| Working Cap: | $18,248,346 | As of: | 9/30/2023 |

| Issued: | 61,007,944 | Insider %: | 6.7% | | Diluted: | 72,091,944 | Story Type: | Resource: Discovery Exploration |

| Key People: | Morgan J. Poliquin (CEO), J. Duane Poliquin (Chair), Korm Trieu (CFO), Douglas McDonald (VP CD), |

SV Rating: Bottom-Fish Spec Value - as of October 18, 2023 SV Rating: Bottom-Fish Spec Value - as of October 18, 2023 |

| Recent News - Apr 16, 2024: Update on Three Epithermal Gold Silver Prospects in Nevada, USA |

|

![]() |

|

|

| Price: | $0.620 | Open Rec: | No |  |

| Market Cap: | $145,010,974 | WC % of Mkt Cap: | -21% |

| Working Cap: | ($30,458,000) | As of: | 12/31/2023 |

| Issued: | 233,888,668 | Insider %: | 56.4% | | Diluted: | 269,140,882 | Story Type: | Resource: Producer |

| Key People: | M. Lewis Black (CEO), Mark Gelmon (CFO), Marion McGrath (Sec), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Jun 1, 2018: New Exchange Listing |

| Recent News - Apr 22, 2024: Closes Additional Tranches of Private Placement |

|

![]() |

|

|

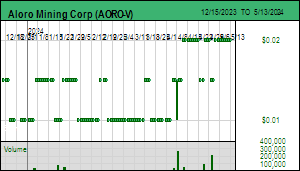

| Price: | $0.020 | Open Rec: | No |  |

| Market Cap: | $1,154,585 | WC % of Mkt Cap: | -132% |

| Working Cap: | ($1,527,961) | As of: | 9/30/2023 |

| Issued: | 57,729,263 | Insider %: | 27.0% | | Diluted: | 60,476,263 | Story Type: | Resource: Discovery Exploration |

| Key People: | Thomas A. Doyle (CEO), David Cross (CFO), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Feb 21, 2018: 1:1 Name Change from Wolverine Minerals Corp (WLV-V) |

| Recent News - Aug 25, 2023: Cancels Quitovac Option |

|

![]() |

|

|

| Price: | $0.385 | Open Rec: | No |  |

| Market Cap: | $4,191,791 | WC % of Mkt Cap: | -32% |

| Working Cap: | ($1,357,567) | As of: | 9/30/2011 |

| Issued: | 10,887,770 | Insider %: | 54.2% | | Diluted: | 11,436,770 | Story Type: | Resource: Discovery Exploration |

| Key People: | Nazrul Islam (CEO), Robin Chan (CFO), |

| Delisted: Alpetro, led by President and CEO Nazrul Islam, is a virtually inactive shell that has minor interests in several oil and gas properties in Alberta with nominal production. Was delisted on December 5, 2011 after a $0.39 per share takeover bid from Big Coulee Resources Ltd. |

| Last Corporate Change - Dec 5, 2011: Takeover Bid at $0.39 - |

|

![]() |

|

|

| Price: | $0.245 | Open Rec: | No |  |

| Market Cap: | $21,862,542 | WC % of Mkt Cap: | 0% |

| Working Cap: | $72,436 | As of: | 6/30/2023 |

| Issued: | 89,234,865 | Insider %: | 7.7% | | Diluted: | 131,747,397 | Story Type: | Resource: Discovery Exploration |

| Key People: | Darryl Jones (CEO), Sean Kingsley (VP CD), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Jan 4, 2022: 1:1 Name Change from Prophecy Potash Corp (NUGT-CSE) |

| Recent News - Feb 21, 2024: CSE Bulletin: Consolidation Alpha Copper Corp. (ALCU) |

|

![]() |

|

|

| Price: | $0.045 | Open Rec: | No |  |

| Market Cap: | $1,416,949 | WC % of Mkt Cap: | 90% |

| Working Cap: | $1,277,224 | As of: | 4/30/2015 |

| Issued: | 31,487,748 | Insider %: | 4.4% | | Diluted: | 45,904,802 | Story Type: | Resource: Discovery Exploration |

| Key People: | Benjamin Ainsworth (CEO), Michael Gunning (Chair), Kurt Bordian (CFO), |

| Delisted: Alpha Exploration Inc is the successor to Alpha Minerals, following that company's acquisition by its joint venture partner Fission Uranium in order to acquire Alpha's 50% interest in the Patterson Lake South uranium exploration discovery in the Athabasca Basin. Following the acquisition, Alpha Exploration is headed by same management group of CEO and President Ben Ainsworth and Chairman Michael Gunning, and holds Alpha's non-core property assets, including the Hook, Bridle Lake, and Donna uranium exploration properties. |

| Last Corporate Change - Sep 25, 2015: Plan of Arrangement at $0.05 |

| Recent News - Apr 26, 2024: Final Assay Results Including 5m @ 11.03 g/t Gold at Aburna |

|

![]() |

|

|

| Price: | $0.840 | Open Rec: | No |  |

| Market Cap: | $55,094,184 | WC % of Mkt Cap: | 1% |

| Working Cap: | $375,023 | As of: | 9/30/2023 |

| Issued: | 65,588,314 | Insider %: | 65.8% | | Diluted: | 76,782,292 | Story Type: | Resource: Discovery Exploration |

| Key People: | Michael Hopley (CEO), Christopher Van Der Westhuyzen (CFO), |

SV Rating: Unrated SV Rating: Unrated |

|

![]() |

|

|

| Price: | $1.090 | Open Rec: | No |  |

| Market Cap: | $935,008,626 | WC % of Mkt Cap: | 1% |

| Working Cap: | $12,729,588 | As of: | 6/30/2023 |

| Issued: | 857,806,079 | Insider %: | 30.1% | | Diluted: | 869,806,079 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Rimas Kairaitis (MD), Norman A. Seckold (Chair), Peter J. Nightingale (CFO), Richard Edwards (Sec), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Dec 4, 2018: 1:1 Name Change from Collerina Cobalt Ltd (CLL-ASX) |

|

![]() |

|

|

| Price: | $0.930 | Open Rec: | No |  |

| Market Cap: | $74,957,106 | WC % of Mkt Cap: | 54% |

| Working Cap: | $40,186,419 | As of: | 3/31/2022 |

| Issued: | 80,599,039 | Insider %: | 3.7% | | Diluted: | 147,084,197 | Story Type: | Resource: Discovery Exploration |

| Key People: | Brad Nichol (CEO), David Hodge (Pres), Sean Charland (Sec), |

| Delisted: Prima Diamond Corp, led by CEO and President Robert Bick, changed its name from Prima Fluorspor in July 2014. The company has acquired options on the Munn Lake and Godspeed Lake diamond prospects in Canada's Northwest Territories. |

| Last Corporate Change - Sep 19, 2022: Voluntary Delisting - Relisted on the NEO Exchange. |

| Recent News - Dec 19, 2023: Tecpetrol Completes the Privatization of Alpha Lithium |

|

![]() |

|