Home / Companies / KRO Profile

KRO Profile

|

|

| Price: | $0.048 | Open Rec: | No |  |

| Market Cap: | $18,220,884 | WC % of Mkt Cap: | 10% |

| Working Cap: | $1,769,376 | As of: | 6/30/2023 |

| Issued: | 379,601,756 | Insider %: | 21.2% | | Diluted: | 424,601,756 | Story Type: | Resource: Discovery Exploration |

| Key People: | Yaxi Zhan (MD), Richard Hill (Chair), Deborah Ho (Sec), |

SV Rating: Unrated SV Rating: Unrated |

|

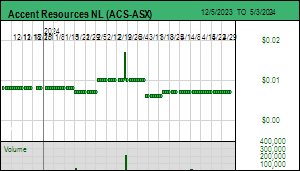

![]() |

|

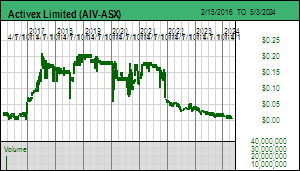

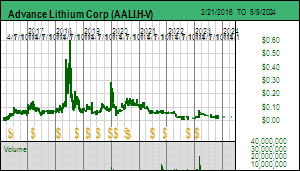

|

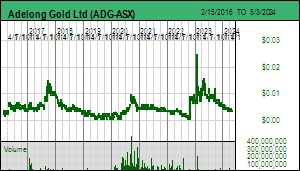

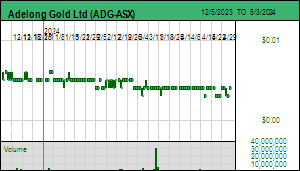

| Price: | $0.007 | Open Rec: | No |  |

| Market Cap: | $3,311,891 | WC % of Mkt Cap: | 217% |

| Working Cap: | $7,176,985 | As of: | 6/30/2023 |

| Issued: | 473,127,283 | Insider %: | 35.9% | | Diluted: | 473,127,283 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Dian Zhou He (Chair), Yuzi (Albert) Zhou (Chair), Robert Allen (Sec), |

SV Rating: Unrated SV Rating: Unrated |

|

![]() |

|

|

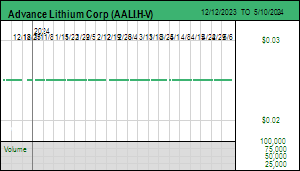

| Price: | $0.095 | Open Rec: | No |  |

| Market Cap: | $7,209,303 | WC % of Mkt Cap: | -7% |

| Working Cap: | ($503,185) | As of: | 9/30/2018 |

| Issued: | 75,887,400 | Insider %: | 10.7% | | Diluted: | 96,324,564 | Story Type: | Non-Resource: Undefined |

| Key People: | Steve Levely (CEO), Reinis N. Sipols (COO), |

SV Rating: Unrated: Ackroo Inc (AKR-V) is no longer involved in the resource sector and consequently its information is no longer being updated.(see Profile for full Overview) SV Rating: Unrated: Ackroo Inc (AKR-V) is no longer involved in the resource sector and consequently its information is no longer being updated.(see Profile for full Overview) |

| Last Corporate Change - Dec 9, 2014: 10:1 Rollback with no Name Change |

| Recent News - Apr 26, 2024: Looks to Appoint Chief Financial Officer |

|

![]() |

|

|

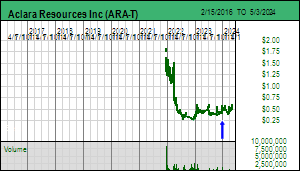

| Price: | $0.495 | Open Rec: | No |  |

| Market Cap: | $80,839,162 | WC % of Mkt Cap: | 36% |

| Working Cap: | $28,897,000 | As of: | 12/31/2023 |

| Issued: | 163,311,439 | Insider %: | 39.4% | | Diluted: | 167,440,087 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Ramon Barua (CEO), Eduardo Hochschild (Chair), |

SV Rating: Bottom-Fish Spec Value - as of December 18, 2023 SV Rating: Bottom-Fish Spec Value - as of December 18, 2023 |

| Recent News - Apr 17, 2024: The Closing of the Transaction with Cap and the Receipt of Initial Payment of Us$9.7M as Part of the US$29.1M Strategic Investment |

|

![]() |

|

|

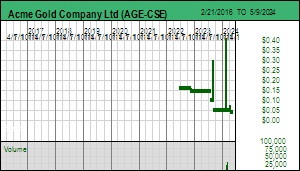

| Price: | $0.040 | Open Rec: | No |  |

| Market Cap: | $523,800 | WC % of Mkt Cap: | 16% |

| Working Cap: | $83,027 | As of: | 12/31/2023 |

| Issued: | 13,095,001 | Insider %: | 44.5% | | Diluted: | 20,990,001 | Story Type: | Resource: Discovery Exploration |

| Key People: | Donald Crossley (CEO), |

SV Rating: Unrated SV Rating: Unrated |

| Recent News - Apr 19, 2024: Incentive Stock Option Granted |

|

![]() |

|

|

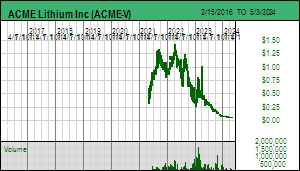

| Price: | $0.060 | Open Rec: | No |  |

| Market Cap: | $3,658,364 | WC % of Mkt Cap: | -1% |

| Working Cap: | ($38,124) | As of: | 12/31/2023 |

| Issued: | 60,972,727 | Insider %: | 0.0% | | Diluted: | 73,291,070 | Story Type: | Resource: Discovery Exploration |

| Key People: | Stephen Hanson (CEO), Zahara Kanji-Aquino (CFO), |

SV Rating: Unrated SV Rating: Unrated |

| Recent News - Mar 14, 2024: Files NI 43 101 Technical Report Including Lithium Resource Estimate for Clayton Valley Lithium Brine Project |

|

![]() |

|

|

| Price: | $0.007 | Open Rec: | No |  |

| Market Cap: | $1,240,599 | WC % of Mkt Cap: | 30% |

| Working Cap: | $371,120 | As of: | 12/31/2019 |

| Issued: | 177,228,401 | Insider %: | 75.3% | | Diluted: | 177,228,401 | Story Type: | Resource: Discovery Exploration |

| Key People: | Grant Thomas (MD), Min Yang (Chair), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Nov 28, 2016: 1:1 Rollback with no Name Change |

|

![]() |

|

|

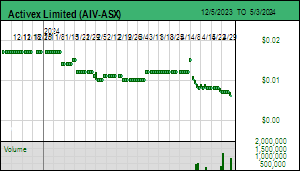

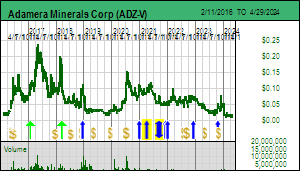

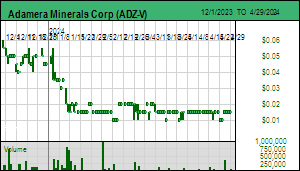

| Price: | $0.015 | Open Rec: | No |  |

| Market Cap: | $3,442,094 | WC % of Mkt Cap: | 6% |

| Working Cap: | $207,720 | As of: | 9/30/2023 |

| Issued: | 229,472,928 | Insider %: | 5.9% | | Diluted: | 291,034,260 | Story Type: | Resource: Discovery Exploration |

| Key People: | Mark Kolebaba (CEO), Mark T. Brown (CFO), Janice Davies (Sec), |

SV Rating: Bottom-Fish Spec Value - as of October 16, 2023: Adamera Minerals Corp has had Bottom-Fish Spec Value ratings assigned below $0.10 multiple times since late 2013 after Mark Kolebaba merged his two uranium and diamond companies and pivoted to gold exploration in northeastern Washington, a former mining region abandoned by juniors and majors alike. But the stock rarely made it above $0.10 and only briefly above $0.20 in 2017 because Adamera never pulled a clear cut discovery hole and there was always a wall of paper from clip and flippers who took a series of cheap unit private placements. The first exploration wave ran from 2013-2015 and focused on epithermal plays like Empire and Flag Hill on the western margin of the Republic Graben, and to a lesser extent on the eastern margin where a group of claims collectively known as Cooke Mountain had potential for skarn hosted gold deposits. The second wave ran from 2016-2019 and was focused on Cooke Mountain where Adamera had undertaken a regional Mag-EM survey to identify new targets premised on the model that the gold bearing sulphide deposits, which would be conductive, were associated with magnetite in the skarns formed in limestone near the gold mineralization. During 2020, a year when Adamera got no drilling done because of the covid pandemic, there were three important developments that became the basis for making Adamera a Bottom-Fish Spec Value rated 2021 Favorite at $0.10 effective April 1, 2021. These three developments are the arrival of Hochschild Mining as a farm-in partner for the Cooke Mountain project where drilling will begin in late April 2021, the assembly of the Buckhorn 2.0 property around the original Buckhorn Mine (1.3 million oz at 12 g/t gold) still owned by Kinross, and the arrival of a new audience linked to Crown Resources Corp (absorbed by Kinro...(see Profile for full Overview) SV Rating: Bottom-Fish Spec Value - as of October 16, 2023: Adamera Minerals Corp has had Bottom-Fish Spec Value ratings assigned below $0.10 multiple times since late 2013 after Mark Kolebaba merged his two uranium and diamond companies and pivoted to gold exploration in northeastern Washington, a former mining region abandoned by juniors and majors alike. But the stock rarely made it above $0.10 and only briefly above $0.20 in 2017 because Adamera never pulled a clear cut discovery hole and there was always a wall of paper from clip and flippers who took a series of cheap unit private placements. The first exploration wave ran from 2013-2015 and focused on epithermal plays like Empire and Flag Hill on the western margin of the Republic Graben, and to a lesser extent on the eastern margin where a group of claims collectively known as Cooke Mountain had potential for skarn hosted gold deposits. The second wave ran from 2016-2019 and was focused on Cooke Mountain where Adamera had undertaken a regional Mag-EM survey to identify new targets premised on the model that the gold bearing sulphide deposits, which would be conductive, were associated with magnetite in the skarns formed in limestone near the gold mineralization. During 2020, a year when Adamera got no drilling done because of the covid pandemic, there were three important developments that became the basis for making Adamera a Bottom-Fish Spec Value rated 2021 Favorite at $0.10 effective April 1, 2021. These three developments are the arrival of Hochschild Mining as a farm-in partner for the Cooke Mountain project where drilling will begin in late April 2021, the assembly of the Buckhorn 2.0 property around the original Buckhorn Mine (1.3 million oz at 12 g/t gold) still owned by Kinross, and the arrival of a new audience linked to Crown Resources Corp (absorbed by Kinro...(see Profile for full Overview) |

| Last Corporate Change - Feb 19, 2013: 5:1 Name Change from Uranium North Resources Corp (UNR-V) |

| Last KRO Comment - Nov 22, 2023: KW Excerpt: Kaiser Watch November 22, 2023: Adamera Minerals Corp (ADZ-V) |

| Recent News - Apr 24, 2024: BLM Approval to Drill Multiple Targets on Buckhorn 2.0 Gold Project |

|

![]() |

|

|

| Price: | $0.175 | Open Rec: | No |  |

| Market Cap: | $4,455,936 | WC % of Mkt Cap: | 104% |

| Working Cap: | $4,638,574 | As of: | 2/26/2015 |

| Issued: | 25,462,490 | Insider %: | 76.9% | | Diluted: | 25,462,490 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Leonard J. Sojka (CEO), |

| Delisted: Adanac Molybdenum Corporation is the owner of the Ruby Creek molybdenum project located near Atlin in northern British Columbia for which a measured and indicated 43-101 resource of 407.9 million tonnes of 0.067% Mo was reported in 2009. Ruby Creek was explored by various parties from 1966 until the claims were allowed to lapse in the late nineties. They were restaked in 2002 and acquired by Larry Reaugh's Adanac which initiated a feasibility study in 2004 when molybdenum prices underwent a tenfold price gain to levels above $30/lb where they stayed until the financial collapse in late 2008. Adanac received approval in late 2007 to develop a 23,000 tpd open pit mine at a cost of $640 million, toward which it secured senior note bridge financing of $80 million in May 2008, the proceeds of which were used to order mine equipment. On December 19, 2008 Adanac filed for bankruptcy protection and undertook a restructuring plan completed on February 28, 2011 which involved a 150:1 rollback and the issue of new stock which resulted in note holders owning 92% of Adanac, unsecured creditors 5%, and existing shareholders 3% of the resulting 25,462,544 issued stock. Larry Reaugh's team has been replaced by representatives of the resulting key shareholders. All development permits remain valid, though a federal permit for a tailings pond is still needed. All development work is on hold while management awaits better molybdenum prices and seeks the joint venture or sale of the Ruby Creek project. |

| Last Corporate Change - Dec 16, 2015: Takeover Bid at $0.18 - WBOX acquired 100% of Adanc's shares under a plan of arrangement. Adanac distributed $4.27 million in cash to Adanac shareholders as a return of capital for 18.37 cents per Adanac share. |

| Last KRO Comment - Feb 7, 2008: Tracker 2008-08: Creston Moly infill drill results boost grade optimism |

| Recent News - Jan 28, 2016: OSC Re Adanac Molybdenum Corp € S 1 (10) (a) (ii) |

|

![]() |

|

|

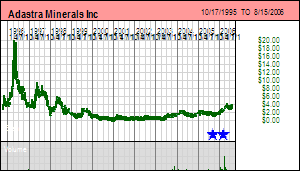

| Price: | $3.610 | Open Rec: | No |  |

| Market Cap: | $294,320,105 | WC % of Mkt Cap: | 2% |

| Working Cap: | $5,592,542 | As of: | 4/30/2006 |

| Issued: | 81,529,115 | Insider %: | 15.3% | | Diluted: | 83,219,237 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Timothy Read (CEO), Bernard Vavala (Chair), Bernard Pryor (COO), |

| Delisted: Adastra Minerals was acquired by First Quantum Minerals through a takeover bid that offered $0.265 and 1 First Quantum share for 14.76 Adastra shares. Adastra's shares were delisted on August 15, 2006. Adastra's flagship project was the copper-cobalt Kolwezi tailings project in Congo on whcih Adastra was completing a feasibility study. |

| Last Corporate Change - Aug 14, 2006: Takeover Bid at $3.61 - Delisted pursuant to hostile / friendly Cash bid by First Quantum at $3.61 worth $300,421,005 involving $2.92 per Adastra share or 1 FM share per 14.76 AAA shares + $.265 |

| Last KRO Comment - Jun 4, 1995: Excerpt from KBFR May-June 1995 |

|

![]() |

|

|

| Price: | $0.003 | Open Rec: | No |  |

| Market Cap: | $1,788,967 | WC % of Mkt Cap: | 142% |

| Working Cap: | $2,544,476 | As of: | 6/30/2023 |

| Issued: | 596,322,292 | Insider %: | 55.8% | | Diluted: | 639,572,288 | Story Type: | Resource: Discovery Exploration |

| Key People: | Ian Hastings (Chair), Andrew Draffin (Sec), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Oct 27, 2022: 10:1 Name Change from 3D Resources Ltd (DDD-ASX) |

|

![]() |

|

|

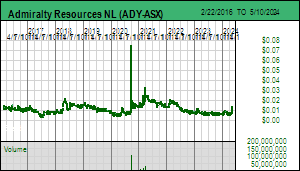

| Price: | $0.005 | Open Rec: | No |  |

| Market Cap: | $3,386,057 | WC % of Mkt Cap: | -1% |

| Working Cap: | ($46,538) | As of: | 9/30/2023 |

| Issued: | 677,211,441 | Insider %: | 81.9% | | Diluted: | 677,211,441 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Linda Kwan Lam (CEO), Yan Kim Po (Chair), Xiao Long Li (CFO), |

SV Rating: Unrated SV Rating: Unrated |

| Recent News - Mar 5, 2024: New Loan Agreement With Great Harvest |

|

![]() |

|

|

| Price: | $0.080 | Open Rec: | No |  |

| Market Cap: | $411,378 | WC % of Mkt Cap: | -163% |

| Working Cap: | ($672,085) | As of: | 4/30/2011 |

| Issued: | 5,142,226 | Insider %: | 5.9% | | Diluted: | 7,304,150 | Story Type: | Resource: Discovery Exploration |

| Key People: | Steven Tedesco (CEO), |

| Delisted: Led by CEO Steven Tedesco, Admiral Bay is focused on unconventional natural gas projects in the United States, where its flagship Ft. Scott project is located in Kansas.The company underwent a rollback in October 2010. After receiving a cease-trade order in December 2011, management announced in November 2012 that it would be winding down the company and selling remaining assets to pay creditors. Following the company's supension and transfer to the NEX in Jan 2013, the company was delisted from the NEX in October 2014 for failing to pay its quarterly filing fees. |

| Last Corporate Change - Oct 16, 2014: Defunct Delisting - |

| Recent News - Oct 16, 2014: Listing Maintenance Fee Delist |

|

![]() |

|

|

| Price: | $0.006 | Open Rec: | No |  |

| Market Cap: | $6,954,808 | WC % of Mkt Cap: | -38% |

| Working Cap: | ($2,609,153) | As of: | 12/31/2019 |

| Issued: | 1,159,134,699 | Insider %: | 52.8% | | Diluted: | 1,159,134,699 | Story Type: | Resource: Discovery Exploration |

| Key People: | Qing Zhong (CEO), Bin Li (Chair), Jarrod T. White (Sec), |

SV Rating: Unrated SV Rating: Unrated |

|

![]() |

|

|

| Price: | $4.330 | Open Rec: | No |  |

| Market Cap: | $1,180,991,444 | WC % of Mkt Cap: | 6% |

| Working Cap: | $71,694,852 | As of: | 12/31/2022 |

| Issued: | 272,746,292 | Insider %: | 0.0% | | Diluted: | 277,920,592 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Geraint Harris (CEO), Peter R. Bilbe (Chair), Robert Annett (VP EX), Sean Duffy (Sec), |

SV Rating: Unrated SV Rating: Unrated |

|

![]() |

|

|

| Price: | $0.025 | Open Rec: | No |  |

| Market Cap: | $972,476 | WC % of Mkt Cap: | -7% |

| Working Cap: | ($66,180) | As of: | 2/29/2020 |

| Issued: | 38,899,034 | Insider %: | 28.6% | | Diluted: | 56,573,619 | Story Type: | Resource: Discovery Exploration |

| Key People: | Allan Barry Laboucan (CEO), Marie Cupello (CFO), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Jan 29, 2024: Symbol Change |

| Last KRO Comment - Jan 11, 2011: Bottom-Fish Comment: Recommendation Strategy for Advance Gold Corp |

| Recent News - Jan 25, 2024: Transfer and New Addition to NEX, Symbol Change, Remain Suspended |

|

![]() |

|

|

| Price: | $0.023 | Open Rec: | No |  |

| Market Cap: | $13,341,014 | WC % of Mkt Cap: | 8% |

| Working Cap: | $1,116,809 | As of: | 12/31/2022 |

| Issued: | 580,044,068 | Insider %: | 16.2% | | Diluted: | 597,844,068 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Mark Sykes (CEO), Geoffrey Guild Hill (Chair), Ian H. Morgan (Sec), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Jun 15, 2022: 1:1 Name Change from Pacific American Holdings Ltd (PAK-ASX) |

|

![]() |

|

|

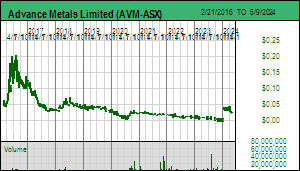

| Price: | $0.020 | Open Rec: | No |  |

| Market Cap: | $3,933,722 | WC % of Mkt Cap: | -378% |

| Working Cap: | ($14,850,494) | As of: | 12/31/2014 |

| Issued: | 196,686,104 | Insider %: | 14.9% | | Diluted: | 234,046,104 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Lei Guo (CEO), John C. Gingerich (Pres), Carina Da Mota (CFO), |

| Delisted: Advanced Exploration is led by President and CEO John Gingerich and focused on iron ore in Nunavat, where it has two projects, Roche Bay and Tuktu. In July 2010 the company announced a letter of intent for China-based Xinxing Pipes Group Co. Ltd to acquire a 19% interest in Advanced Exploration through a $0.25 private placement, and for the companies to jointly create project development plans that are to be financed through the XXP partnership for Advanced's properties. In September 2010 an agreement was reached for Xinxing Pipes to acquire 50% of the company's flagship Roche Bay project, where 550 million tonnes of indicated and inferred mineralization have been identified grading 26% Fe, by spending $20 million to complete a BFS, $30 million of working capital, and providing the necessary financing and development capital for AEI's Roche Bay project to a maximum of $1-billion. More recently, the company has acquired a significant land position on the Melville Peninsula on ground it considers highly prospective for nickel and copper. |

| Last Corporate Change - Feb 24, 2016: Defunct Delisting - Failure to pay Quarterly NEX Listing Maintenance Fee |

| Recent News - May 30, 2016: OSC Delinquent Filer; Annual Financial Statements |

|

![]() |

|

|

| Price: | $0.020 | Open Rec: | No |  |

| Market Cap: | $1,055,978 | WC % of Mkt Cap: | -59% |

| Working Cap: | ($618,047) | As of: | 9/30/2023 |

| Issued: | 52,798,906 | Insider %: | 20.5% | | Diluted: | 59,005,807 | Story Type: | Resource: Discovery Exploration |

| Key People: | James R. Atkinson (CEO), Andrew J. Ramcharan (Pres), Radovan Danilovsky (CFO), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Sep 26, 2023: 1:1 Name Change from Advance United Holdings Inc (AUHI-CSE) |

| Recent News - Apr 5, 2024: Closing of Private Placement |

|

![]() |

|

|

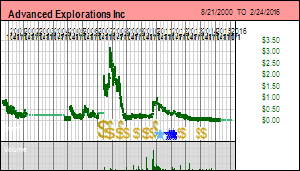

| Price: | $0.265 | Open Rec: | No |  |

| Market Cap: | $43,143,800 | WC % of Mkt Cap: | 4% |

| Working Cap: | $1,782,046 | As of: | 1/31/2020 |

| Issued: | 162,806,792 | Insider %: | 33.5% | | Diluted: | 166,906,792 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Callum Grant (CEO), Nick Demare (CFO), Miguel Peral (VP EX), |

| Delisted: |

| Last Corporate Change - Apr 21, 2020: Plan of Arrangement at $0.28 |

| Recent News - Apr 20, 2020: Plan of Arrangement, Delist |

|

![]() |

|