Home / Companies / KRO Profile

KRO Profile

|

|

| Price: | $0.315 | Open Rec: | No |  |

| Market Cap: | $25,262,204 | WC % of Mkt Cap: | 7% |

| Working Cap: | $1,645,917 | As of: | 1/31/2016 |

| Issued: | 80,197,474 | Insider %: | 4.5% | | Diluted: | 86,934,224 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Marco Gagnon (CEO), Stephane Le Bouyonnec (Chair), Khadija Abounaim (CFO), Jules Riopel (VP EX), |

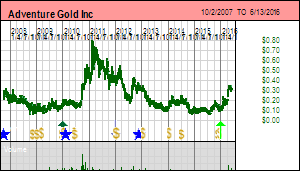

| Delisted: Adventure Gold, led by CEO and President Marco Gagnon, is an exploration company with a property portfolio focused on Canada's Abitibi Belt. The company's Beaufor West property is adjacent to the Beaufor Mine, a producing gold mine jointly operated by Richmont Mines and Louvem Mines. Other properties have been joint ventured with partners such as Agnico (Dubuisson) and Mazorro Resources (Lapaska) |

| Last Corporate Change - Jun 13, 2016: Plan of Arrangement at $0.32 |

| Recent News - Jul 20, 2016: GFK Amends Transaction With Adventure Gold To Purchase Properties |

|

![]() |

|

|

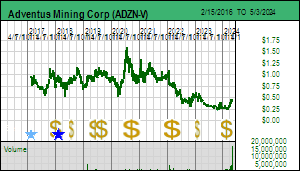

| Price: | $0.440 | Open Rec: | No |  |

| Market Cap: | $79,037,249 | WC % of Mkt Cap: | -15% |

| Working Cap: | ($11,836,000) | As of: | 9/30/2023 |

| Issued: | 179,630,112 | Insider %: | 21.9% | | Diluted: | 207,551,612 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Christian Kargl-Simard (CEO), Mark Wellings (Chair), Jason Dunning (VP EX), Frances Kwong (VP FI), Sam Leung (VP CD), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Jun 12, 2019: 1:1 Name Change from Adventus Zinc Corp (ADZN-V) |

| Recent News - Apr 26, 2024: Salazar Congratulates Silvercorp on Its Proposed Acquisition of Adventus |

|

![]() |

|

|

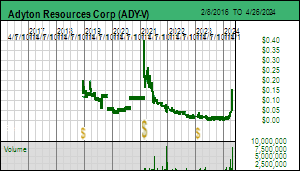

| Price: | $0.155 | Open Rec: | No |  |

| Market Cap: | $23,085,992 | WC % of Mkt Cap: | 0% |

| Working Cap: | $14,661 | As of: | 9/30/2023 |

| Issued: | 148,941,886 | Insider %: | 41.9% | | Diluted: | 159,179,830 | Story Type: | Resource: Discovery Exploration |

| Key People: | J. Sinton Spence (Chair), Timothy E. S. Crossley (Chair), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Feb 24, 2021: 2.62:1 Name Change from XIB I Capital Corp (XIB.P-V) |

| Recent News - Apr 26, 2024: Filing of Financial Statements and MD&A for the three and twelve months ended December 31, 2023 |

|

![]() |

|

|

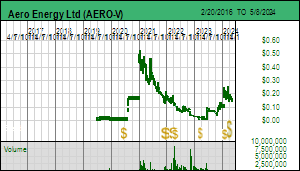

| Price: | $0.030 | Open Rec: | No |  |

| Market Cap: | $1,182,240 | WC % of Mkt Cap: | 4% |

| Working Cap: | $52,163 | As of: | 9/30/2014 |

| Issued: | 39,407,996 | Insider %: | 32.0% | | Diluted: | 60,512,992 | Story Type: | Resource: Discovery Exploration |

| Key People: | Eric Roth (CEO), Cesar Lopez (Chair), Stephanie Ashton (CFO), Thomas Henricksen (VP EX), |

| Delisted: Aegean Metals Group Inc, led by CEO and President Juan Villarzu, listed on the TSXV in November 2012. The company has a portfolio of exploration properties located along the Tethyan Porphyry Belt in Turkey. In September 2014 the company announced it had agreed to be acquired by AIM-listed Mariana Resources on the basis of 1.902 ordinary shares of Mariana for every one Aegean share held. This represents an approximate value of 6.25 cents per Aegean share, or slightly more than $2 million. |

| Last Corporate Change - Jan 20, 2015: Plan of Arrangement at $0.03 |

| Recent News - Feb 13, 2015: OSC Re Aegean Metals Group Inc |

|

![]() |

|

|

| Price: | $0.006 | Open Rec: | No |  |

| Market Cap: | $6,663,006 | WC % of Mkt Cap: | 6% |

| Working Cap: | $394,000 | As of: | 6/30/2023 |

| Issued: | 1,110,501,000 | Insider %: | 12.6% | | Diluted: | 1,147,301,000 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Fred Hess (MD), Lucy Rowe (Sec), |

SV Rating: Unrated SV Rating: Unrated |

|

![]() |

|

|

| Price: | $0.275 | Open Rec: | No |  |

| Market Cap: | $77,063,970 | WC % of Mkt Cap: | -32% |

| Working Cap: | ($24,301,000) | As of: | 12/31/2017 |

| Issued: | 280,232,617 | Insider %: | 26.1% | | Diluted: | 467,053,853 | Story Type: | Resource: Producer |

| Key People: | Andre Labuschagne (Chair), Robert Brainsbury (Sec), |

SV Rating: Unrated SV Rating: Unrated |

|

![]() |

|

|

| Price: | $0.140 | Open Rec: | No |  |

| Market Cap: | $2,025,874 | WC % of Mkt Cap: | 22% |

| Working Cap: | $450,828 | As of: | 10/31/2023 |

| Issued: | 14,470,526 | Insider %: | 4.8% | | Diluted: | 19,854,678 | Story Type: | Resource: Discovery Exploration |

| Key People: | Adrian Rothwell (CEO), Carson Halliday (CFO), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Feb 13, 2024: 1:1 Name Change from Angold Resources Ltd (AAU-V) |

| Recent News - Apr 16, 2024: Standard Uranium Reports on Recent Exploration Insights at the Sun Dog Project with Option Partner Aero Energy Ltd. |

|

![]() |

|

|

| Price: | $0.045 | Open Rec: | No |  |

| Market Cap: | $1,283,852 | WC % of Mkt Cap: | 224% |

| Working Cap: | $2,880,365 | As of: | 8/31/2018 |

| Issued: | 28,530,050 | Insider %: | 22.9% | | Diluted: | 32,817,325 | Story Type: | Non-Resource: Technology |

| Key People: | Blake Olafson (CEO), Vivian A. Katsuris (CFO), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Aug 1, 2023: 1:1 Name Change from Plymouth Rock Technologies Inc (PRT-CSE) |

| Recent News - Oct 25, 2018: Receives Conditional Approval For Change Of Business, Change Of Name And Symbol |

|

![]() |

|

|

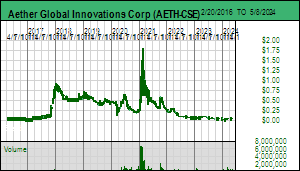

| Price: | $0.170 | Open Rec: | No |  |

| Market Cap: | $4,697,667 | WC % of Mkt Cap: | 75% |

| Working Cap: | $3,502,568 | As of: | 5/31/2019 |

| Issued: | 27,633,333 | Insider %: | 38.8% | | Diluted: | 45,528,060 | Story Type: | Resource: Discovery Exploration |

| Key People: | John Miniotis (CEO), Carlos Pinglo (VP FI), |

| Delisted: |

| Last Corporate Change - Dec 20, 2019: Plan of Arrangement at $0.17 |

| Recent News - Dec 19, 2019: AbraPlata Completes Plan Of Arrangement With Aethon |

|

![]() |

|

|

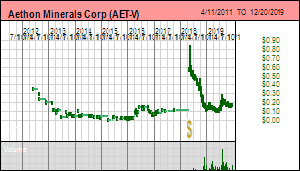

| Price: | $0.630 | Open Rec: | No |  |

| Market Cap: | $111,222,707 | WC % of Mkt Cap: | 2% |

| Working Cap: | $1,992,250 | As of: | 6/30/2005 |

| Issued: | 176,543,979 | Insider %: | 31.0% | | Diluted: | 176,543,979 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | David G. Netherway (CEO), Benoit La Salle (Chair), |

| Delisted: Afcan Mining, led by CEO David Netherway and Chairman Benoit La Salle had as it flagship the Tanjianshan gold development project in China before being acquired by Eldorado Mining in 2005 at $.44 per share, valuing Afcan's 85% interest in Tanjianshan at $79 million, or $75 per gold ounce based on Tanjianshan's measured, indicated, and inferred resource of 1.3 million ounces grading 4 grams per tonne. |

| Last Corporate Change - Sep 19, 2005: Takeover Bid at $0.63 - Delisted pursuant to friendly Cash bid by Eldorado Gold at $0.63 worth $113,628,163 involving 1 Eldorado share per 6.5 AFK shares |

|

![]() |

|

|

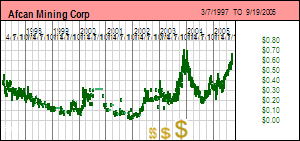

| Price: | $1.570 | Open Rec: | No |  |

| Market Cap: | $165,091,209 | WC % of Mkt Cap: | 45% |

| Working Cap: | $75,056,676 | As of: | 9/30/2013 |

| Issued: | 105,153,636 | Insider %: | 6.3% | | Diluted: | 111,044,134 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Luis Cabrita da Silva (CEO), David G. Netherway (Chair), |

| Delisted: Affero Mining Inc is the successor to African Aura Mining Inc which spun off its gold and diamond assets on April 13, 2011 as Aureus Mining Inc so that it could concentrate on developing its west African iron ore assets. Affero's flagship project is the Nkout iron deposit in southern Cameroon for which it completed a PEA in May 2012 which envisions scenarios producing 15 million tonnes of direct shipping ore (61.5% Fe sinter fines) annually, and 35 million tonnes. The 43-101 resource is 944 million tonnes of 32.7% iron indicated and 1.05 billion tonnes of 31.6% iron inferred over an 8.9 km strike. The project is located 330 km from the Kribi deep water port. A 516 km rail corridor has been proposed which will connect the port to the Mbarga iron project of ASX listed Sundance Resources Ltd and which would pass within 20 km of Nkout. Affero hopes to share in the construction cost of this railway proportional to its planned usage. Affero is proceeding with a prefeasibility study it hopes to complete in 2013. In 2011 Affero sold its 38.9% stake in the Putu iron deposit for $55 million which it received in April 2012. Affero is headed by CEO Luis Cabrita da Silva and chairman David Netherway, and guided by Geneva based founder Guido Pas, Affero's largest disclosed shareholder. In May 2013 Affero agreed to be acquired by International Mining and Infrastructure Corp. for 80 pence per share and a convertible loan, which together represented a $190 million valuation for the company. |

| Last Corporate Change - Dec 13, 2013: Plan of Arrangement at $1.54 |

| Recent News - Dec 19, 2013: Plan of Arrangement, Delist |

|

![]() |

|

|

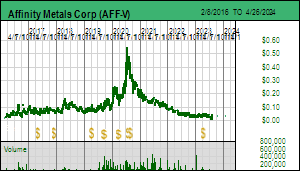

| Price: | $0.030 | Open Rec: | No |  |

| Market Cap: | $1,615,745 | WC % of Mkt Cap: | -23% |

| Working Cap: | ($364,373) | As of: | 12/31/2023 |

| Issued: | 53,858,165 | Insider %: | 20.0% | | Diluted: | 61,528,165 | Story Type: | Resource: Discovery Exploration |

| Key People: | Robert Edwards (CEO), Darren Blaney (CFO), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Mar 1, 2017: 1:1 Name Change from Acme Resources Inc (ARI-V) |

| Recent News - Feb 16, 2024: Grant of Stock Options |

|

![]() |

|

|

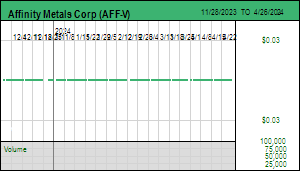

| Price: | $0.160 | Open Rec: | No |  |

| Market Cap: | $1,768,718 | WC % of Mkt Cap: | -13% |

| Working Cap: | ($223,689) | As of: | 8/31/2008 |

| Issued: | 11,054,489 | Insider %: | 148.9% | | Diluted: | 12,719,489 | Story Type: | Resource: Discovery Exploration |

| Key People: | Nick Brusatore (Chair), Daniel Barrette (Pres), |

| Delisted: Affinor Resources Inc moved from the TSXV on June 13, 2008 to the NEX board for failure to maintain the requirements for a TSX Venture Exchange Tier 2 company. The company did not trade after moving to the NEX, andon October 4, 2012 listed on the CNSX. In March 2014 the company, still listed on the renamed CSE, indicated it " plans to diversify into the medical marijuana and industrial hemp industries." In May 2014 the company announced it had come to an agreement to acquire 100 per cent of a private company in the final stage of obtaining their medical marijuana growers licence. The company announced a second letter of intent to acquire 49% of Good to Grow medical dispensary and grower located on the Olympic Peninsula in Washington state. On May 30, 2014 Affinor changed its name to Affinor Growers Inc to reflect its new focus as a grower of medical marijuana. |

| Last Corporate Change - Jun 13, 2008: Symbol Change |

| Recent News - May 28, 2014: 2014 0515 name Change Affinor Resources Inc. (AFI) |

|

![]() |

|

|

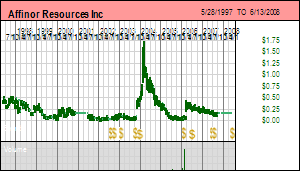

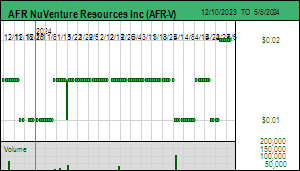

| Price: | $0.010 | Open Rec: | No |  |

| Market Cap: | $180,387 | WC % of Mkt Cap: | 123% |

| Working Cap: | $222,267 | As of: | 11/30/2023 |

| Issued: | 18,038,681 | Insider %: | 8.5% | | Diluted: | 19,838,681 | Story Type: | Resource: Discovery Exploration |

| Key People: | John F. O'Donnell (CEO), Daniel J. Gregory (CFO), Ronald Lawrence (VP EX), James L. Harris (Sec), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Nov 23, 2021: 1:1 Name Change from African Metals Corp (AFR.H-V) |

| Recent News - Feb 26, 2024: Update on its New Property Near Past Producing Stirling Mine |

|

![]() |

|

|

| Price: | $2.510 | Open Rec: | No |  |

| Market Cap: | $1,181,124,724 | WC % of Mkt Cap: | 31% |

| Working Cap: | $371,469,000 | As of: | 9/30/2018 |

| Issued: | 470,567,619 | Insider %: | 14.5% | | Diluted: | 524,838,119 | Story Type: | Energy: Producer |

| Key People: | Keith C. Hill (CEO), James Phillips (VP EX), |

SV Rating: Unrated: Africa Oil Corp (AOI-T) is no longer involved in the resource sector and consequently its information is no longer being updated.(see Profile for full Overview) SV Rating: Unrated: Africa Oil Corp (AOI-T) is no longer involved in the resource sector and consequently its information is no longer being updated.(see Profile for full Overview) |

| Last Corporate Change - May 6, 2014: New Exchange Listing |

| Recent News - Apr 24, 2024: Annual general meeting to be held on may 23, 2024 |

|

![]() |

|

|

| Price: | $0.180 | Open Rec: | No |  |

| Market Cap: | $12,068,460 | WC % of Mkt Cap: | 39% |

| Working Cap: | $4,662,000 | As of: | 3/31/2009 |

| Issued: | 67,047,000 | Insider %: | 22.8% | | Diluted: | 67,972,000 | Story Type: | Resource: Discovery Exploration |

| Key People: | John A. Gray (CEO), David G. Netherway (Chair), David Swan (CFO), Mark Biddulph (COO), |

| Delisted: African Aura Resources Ltd is headed by a London-based group which includes John Gray, David Netherway and Steven Poulton that has substantial experience exploring in Africa. African Aura, which listed on the TSXV in March 2008 through a $7.9 million IPO, has been engaged in grassroots exploration in Cameroon and Liberia since 2004. Although gold in sheared Archean greenstone rocks are the primary target, African Aura also investigates the iron ore and uranium potential it encounters. The flagship project is the 100% Batouri license in Cameroon where drilling in 2008 focused on the Kambele prospect. African Aura has 600,000 ha of licenses in Cameroon and 400,000 ha in Liberia. In April 2009 Africa-focused Mano River Resources offered 1.57 Mano River shares per African Aura share, a proposal that was accepted, with a definitive merger agreement signed on July 1, 2009. |

| Last Corporate Change - Oct 13, 2009: Plan of Arrangement at $0.18 |

| Last KRO Comment - Jan 5, 2009: Recommendation Strategy for African Aura Resources Ltd |

|

![]() |

|

|

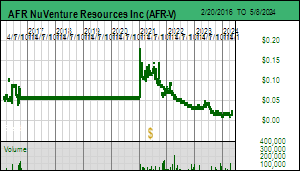

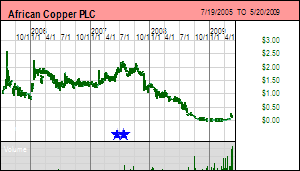

| Price: | $0.090 | Open Rec: | No |  |

| Market Cap: | $13,217,306 | WC % of Mkt Cap: | -4% |

| Working Cap: | ($555,000) | As of: | 9/30/2008 |

| Issued: | 146,858,957 | Insider %: | 13.0% | | Diluted: | 158,073,957 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Christopher Reid Fredericks (CEO), Roy D. Corrans (Chair), Bradley R. Kipp (CFO), |

| Delisted: African Copper is a London-based company focused on base metals in Botswana, where its flagship Mowana Mine hosts proven and probable reserves in the open pit area of 361 million lbs. contained Cu. Construction at Mowana was expected to be completed during Q1 2008, with the first concentrates expected to be producted in Q2 2008, but both dates have been pushed back to Q4 2008. In May 2009 the company chose to delist from the TSX, but the shares continue to be listed on AIM under the symbol ACU, and on the Botswana Stock Exchange under the symbol African Copper. |

| Recent News - Apr 25, 2016: OSC Delinquent Filer; Annual Financial Statements |

|

![]() |

|

|

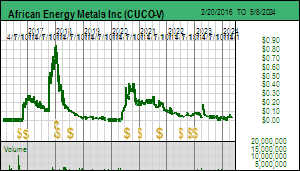

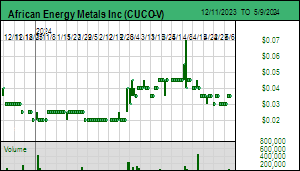

| Price: | $0.035 | Open Rec: | No |  |

| Market Cap: | $702,378 | WC % of Mkt Cap: | -80% |

| Working Cap: | ($565,024) | As of: | 9/30/2023 |

| Issued: | 20,067,952 | Insider %: | 38.3% | | Diluted: | 23,104,202 | Story Type: | Resource: Discovery Exploration |

| Key People: | Yves Kabongo (CEO), Grant Dempsey (CEO), J. Stephen Barley (Chair), Murray G. Flanigan (CFO), Robert J. March (VP OP), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Apr 10, 2023: 4:1 Rollback with no Name Change |

| Recent News - Apr 12, 2024: Late Filing of Financial Statements |

|

![]() |

|

|

| Price: | $0.005 | Open Rec: | No |  |

| Market Cap: | $457,639 | WC % of Mkt Cap: | -236% |

| Working Cap: | ($1,080,529) | As of: | 5/31/2014 |

| Issued: | 91,527,864 | Insider %: | 15.1% | | Diluted: | 118,733,804 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Pierre Leveille (CEO), Michael Brown (Chair), |

| Delisted: Afri-Can Marine Minerals Corp has a 70% stake in Block J, an offshore marine diamond license in Namibia, on which the junior is conducting a prefeasibility study. |

| Last Corporate Change - May 19, 2016: Defunct Delisting - |

| Recent News - May 19, 2016: Listing Maintenance Fees Delist |

|

![]() |

|

|

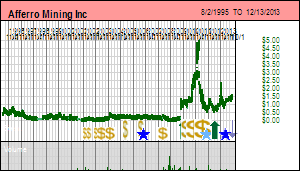

| Price: | $1.050 | Open Rec: | No |  |

| Market Cap: | $74,878,783 | WC % of Mkt Cap: | 60% |

| Working Cap: | $45,056,443 | As of: | 3/31/2016 |

| Issued: | 71,313,127 | Insider %: | 99.0% | | Diluted: | 73,468,127 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Chris Theodoropoulos (CEO), |

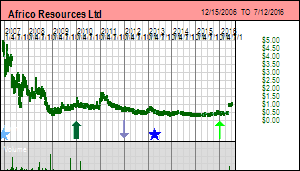

| Delisted: Africo Resources Ltd, controlled by Chairman Chris Theodoropoulos, is focused on the high-grade Kalukundi copper cobalt deposit in Katanga province in southeasterrn DRC near Kolwezi. The Kalukundi project has a dozen so-called "fragments" of which four have a combined M+I+I resource of 27,130,000 tonnes of 2.54% copper and 0.59% cobalt to a depth of 200 metres. A feasiblity study was completed in 2006 and preparations were underway to begin construction of the $200 million project prior to the onset of ownership/taxation disputes with the government and the collapse of copper prices in 2008. During 2009 the DRC and Africo adopted a new definitive agreement and the company spent the rest of the year drilling "fragments" not in the resource estimate. In late 2009 Africo had working capital of $80 million, most of which came from then-controlling shareholder Dan Gertler. Africo is slowly advancing Kalukundi while investigating other potential acquisitions. |

| Last Corporate Change - Jul 12, 2016: Plan of Arrangement at $1.05 |

| Last KRO Comment - Apr 5, 2010: Bottom-Fish Comment: Recommendation Strategy for Africo Resources Ltd |

| Recent News - Jul 7, 2016: Bulletin 2016 0695: Delisting |

|

![]() |

|