Home / Research Tools

Research Tools

| | Corporate Profile: Oxford Resources Inc

Publisher: Kaiser Research Online

Author: Copyright 2013 John A. Kaiser

|

| |

Oxford Resources Inc (OXI.H-V)

| Oxford Resources Inc, led by CEO and President Mitchell Adam, listed on the TSXV by IPO on June 9, 2011 as Highpoint Exploration Inc with the Tasco copper-moly porphyry prospect in south central British Columbia as its flagship. Highpoint drilled 2 so-so holes before chasing after prospects in Mevada and elsewhere in BC. On Nov 8, 2014 Highpointe undertook a 5:1 rollback and name change to Oxford, which sold Tasco (now known as IKE) to Amarc Resources Ltd, retaining a 1% NSR on future production that can be bought out for $2 million. Oxford is settling debts through a 15,850,000 unit private placement at $0.02 (full $0.05 1 yr warrant), after which it will be a cash-less shell with 55.8 million shares fully diluted. |

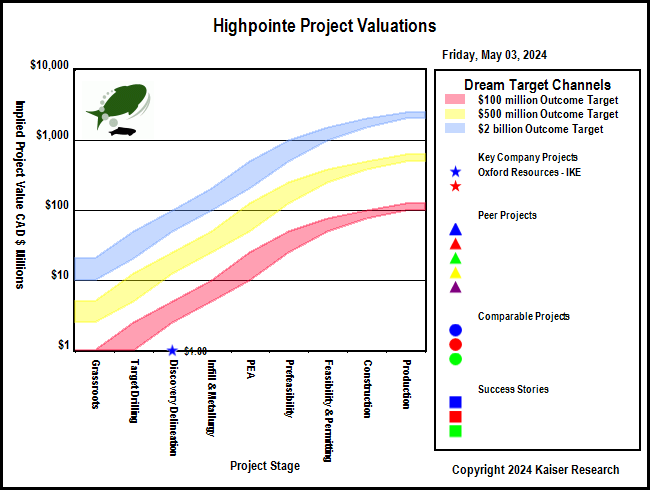

Key to Understanding IPV Charts and Spec Value Hunter Tables

| An IPV Chart is a graphical presentation of a Spec Value Hunter table that has been constructed according to the Rational Speculation Model developed by John Kaiser. The IPV Chart allows speculators to identify which projects offer poor, fair or good speculative value in both absolute and relative terms. The speculative value depends on the project stage, the project's implied value as calculated by the company's fully diluted capitalization, stock price and net project interest, and the dream target deemed appropriate for the project. A dream target is what a project would be worth in discounted cash flow terms once in production. |

| Green background indicates the dream target judged appropriate for this play by John Kaiser - otherwise unranked. |

Poor Speculative Value -   |

Fair Speculative Value -  |

Good Speculative Value -   |

Note:   narrow arrows indicate IPV is outside the fair value channel but within 25% of the fair value limits narrow arrows indicate IPV is outside the fair value channel but within 25% of the fair value limits |

| Click on the company name to view the company profile, the project name to view project details. |

| Click on the project icon if its background is shaded to get the IPV Chart for that company. |

Highpointe Project Valuations

| Company | Project | Country | Stage | IPV $

MM |

$100 | UPV

$500 |

$2000 | Target Metals | Deposit Style |

| Key Company Projects |

|

Oxford Resources Inc (OXI.H-V) | IKE |  | Canada | Discovery Delineation |

$0 |  |  |

| Copper Molybdenum Silver | Porphyry |

|

|

| Peer Projects |

|

|

|

|

|

|

| Comparable Projects |

|

|

|

|

| Success Stories |

|

|

|

|

| |

| | You can return to the Top of this page

|

|