Home / Companies / KRO Profile

KRO Profile

|

|

| Price: | $0.070 | Open Rec: | No |  |

| Market Cap: | $251,300 | WC % of Mkt Cap: | -12% |

| Working Cap: | ($30,555) | As of: | 1/31/2014 |

| Issued: | 3,590,000 | Insider %: | 117.8% | | Diluted: | 5,594,000 | Story Type: | Resource: Discovery Exploration |

| Key People: | Keith F. Anderson (CEO), P. Joseph Meagher (CFO), |

| Delisted: Alchemist Mining Inc, which listed on the TSXV as a CPC called NY85 Capital Inc on July 28, 2011, completed its qualifying transaction in May 2012 through the acquisition of an option on the Carscallen project in Ontario's Porcupine District. Although the company subsequently abandoned the Carscallen property, it continued to explore for gold in the Porcupine District, currently at its flagship Mondotta exploration property. On January 27, 2014 Alchemist conducted a 5:1 rollback after CEO Keith Anderson concluded that having only 4 million shares issued would be the only way to finance the company. In March 2014 the company indicated it was looking for new projects, "in various sectors, including resources, agricultural, technology, as well as the medical industry." Dal Brynelsen joined the board on May 16, 214 so that Alchemist's search for new projects unrelated to the resource sector could benefit from Brynelsen's "30 years of experience in the mining industry." In August 2014 the company delisted from the TSXV, choosing to list its shares on the Canadian Securities Exchange. |

| Last Corporate Change - Aug 19, 2014: Voluntary Delisting - Alchemist Mining started trading on CSE on August 20, 2014. |

| Recent News - Aug 11, 2023: Name Change to Lithos Energy Ltd. |

|

![]() |

|

|

| Price: | $0.007 | Open Rec: | No |  |

| Market Cap: | $8,246,534 | WC % of Mkt Cap: | 58% |

| Working Cap: | $4,774,480 | As of: | 6/30/2023 |

| Issued: | 1,178,076,256 | Insider %: | 30.8% | | Diluted: | 1,221,626,256 | Story Type: | Resource: Discovery Exploration |

| Key People: | James M. Wilson (CEO), Lindsay G. Dudfield (Chair), Bernard Crowford (Sec), |

SV Rating: Unrated SV Rating: Unrated |

|

![]() |

|

|

| Price: | $0.910 | Open Rec: | No |  |

| Market Cap: | $154,535,399 | WC % of Mkt Cap: | 14% |

| Working Cap: | $21,467,482 | As of: | 12/31/2023 |

| Issued: | 169,819,120 | Insider %: | 11.3% | | Diluted: | 181,669,120 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | John E. Black (CEO), Mark Wayne (CFO), Adam Greening (VP CD), Megan M. Cameron-Jones (Sec), |

SV Rating: Unrated SV Rating: Unrated |

| Recent News - Apr 25, 2024: To Host Investor Day on May 29, 2024 |

|

![]() |

|

|

| Price: | $0.010 | Open Rec: | No |  |

| Market Cap: | $902,356 | WC % of Mkt Cap: | 0% |

| Working Cap: | $0 | As of: | 3/31/2015 |

| Issued: | 90,235,585 | Insider %: | 8.3% | | Diluted: | 98,092,585 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Don Dudek (CEO), John Spurney (VP EX), Marcelo Albuquerque (VP EX), |

| Delisted: Alder, led by President and CEO joseph Arengi, is focused on gold exploration in Latin America, where its flagship Rosita copper-gold-silver project is located in Nicaragua. Its former flagship, the Canadian Creek project in the Yukon, has been optioned 60% to Castillian Resources. |

| Last Corporate Change - Jul 27, 2015: Plan of Arrangement at $0.01 |

| Recent News - Jul 13, 2021: Property Asset or Share Disposition Agreement |

|

![]() |

|

|

| Price: | $0.005 | Open Rec: | No |  |

| Market Cap: | $3,083,473 | WC % of Mkt Cap: | -4% |

| Working Cap: | ($128,078) | As of: | 6/30/2023 |

| Issued: | 616,694,644 | Insider %: | 11.7% | | Diluted: | 1,064,483,338 | Story Type: | Resource: Discovery Exploration |

| Key People: | Chrstopher R. Wanless (CEO), Nicolaus Heinen (Chair), Brett W. Tucker (Sec), |

SV Rating: Unrated SV Rating: Unrated |

|

![]() |

|

|

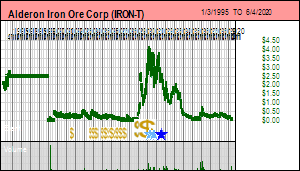

| Price: | $0.075 | Open Rec: | No |  |

| Market Cap: | $10,451,511 | WC % of Mkt Cap: | -234% |

| Working Cap: | ($24,459,656) | As of: | 9/30/2019 |

| Issued: | 139,353,486 | Insider %: | 57.8% | | Diluted: | 144,963,486 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Mark J. Morabito (Chair), Brian Penney (COO), Simon Marcotte (VP CD), |

| Delisted: Alderon Iron Ore optioned in December 2010 the Kami iron ore project in Labrador from Altius for 32 million shares, giving Altius effective control of the company. Since then Alderon has completed a PEA in September 2011 and advanced Kami to the prefeasibilty stage. The PEA forecast average annual production of eight million tonnes of concentrate per year at a grade of 65.5% iron, with operating costs of $44.87 per tonne of concentrate over a 15 year mine life. Initial capex was estimated at $989 million, with a pretax NPV(8%) of $3.07 billion and an IRR of 40.2%. The project's prefeasibility study is expected to be completed during the third quarter of 2012. In April 2012 the company announced a $194 million investment and offtake agreement with Hebei Iron & Steel Group Co. Ltd., China's largest steel producer, where Hebie would acquire a 25% interest in Kami, an offtake for 60% of the project's output, and a 19.9% position in Alderon. |

| Last Corporate Change - Jun 4, 2020: Defunct Delisting - Failure to maintain TSX listing requirements. |

| Recent News - Nov 16, 2020: To Acquire the Kami Project |

|

![]() |

|

|

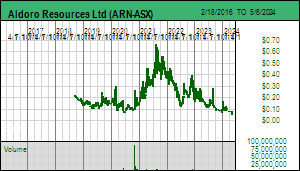

| Price: | $0.070 | Open Rec: | No |  |

| Market Cap: | $9,409,662 | WC % of Mkt Cap: | 27% |

| Working Cap: | $2,566,153 | As of: | 6/30/2023 |

| Issued: | 134,423,743 | Insider %: | 10.3% | | Diluted: | 145,173,743 | Story Type: | Resource: Discovery Exploration |

| Key People: | Sarah Smith (Sec), |

SV Rating: Unrated SV Rating: Unrated |

|

![]() |

|

|

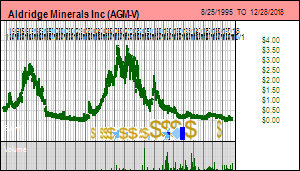

| Price: | $0.095 | Open Rec: | No |  |

| Market Cap: | $13,343,625 | WC % of Mkt Cap: | -392% |

| Working Cap: | ($52,273,335) | As of: | 9/30/2018 |

| Issued: | 140,459,214 | Insider %: | 57.7% | | Diluted: | 147,043,902 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Jacob Willoughby (Pres), Jim O'Neill (CFO), |

| Delisted: Aldridge, led by CEO Mario Caron, is focused on Turkey, where it has precious metals and polymetallic exploration projects. Its flagship Yenipazar project, optioned from Alacer Gold, has 3 million indicated tonnes and 25 million inferred tonnes of polymetallic mineralization where a PEA was completed in 2010 showing a $200 million NPV for a 12 year open pit operation with capex of $200 million. Aldridge continues to focus on advancing Yenipazar, with a prefeasibilty due prior to December 1, 2012. |

| Last Corporate Change - Dec 27, 2018: Plan of Arrangement at $0.10 |

| Recent News - Dec 21, 2018: Closing Of Plan Of Arrangement |

|

![]() |

|

|

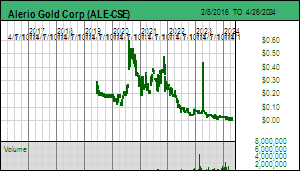

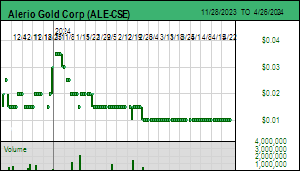

| Price: | $0.010 | Open Rec: | No |  |

| Market Cap: | $1,013,208 | WC % of Mkt Cap: | -36% |

| Working Cap: | ($368,298) | As of: | 5/31/2023 |

| Issued: | 101,320,827 | Insider %: | 36.4% | | Diluted: | 106,676,697 | Story Type: | Resource: Discovery Exploration |

| Key People: | Allan J. Fabbro (CEO), Geoffrey Balderson (CFO), Greg Smith (COO), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Nov 3, 2021: 1:1 Name Change from Project One Resources Ltd (PJO-CSE) |

| Recent News - Feb 29, 2024: CSE Bulletin: Suspensions (GEMS, ALE) |

|

![]() |

|

|

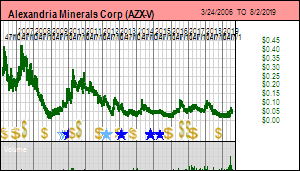

| Price: | $0.045 | Open Rec: | No |  |

| Market Cap: | $23,259,347 | WC % of Mkt Cap: | -8% |

| Working Cap: | ($1,773,719) | As of: | 4/30/2019 |

| Issued: | 516,874,369 | Insider %: | 6.6% | | Diluted: | 607,097,131 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Walter Henry (CEO), Peter Gundy (Chair), |

| Delisted: Alexandria Minerals Corp, headed by CEO Eric Owens, owns 100% of a 35 km long package of claims straddling the Cadillac Break east of Val D'Or in Quebec, Canada which it calls the Cadiallac Break project. Alexandria has outlined several deposits called Orenada and Akasaba. The focus in 2017 is in the Orenada area south of Ientegra Gold's Triangle project. |

| Last Corporate Change - Aug 2, 2019: Plan of Arrangement at $0.05 |

| Recent News - Oct 1, 2021: Acquires 80% Interest in the Centremaque Property Located on Its Alpha Property |

|

![]() |

|

|

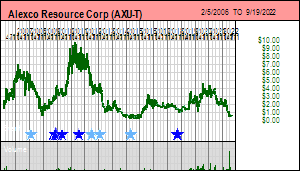

| Price: | $0.650 | Open Rec: | No |  |

| Market Cap: | $105,770,858 | WC % of Mkt Cap: | -6% |

| Working Cap: | ($6,331,000) | As of: | 6/30/2022 |

| Issued: | 162,724,397 | Insider %: | 7.9% | | Diluted: | 171,098,415 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Clynton R. Nauman (CEO), David Miloes (CFO), Bradley Thrall (COO), Thomas F. Fudge Jr. (VP CD), Stan Dodd (VP EX), |

| Delisted: Alexco is an emerging silver producer with an environmental services business focused on remediation of past producing mine sites. Alexco's primary focus is on the Yukon Territory's Keno Hill property, historically one of the world's highest-grade silver districts, where it is combining government-contracted remediation efforts with exploration intended to expand historical resources. Following a production decision in 2009, construction was financed in part through an agreement for Silver Wheaton to purchase 25% of Keno Hill's silver production at $3.90 per ounce in exchange for a $50 million staged payment. Initial production at the past-producing Bellekeno mine, at a rate of 250 tonnes per day, began in Q4 2010, with commercial production declared in early January 2011. For calendar 2011 the company produced 2 million silver ounces, and in 2012 produced 2.15 million ounces, with lead and zinc concentrates sold to Glencore. Going forward the company intends to continue exploration at Keno Hill in order to increase known resources, and to work towards production decisions in regards to potential capacity expansions from mining at the Onek, Lucky Queen and Silver King mine areas. During summer 2013 the company announced it would be suspending mining operations during the upcoming winter of 2013-2014, with plans to resume production in 2014 pending an increase in the silver price. |

| Last Corporate Change - Sep 9, 2022: Plan of Arrangement at $0.62 |

| Recent News - Sep 8, 2022: Bulletin 2022 0682; Delisting |

|

![]() |

|

|

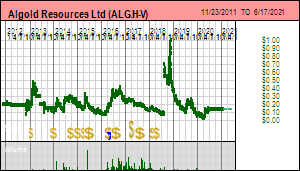

| Price: | $0.145 | Open Rec: | No |  |

| Market Cap: | $4,035,426 | WC % of Mkt Cap: | -250% |

| Working Cap: | ($10,103,856) | As of: | 9/30/2019 |

| Issued: | 27,830,525 | Insider %: | 2.6% | | Diluted: | 33,144,690 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Benoit La Salle (CEO), Yves Grou (CFO), |

| Delisted: Algold Resources Ltd listed on the TSXV on Nov 23, 2011 as a Jones Gable CPC called Kanosak Capital Venture Corp which completed its QT in Oct 2012 by acquiring the Ysasinski Lake prospect in Quebec. In 2013 Kanosak shifted its focus to northern Africa, acquiring projects in Mauritania. Francois Auclair took over as CEO and on June 28, 2013 changed its name to Algold. In Dec 2013 Algold scooped up $3.1 million by acquiring First Uranium Inc on the basis of 1 Algold for 0.0729849 First Uranium shares. In 2016 Algold acquired the Tijirit project in Mauritania from Gryphon Minerals where the goal is to outline a deposit similar to the Tasiast deposit. Drilling during 2017 is focused on establishing higher grade gold zones for which it raised $7.5 million through a bought deal of 37.5 million units at $0.20 in March 2017. . |

| Last Corporate Change - Jun 17, 2021: Takeover Bid at $0.15 - Acquired by Aya Gold & Silver Inc for $2.4 million in Aya stock. |

| Recent News - Jun 15, 2021: Delist |

|

![]() |

|

|

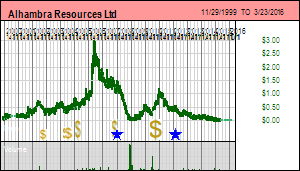

| Price: | $0.015 | Open Rec: | No |  |

| Market Cap: | $1,561,981 | WC % of Mkt Cap: | -534% |

| Working Cap: | ($8,338,000) | As of: | 12/31/2014 |

| Issued: | 104,132,059 | Insider %: | 11.0% | | Diluted: | 114,057,059 | Story Type: | Resource: Producer |

| Key People: | John J. Komarnicki (CEO), Donald D. McKechnie (CFO), Pavalo Marchenko (VP CD), |

| Delisted: Alhambra Resources Ltd., controls the 2.7 million acre Uzboy Project located in north central Kazakhstan. Within this larger concession that hosts numerous exploration targets is the Uzboy Mine, where commercial production commenced at this heap leach project effective May 1, 2006. Including inferred resources Uzboy hosts a 2 million ounce resource. Alhambra is led by CEO John Komarnicki and President Elmer Stewart. |

| Last Corporate Change - Mar 23, 2016: Defunct Delisting - |

| Recent News - Mar 21, 2016: Commences International Arbitration Against The Government Of Kazakhstan |

|

![]() |

|

|

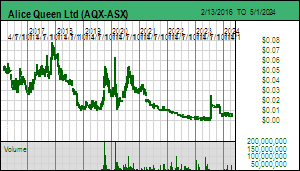

| Price: | $0.020 | Open Rec: | No |  |

| Market Cap: | $10,806,736 | WC % of Mkt Cap: | 27% |

| Working Cap: | $2,914,035 | As of: | 6/30/2023 |

| Issued: | 540,336,806 | Insider %: | 3.4% | | Diluted: | 626,336,806 | Story Type: | Resource: Discovery Exploration |

| Key People: | Travis Schwertfeger (CEO), Didier Murcia (Chair), Brett Dunnachie (CFO), |

SV Rating: Unrated SV Rating: Unrated |

|

![]() |

|

|

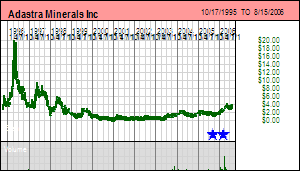

| Price: | $0.005 | Open Rec: | No |  |

| Market Cap: | $4,050,801 | WC % of Mkt Cap: | 29% |

| Working Cap: | $1,155,191 | As of: | 12/31/2019 |

| Issued: | 810,160,160 | Insider %: | 15.2% | | Diluted: | 810,160,160 | Story Type: | Resource: Discovery Exploration |

| Key People: | Andrew Buxton (MD), Phillip Harman (Chair), |

SV Rating: Unrated SV Rating: Unrated |

|

![]() |

|

|

| Price: | $1.960 | Open Rec: | No |  |

| Market Cap: | $168,547,007 | WC % of Mkt Cap: | 25% |

| Working Cap: | $41,535,000 | As of: | 3/31/2020 |

| Issued: | 85,993,371 | Insider %: | 6.2% | | Diluted: | 89,985,201 | Story Type: | Resource: Producer |

| Key People: | Douglas M. Jones (COO), Paul C. Jones (VP CD), Antoine Fournier (VP EX), Taj P. Singh (VP CD), |

| Delisted: Timmins Gold Corp is led by CEO Bruce Bragagnolo and is focused on Mexico, where the company has assembled a portfolio of properties including its principle project, the past-producing San Francisco Gold Mine in Sonora. In September 2010 Timmins Gold offered to acquire Capital Gold on the basis of 2.27 TMM share per Capital Gold share, roughly a $4.50 per share value, or a total transaction value of ~$275 million, but was outbid by Gammon Gold on October 1, 2010, when $288 was offered for Capital Gold. |

| Last Corporate Change - Jul 3, 2020: Plan of Arrangement at $1.92 |

| Recent News - May 19, 2023: Signs Definitive Agreement and Provides Update on Qualifying Transaction |

|

![]() |

|

|

| Price: | $0.082 | Open Rec: | No |  |

| Market Cap: | $107,034,388 | WC % of Mkt Cap: | -9% |

| Working Cap: | ($10,050,000) | As of: | 12/31/2018 |

| Issued: | 1,305,297,411 | Insider %: | 0.0% | | Diluted: | 1,305,297,411 | Story Type: | Resource: Producer |

| Key People: | Mark Calderwood (MD), Geoffrey McNamara (Chair), Ronald Chamberlain (CFO), Mark Turner (COO), |

| Delisted: |

| Last Corporate Change - Oct 1, 2020: Defunct Delisting - Listing rule 17.12 |

|

![]() |

|

|

| Price: | $0.655 | Open Rec: | No |  |

| Market Cap: | $394,030,990 | WC % of Mkt Cap: | 16% |

| Working Cap: | $63,663,000 | As of: | 6/30/2023 |

| Issued: | 601,574,030 | Insider %: | 21.1% | | Diluted: | 608,644,549 | Story Type: | Resource: Producer |

| Key People: | Nicholas P. Earner (MD), Ian J. Gandel (Chair), Dennis Wilkins (Sec), |

SV Rating: Unrated SV Rating: Unrated |

| Last KRO Comment - Dec 2, 2012: Bracing for the extinction of 500 juniors or an entire institution? |

|

![]() |

|

|

| Price: | $0.498 | Open Rec: | No |  |

| Market Cap: | $163,296,693 | WC % of Mkt Cap: | -7% |

| Working Cap: | ($10,688,059) | As of: | 4/30/2015 |

| Issued: | 327,905,006 | Insider %: | 30.5% | | Diluted: | 449,650,484 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Farhad Abasov (CEO), Mark Stauffer (Chair), Richard Kelertas (VP CD), Nejib Abba Biya (VP CD), Peter J. MacLean (VP EX), |

| Delisted: Allana Resources, led by President and CEO Farhad Abasov and part of the Stan Bharti group of companies, changed its name from Printlux.Com Inc. in December 2007 and announced in May 2008 the acquisition of 100% of the outstanding shares of Latin American Potash Corporation which holds title to 154,000 hectares considered to be prospective for potash in Argentina, some of which adjoin Rio Tinto's Potasio Rio Colorado project and are in the same evaporitic basin and display the correct statigraphy to host Potash in an undisturbed structure. Allana also controls a potash project in the Danakil depression in Ethiopia. |

| Last Corporate Change - Jun 24, 2015: Takeover Bid at $0.50 - Israel Chemicals Ltd acquired all of the outstanding common shares of Allana, 50 cents in cash per Allana share exchange. |

| Recent News - Jul 23, 2015: OSC Re Allana Potash Corp |

|

![]() |

|

|

| Price: | $0.013 | Open Rec: | No |  |

| Market Cap: | $3,671,558 | WC % of Mkt Cap: | 109% |

| Working Cap: | $4,018,971 | As of: | 6/30/2021 |

| Issued: | 282,427,568 | Insider %: | 34.5% | | Diluted: | 287,575,901 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Malcolm Carson (Chair), David Deitz (Sec), |

| Delisted: |

| Last Corporate Change - Aug 29, 2023: Defunct Delisting - Delisted under rule 17.15 - failure to pay annual listing fee |

|

![]() |

|