Home / Companies / KRO Profile

KRO Profile

|

|

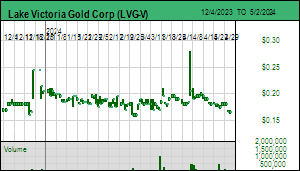

| Price: | $0.160 | Open Rec: | No |  |

| Market Cap: | $16,860,855 | WC % of Mkt Cap: | -4% |

| Working Cap: | ($591,015) | As of: | 9/30/2023 |

| Issued: | 105,380,345 | Insider %: | 32.0% | | Diluted: | 108,927,679 | Story Type: | Resource: Discovery Exploration |

| Key People: | Marc Cernovitch (CEO), David Anthony (Chair), Simon Benstead (CFO), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Dec 21, 2023: 1:1 Name Change from Tembo Gold Corp (TEM-V) |

| Recent News - Mar 12, 2024: Approval by the Tanzanian Fair Competition Commission of the Imwelo Mining Licence Acquisition |

|

![]() |

|

|

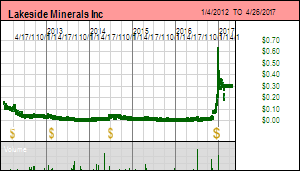

| Price: | $0.300 | Open Rec: | No |  |

| Market Cap: | $7,423,565 | WC % of Mkt Cap: | -7% |

| Working Cap: | ($517,506) | As of: | 10/31/2016 |

| Issued: | 24,745,216 | Insider %: | 3.5% | | Diluted: | 33,281,426 | Story Type: | Resource: Discovery Exploration |

| Key People: | Peter Bibdeau (CEO), Yannis Banks (Chair), Amy Stephenson (CFO), |

| Delisted: Lakeside Minerals Inc listed on the TSXV by Wolverton IPO on Feb 5, 2002 as Grasslands Entertainment Inc, a producer of TV programs. In 2009 Grasslands attempted a change of business to become a merchant bank specializing in the resource and energy sectors but instead on Jan 4, 2012 did a 5:1 rollback, completed an RTO of Lakeside Minerals Corp which had gold and rare earth prospects in Quebec, and changed its name to Lakeside. Its flagship project was the Launay project in the Abitibi which covered a 17 km deformation zone which CEO Mario Justino explored for Archean lode type gold deposits until Mar 2014 when he was replaced by Yannis Banks. On June 12, 2014 Lakeside did a 4:1 rollback and then bailed out two CPC by merging with one (United Capital Corp) and letting the other (Canada Pacific Capital Corp) invest its cash in Lakeside and distributing the Lakeside stock to its shareholders before dissolving itself. In April 2015 Lakeside proposed to acquire the Misery Lake rare earth project from Peter Cashin, the former CEO of Quest Rare Metals who had received the project as part of his severance package. Misery Lake was a rare earth project which yielded significant scandium intervals within late stage dykes that cut across the syenite intrusion. Lakeside planned a $0.03 financing to be followed by a 3:1 rollback and the issue of 13.5 million shares for Misery Lake. When nobody wanted to buy the PP, Lakeside increased the amount to 21 million shares, but in Oct 2015 the transaction was abandoned. On July 6, 2016 Lakeside was moved to the NEX board. |

| Last Corporate Change - Apr 26, 2017: Voluntary Delisting - Change of business to cannabis industry. |

| Recent News - May 31, 2017: Lakeside Progress Translates To Near term Opportunities |

|

![]() |

|

|

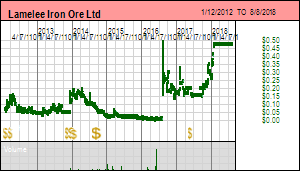

| Price: | $0.475 | Open Rec: | No |  |

| Market Cap: | $1,881,752 | WC % of Mkt Cap: | -7% |

| Working Cap: | ($125,164) | As of: | 3/31/2018 |

| Issued: | 3,961,584 | Insider %: | 89.6% | | Diluted: | 5,107,080 | Story Type: | Resource: Discovery Exploration |

| Key People: | Stephane Leblanc (CEO), Maxime Lemieux (Sec), Carole Turcotte (Sec), |

| Delisted: Lamelee Iron Ore Ltd listed on the TSXV on Jan 23, 2012 as Gimus Resources Inc through a Jones Gable IPO to explore the Bouchard VMS project south of Chibougamau in Quebec. In September 2013 Gimus acquired 100% of the Lac Lamelee South iron deposit (520 million tonnes 39.5% Fe2O3) from Fancamp Resources Inc for 45 million shares. The project is located in the iron mining district of northern Quebec and Labrador. On Dec 24, 2014 Gimus changed its name to Lamelee and Hubert Vallee was appointed CEO. On Nov 25, 2014 Lamelee released a PEA with a 20 year mine life that would produce 5 million tonnes of 64% iron concentrate annually. CapEx was $817 million and OpEx $54.81 per tonne concentrate. Using a base case price of US $79.50 per tonne (FOB Sept-Iles) the project had an after-tax NPV of $244 million at 8% and IRR of 12.1%. The subsequent collapse in iron prices as Australian supply blossomed and Chinese demand growth slowed rendered the project sub-economic. In view of advance royalties Lamelee made a decision in early 2016 to return the deposit to Fancamp in exchange for the surrender of 43 million shares held by Fancamp. A 10:1 rollback and name change to Lamelee Mining Corp is expected to become effective in July 2016. In May 2016 Lamelee issued 9 million shares to acquire a gold prospect south of Chibougamau called Meston Lake West. |

| Last Corporate Change - Aug 8, 2018: Voluntary Delisting - Lamelee completed a RTO with Aura Health Corp and will be trading on CSE. |

| Recent News - Aug 7, 2018: Effective Date Of TSX V Voluntary Delisting |

|

![]() |

|

|

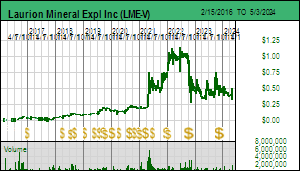

| Price: | $0.445 | Open Rec: | No |  |

| Market Cap: | $114,787,188 | WC % of Mkt Cap: | 7% |

| Working Cap: | $7,952,373 | As of: | 9/30/2023 |

| Issued: | 257,948,737 | Insider %: | 0.9% | | Diluted: | 261,770,892 | Story Type: | Resource: Discovery Exploration |

| Key People: | Cynthia Le Sueur-Aquin (Pres), Tyler Dilney (CFO), Miles Nagamatsu (CFO), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Nov 3, 2006: 1:1 Name Change from Laurion Gold Inc (LAG-V) |

| Recent News - May 3, 2024: President and CEO Announces Intention to Exercise Stock Options, Demonstrating Confidence in LAURION's Future |

|

![]() |

|

|

| Price: | $0.015 | Open Rec: | No |  |

| Market Cap: | $6,010,225 | WC % of Mkt Cap: | 13% |

| Working Cap: | $774,531 | As of: | 1/31/2024 |

| Issued: | 400,681,645 | Insider %: | 2.8% | | Diluted: | 565,741,098 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Belinda Labatte (CEO), A. Paul S. Gill (Chair), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Dec 19, 2016: 10:1 Rollback with no Name Change |

| Recent News - Apr 1, 2024: Excellent Results From the La Loutre Graphite Single Layer Phase 2 Pouch Cell Battery Testing and Suitability as Battery Anode Material and Company Update on Bourier |

|

![]() |

|

|

| Price: | $0.290 | Open Rec: | No |  |

| Market Cap: | $14,649,230 | WC % of Mkt Cap: | 5% |

| Working Cap: | $677,769 | As of: | 11/30/2018 |

| Issued: | 50,514,585 | Insider %: | 4.6% | | Diluted: | 73,338,677 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | J. William Morton (CEO), |

| Delisted: Lorraine Copper Corp began trading on April 17, 2008 as the holder of the former interests of Lysander Minerals Corp and Eastfield Resources Ltd in the Lorraine-Jajay mineral claims in the Fort St. George region of Northeast British Columbia, where Teck Cominco vested for 51% after spending $9 million by 2010. Lorraine-Jajay is an alkaline copper-gold system. A 43-101 resource estimate for 3 zones (Upper Main, Lower Main, Bishop) was published on May 30, 2012, for 6,419,000 t @ 0.61% Cu & 0.23 g/t Au indicated, and 28,823,000 t @9.45% Cu & 0.19 g/t Au inferred at a 0.2% Cu cutoff. In Dec 2015 Lorraine reached a deal to acquire Teck's 51% for $2 million in the form of 35.6 million shares, provided Lorraine could raise $2 million in equity. Lorraine undertook a 2:1 rollback on Feb 4, 2016. In May 2016 the deal was terminated, following which Bill Morton and Glen Garratt decided to turn Lorraine into a copper"optionality" junior and acquired Eastfield's 40% in the OK copper porphyry deposit near Powell River, BC. In June 2016 Lorraine secured a deal to acquire the Stardust (formerly Lustdust) project in BC's Quesnel Trough for 5.5 million shares from ALQ Gold Corp which had spent $11 million since the 1980s outlining a small gold-copper-silver carbonate replacement deposit. In June 2017 Lorraine optioned Stardust to Sun Metals Corp which can earn 100% by spending $6 million by 2021 and issuing 30% of issued stock on vesting to Lorraine. |

| Last Corporate Change - Apr 12, 2019: Plan of Arrangement at $0.29 |

| Last KRO Comment - Dec 28, 2018: Tracker: Spec Value Rating for Lorraine Copper Corp (LLC-V) |

| Recent News - Apr 8, 2019: Securityholders Approve Arrangement |

|

![]() |

|

|

| Price: | $0.005 | Open Rec: | No |  |

| Market Cap: | $232,268 | WC % of Mkt Cap: | 123% |

| Working Cap: | $286,156 | As of: | 7/31/2020 |

| Issued: | 46,453,560 | Insider %: | 2.0% | | Diluted: | 80,846,017 | Story Type: | Resource: Discovery Exploration |

| Key People: | Adrian Rothwell (CEO), Francois Perron (Chair), Alain Moreau (VP EX), Steven Cozine (Sec), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Jun 10, 2020: 7.5:1 Rollback with no Name Change |

| Recent News - Mar 6, 2024: Cease Trade Order |

|

![]() |

|

|

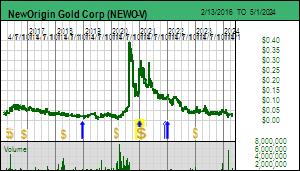

| Price: | $0.025 | Open Rec: | No |  |

| Market Cap: | $1,422,292 | WC % of Mkt Cap: | -13% |

| Working Cap: | ($179,564) | As of: | 12/31/2023 |

| Issued: | 56,891,681 | Insider %: | 22.3% | | Diluted: | 64,626,681 | Story Type: | Resource: Discovery Exploration |

| Key People: | Andrew Thomson (CEO), Robert I. Valliant (Chair), Mark Santarossa (Pres), Brian Jennings (CFO), Steven Dawson (VP CD), |

SV Rating: Bottom-Fish Spec Value - as of December 31, 2021: Tri Origin Exploration Ltd, soon to be renamed NewOrigin Gold Corp, was made a Bottom-Fish Spec Value rated 2021 Favorite at $0.23 on December 31, 2020 based on an Andrew Thomson led management reorganization and Osisko backed financing in December 2020 that finally gives the Ontario project portfolio Bob Valliant built during the past decade a chance to deliver its exploration potential. After cleaning up debts Tri Origin has about $2 million working capital following a private placement completed early January consisting of 21,923,076 units at $0.125-$0.13 with a full 2 year warrant at $0.18. This was taken down by 67 placees including 12 brokers and insiders who took 2.2 million units. Osisko Mining Inc took down 3.2 million units and its spinout O3 Mining took 2.4 million units. Including the 2.7 million shares O3 will get for selling its Kinebik project to Tri Origin, the Osisko group will own 7.8 million shares plus warrants. Not included in this tally are Osisko related individuals who do not qualify as insiders for reporting purposes who may have participated in the financing. The hold period ends May 11, 2021. Tri Origin has 49.1 million issued and 72 million fully diluted, with the dilution from the 22 million warrants at $0.18 potentially adding nearly $4 million to working capital. The stock sagged in Q1 of 2021 because Covid issues prevented the company from getting a drill permit for a winter program at its Sky Lake project. They have contracted a driller to start in mid May and are optimistic the permit will arrive in time. The Bottom-Fish Spec Value rating reflects the 51% back-in rights on the Sky Lake and North Abitibi gold projects which need to be eliminated in order for rethink style exploration programs to attract the major financing they need. Tri...(see Profile for full Overview) SV Rating: Bottom-Fish Spec Value - as of December 31, 2021: Tri Origin Exploration Ltd, soon to be renamed NewOrigin Gold Corp, was made a Bottom-Fish Spec Value rated 2021 Favorite at $0.23 on December 31, 2020 based on an Andrew Thomson led management reorganization and Osisko backed financing in December 2020 that finally gives the Ontario project portfolio Bob Valliant built during the past decade a chance to deliver its exploration potential. After cleaning up debts Tri Origin has about $2 million working capital following a private placement completed early January consisting of 21,923,076 units at $0.125-$0.13 with a full 2 year warrant at $0.18. This was taken down by 67 placees including 12 brokers and insiders who took 2.2 million units. Osisko Mining Inc took down 3.2 million units and its spinout O3 Mining took 2.4 million units. Including the 2.7 million shares O3 will get for selling its Kinebik project to Tri Origin, the Osisko group will own 7.8 million shares plus warrants. Not included in this tally are Osisko related individuals who do not qualify as insiders for reporting purposes who may have participated in the financing. The hold period ends May 11, 2021. Tri Origin has 49.1 million issued and 72 million fully diluted, with the dilution from the 22 million warrants at $0.18 potentially adding nearly $4 million to working capital. The stock sagged in Q1 of 2021 because Covid issues prevented the company from getting a drill permit for a winter program at its Sky Lake project. They have contracted a driller to start in mid May and are optimistic the permit will arrive in time. The Bottom-Fish Spec Value rating reflects the 51% back-in rights on the Sky Lake and North Abitibi gold projects which need to be eliminated in order for rethink style exploration programs to attract the major financing they need. Tri...(see Profile for full Overview) |

| Last Corporate Change - Apr 28, 2021: 1:1 Name Change from Tri Origin Exploration Ltd (TOE-V) |

| Last KRO Comment - Apr 19, 2021: Tracker: What's Next for Tri Origin Exploration Ltd? |

| Recent News - Jan 25, 2022: Acquires Koval Property at its Sky Lake Gold Project |

|

![]() |

|

|

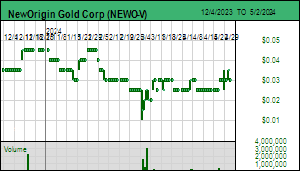

| Price: | $0.030 | Open Rec: | No |  |

| Market Cap: | $7,852,349 | WC % of Mkt Cap: | -19% |

| Working Cap: | ($1,529,733) | As of: | 9/30/2023 |

| Issued: | 261,744,963 | Insider %: | 0.6% | | Diluted: | 400,514,858 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Frank Basa (CEO), Ryan Webster (CFO), Matt Halliday (COO), Gerhard Kiessling (VP EX), William Kerr (VP EX), Tina Whyte (Sec), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Jan 23, 2024: 1:1 Name Change from Canada Silver Cobalt Works Inc (CCW-V) |

| Recent News - May 2, 2024: Shares for Debt |

|

![]() |

|

|

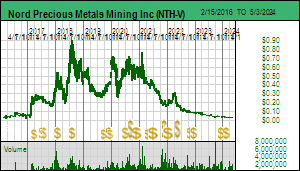

| Price: | $0.110 | Open Rec: | No |  |

| Market Cap: | $19,583,803 | WC % of Mkt Cap: | 8% |

| Working Cap: | $1,573,249 | As of: | 9/30/2023 |

| Issued: | 178,034,575 | Insider %: | 53.9% | | Diluted: | 248,074,304 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Tom M. MacNeill (CEO), Andrew Davidson (CFO), |

SV Rating: Unrated SV Rating: Unrated |

| Recent News - Feb 7, 2024: Intercepts 8 Meters of 25.41 g/m3 Placer Gold in Geotechnical Drilling from the Wingdam Underground Placer Gold Project |

|

![]() |

|

|

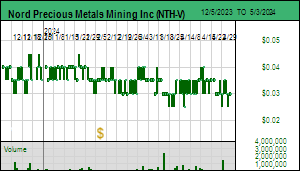

| Price: | $0.060 | Open Rec: | No |  |

| Market Cap: | $14,829,525 | WC % of Mkt Cap: | 41% |

| Working Cap: | $6,060,851 | As of: | 1/31/2023 |

| Issued: | 247,158,745 | Insider %: | 12.9% | | Diluted: | 254,308,745 | Story Type: | Non-Resource: Undefined |

| Key People: | Ronald W. Stewart (CEO), Stephen Stewart (CEO), Alexander Stewart (Chair), Kevin Canario (CFO), Keith Benn (VP EX), Charles Beaudry (VP EX), Kevin Piepgrass (VP EX), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - May 18, 2023: 1:1 Name Change from Orefinders Resources Inc (ORX-V) |

| Recent News - Mar 26, 2024: Normal Course Issuer Bid |

|

![]() |

|

|

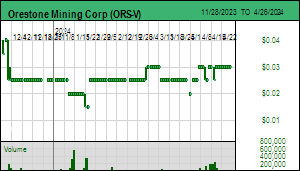

| Price: | $0.025 | Open Rec: | No |  |

| Market Cap: | $1,416,506 | WC % of Mkt Cap: | -9% |

| Working Cap: | ($126,946) | As of: | 10/31/2023 |

| Issued: | 56,660,232 | Insider %: | 12.1% | | Diluted: | 60,630,232 | Story Type: | Resource: Discovery Exploration |

| Key People: | David N. Hottman (CEO), W. D. Bruce Winfield (Pres), Mark T. Brown (CFO), Gary D. Nordin (VP EX), |

SV Rating: Bottom-Fish Spec Value - as of December 14, 2021: Orestone Mining Corp was initially assigned a Bottom-Fish Spec Value rating on December 14, 2018 because was supposed to be the relaunch vehicle for key people involved in the early Refugio gold discovery years of Bema. But Orestone first wanted to tackle unfinished business at the Captain gold-copper porphyry project in British Columbia before moving on to the Resguardo copper-gold project in Chile where the goal was to find the porphyry system associated with a high grade copper skarn mine. Orestone went public in 2008 with the Captain project where the goal was to discover a Mt Milligan lookalike explaining regional soil geochemistry beneath 50 metres plus of overburden cover. The original Orestone management confirmed that bedrock was altered with low copper values, got distracted by a Golden Triangle property, and handed the keys in 2011 to David Hottman and Gary Nordin who first worked together at Bema in the late eighties and then at Eldorado during the nineties. After doing a 4:1 rollback the new group undertook a couple drill programs, focusing mainly on an area south of what is now called the Admiral target which yielded alkaline porphyry dykes but no ore grade in 2012. However, the last hole drilled in 2013 into the Admiral target was defined by a linear magnetic high straddling an IP anomaly based on a couple widely spaced lines. The earlier group had tried to drill this target with a percussion rig but failed to reach bedrock (the Admiral target is under 80-100 m of overburden). The magnetic high proved to be a barren 50-100 m wide gabbro dyke, but hole C13-03 did include a 3 metre interval of very different rock identified as a "highly potassic-sericite altered monzonite porphyry" which management now interprets as a xenolith captured by the dyke when it i...(see Profile for full Overview) SV Rating: Bottom-Fish Spec Value - as of December 14, 2021: Orestone Mining Corp was initially assigned a Bottom-Fish Spec Value rating on December 14, 2018 because was supposed to be the relaunch vehicle for key people involved in the early Refugio gold discovery years of Bema. But Orestone first wanted to tackle unfinished business at the Captain gold-copper porphyry project in British Columbia before moving on to the Resguardo copper-gold project in Chile where the goal was to find the porphyry system associated with a high grade copper skarn mine. Orestone went public in 2008 with the Captain project where the goal was to discover a Mt Milligan lookalike explaining regional soil geochemistry beneath 50 metres plus of overburden cover. The original Orestone management confirmed that bedrock was altered with low copper values, got distracted by a Golden Triangle property, and handed the keys in 2011 to David Hottman and Gary Nordin who first worked together at Bema in the late eighties and then at Eldorado during the nineties. After doing a 4:1 rollback the new group undertook a couple drill programs, focusing mainly on an area south of what is now called the Admiral target which yielded alkaline porphyry dykes but no ore grade in 2012. However, the last hole drilled in 2013 into the Admiral target was defined by a linear magnetic high straddling an IP anomaly based on a couple widely spaced lines. The earlier group had tried to drill this target with a percussion rig but failed to reach bedrock (the Admiral target is under 80-100 m of overburden). The magnetic high proved to be a barren 50-100 m wide gabbro dyke, but hole C13-03 did include a 3 metre interval of very different rock identified as a "highly potassic-sericite altered monzonite porphyry" which management now interprets as a xenolith captured by the dyke when it i...(see Profile for full Overview) |

| Last Corporate Change - Aug 29, 2017: 5:1 Rollback with no Name Change |

| Last KRO Comment - Jan 4, 2021: Tracker: Spec Value Rating for Orestone Mining Corp (ORS-V) |

| Recent News - Apr 11, 2024: Project Review and Financing |

|

![]() |

|

|

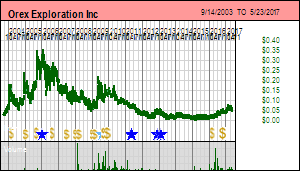

| Price: | $0.055 | Open Rec: | No |  |

| Market Cap: | $11,140,266 | WC % of Mkt Cap: | 11% |

| Working Cap: | $1,190,849 | As of: | 12/31/2016 |

| Issued: | 202,550,284 | Insider %: | 15.3% | | Diluted: | 258,380,284 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Jonathan Fitzgerald (CEO), Mark Billings (Chair), Jacques Levesque (CFO), |

| Delisted: Orex Exploration Inc listed on the Montreal Exchange on Mar 31, 1988 with an IPO to fund the Goldboro project in Nova Scotia which it intended to put in production as a small gold mine. The project got bogged down in litigation in 1990 when the vendor claimed a payment default. After the dispute was settled Minnova optioned 60% in Feb 1992. After Minnova dropped out NovaGold briefly optioned Goldboro. Orex vested for 100% in May 1994 and in Nov 1994 Placer Dome optioned 65% but dropped out in May 1995 after including Goldboro did not meet its size threshold. In 1997 Orex optioned properties in the Marincunga Belt of Chile but soon returned to its Goldboro focus. On Oct 1, 2001 Orex migrated to the CDNX, now the TSXV where it was declared inactive on Dec 12, 2002. In 2004 Orex brought Jean Lafleur on board to revive the Goldboro project on which by then it had spent $18 million since 1988. In 2006 Orex published a new resource estimate that delath with a nugget effect, following which Jacques Levesque was replaced by Ali Al-Hazeem as CEO. In 2008 CFO Mark Billings became CEO and Al-Hazeem became chairman. and Lafleur became chairman. In Sept 2009 Orex optioned Goldboro 60% to Osisko Mining Corp whwich also purchased 13 million units at $0.10. Osisko dropped out in Sept 2011 when it became apparent that Goldboro would not support a large bulk tonnage mine. A new resource estimate was published in Feb 2013. In Sept 2013 Willie McLucas became CEO and Billings became chairman. In April 2014 the company completed a PEA for Goldboro that forecast annual gold production of 21,000 over an 11 year mine life, with cash costs of $500 per gold ounce and an NPV (5%) of $107 million at $1,250 Au. McLucas quit in Jan 2015 and in May Billings also quit with Marcel Faucher emerging as the new CEO. In Mar 2016 Orex completed a private placement of 7.5 million units at $0.05. |

| Last Corporate Change - May 23, 2017: Plan of Arrangement at $0.06 |

| Recent News - May 23, 2017: Delist |

|

![]() |

|

|

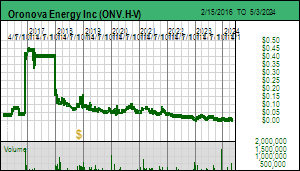

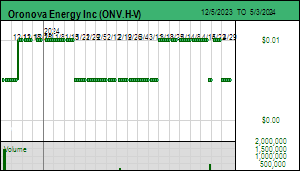

| Price: | $0.005 | Open Rec: | No |  |

| Market Cap: | $218,014 | WC % of Mkt Cap: | 302% |

| Working Cap: | $659,211 | As of: | 10/31/2018 |

| Issued: | 43,602,828 | Insider %: | 6.9% | | Diluted: | 47,102,828 | Story Type: | Energy: Producer |

| Key People: | Ralph Gillcrist (CEO), Joanna Vastardis (CFO), |

SV Rating: Unrated: Oronova Energy Inc (ONV.H-V) is no longer involved in the resource sector and consequently its information is no longer being updated.(see Profile for full Overview) SV Rating: Unrated: Oronova Energy Inc (ONV.H-V) is no longer involved in the resource sector and consequently its information is no longer being updated.(see Profile for full Overview) |

| Last Corporate Change - Feb 14, 2020: Symbol Change |

| Last KRO Comment - Dec 1, 1997: Report Sept-Dec 1997: First Choice Ind Ltd - 1997 Annual Review |

| Recent News - Apr 3, 2017: Halted Security |

|

![]() |

|

|

| Price: | $0.040 | Open Rec: | No |  |

| Market Cap: | $36,156,799 | WC % of Mkt Cap: | -76% |

| Working Cap: | ($27,520,801) | As of: | 7/31/2021 |

| Issued: | 903,919,968 | Insider %: | 6.8% | | Diluted: | 922,603,302 | Story Type: | Resource: Producer |

| Key People: | Michael Hepworth (CEO), Basil Botha (Chair), Anna Lenz (CFO), Joe Ranford (COO), Tom Klaimanee (Sec), |

| Delisted: Firesteel Resources Inc listed on the ASE as a CPC on Aug 26, 1992 headed by David Dupre and completed its QT in Nov 1992 by acquiring a 7.5% interest in a producing gas well. By 1994, building on Dupre's Cominco past, Firesteel was focused on zinc-lead-silver prospects in the Mackenzie Mountains of the NWT in Canada. This was followed by a foray into Mexico and the Lac Rocher area play in Quebec, but in 2002 Firesteel focused on northwestern British Columbia where it staked the Poker claim (a gold quartz boulder chase during the Golden Triangle boom of 1990-91 since which glacial retreat opened new potential to find the source), optioned the Copper Creek prospect in the Sheslay area north of Telegraph Creek, and staked the ROK-Coyote claim next to the Red Chris deposit. In 2007 Dupre quit and was replaced as CEO by Walter Wakula after Firesteel acquired the Blacksteel oil sand leases in Alberta. Firesteel's stake was diluted by third party investors and in 2010 Blacksteel was merged into a CPC. The ROK-Coyote Cu-Au porphyry prospect was under 75% option to Lion's Gate Metals from 2010-2013. In 2012 Wakula was replaced by Michael Hepworth as CEO and Firesteel resolved to focus on Latin America though did nothing about it. ROK-Coyote was optioned 70% to Australia's Oz Minerals Ltd in 2013, and Copper Creek, renamed Sheslay and then again to Star, was optioned 80% to Prosper Gold Corp which has vested for 51%. Prosper has discovered a low grade copper-gold system at Star. It can earn another 29% by paying $700,000 and spending $4 million by 2017. Firesteel subscribes to the prospect generator farmout model. |

| Last Corporate Change - Jan 31, 2023: Defunct Delisting - Failure to maintain listing requirements |

| Last KRO Comment - Dec 1, 1997: Report Sept-Dec 1997: Firesteel Resources Inc - 1997 Annual Review |

| Recent News - Jan 27, 2023: Delist |

|

![]() |

|

|

| Price: | $0.180 | Open Rec: | No |  |

| Market Cap: | $18,144,716 | WC % of Mkt Cap: | 9% |

| Working Cap: | $1,572,392 | As of: | 2/28/2023 |

| Issued: | 100,803,979 | Insider %: | 15.3% | | Diluted: | 114,442,314 | Story Type: | Resource: Discovery Exploration |

| Key People: | Sungbum Spencer Huh (CEO), Nancy Zhao (CFO), Gunmin Park (VP CD), Chris Chung (VP FI), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Mar 7, 2018: 2:1 Rollback with no Name Change |

| Recent News - Apr 16, 2024: Appoints Renowned Battery Industry Pioneer Mr. Ricky Lee as Lead Managerial Advisor |

|

![]() |

|

|

| Price: | $0.020 | Open Rec: | No |  |

| Market Cap: | $1,518,366 | WC % of Mkt Cap: | 12% |

| Working Cap: | $178,114 | As of: | 9/30/2023 |

| Issued: | 75,918,312 | Insider %: | 4.0% | | Diluted: | 86,550,312 | Story Type: | Resource: Discovery Exploration |

| Key People: | Albert Contardi (CEO), Arvin Ramos (CFO), Aaron Stone (VP EX), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Jul 8, 2020: 1:1 Name Change from First Mexican Gold Corp (FMG-V) |

| Recent News - Dec 8, 2023: Acquires High Resolution LiDAR Data, Discovers Pegmatite on Golden Giant Project |

|

![]() |

|

|

| Price: | $0.870 | Open Rec: | No |  |

| Market Cap: | $124,964,101 | WC % of Mkt Cap: | 1% |

| Working Cap: | $1,738,657 | As of: | 11/30/2019 |

| Issued: | 143,636,898 | Insider %: | 66.4% | | Diluted: | 155,636,898 | Story Type: | Non-Resource: Undefined |

| Key People: | Alex Granger (CEO), Warren Gilman (Chair), Karen Dyczkowski (CFO), |

SV Rating: Unrated: Queen's Road Capital Investment Ltd (QRC-V) is no longer involved in the resource sector and consequently its information is no longer being updated.(see Profile for full Overview) SV Rating: Unrated: Queen's Road Capital Investment Ltd (QRC-V) is no longer involved in the resource sector and consequently its information is no longer being updated.(see Profile for full Overview) |

| Last Corporate Change - Jul 6, 2022: New Exchange Listing |

| Last KRO Comment - Jul 16, 2012: Bottom-Fish Comment: Bottom-Fish Strategy for Barisan Gold Corp |

| Recent News - Feb 22, 2024: Completion of Wyloo Exit as a QRC Shareholder |

|

![]() |

|

|

| Price: | $0.160 | Open Rec: | No |  |

| Market Cap: | $1,346,283 | WC % of Mkt Cap: | -15% |

| Working Cap: | ($200,494) | As of: | 12/31/2022 |

| Issued: | 8,414,268 | Insider %: | 209.2% | | Diluted: | 9,666,059 | Story Type: | Resource: Discovery Exploration |

| Key People: | Scott Ackerman (CEO), Doug McFaul (CFO), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Apr 25, 2017: 4.75:1 Name Change from Trident Gold Corp (TTG.H-V) |

| Recent News - Apr 24, 2017: Name Change and Consolidation |

|

![]() |

|

|

| Price: | $0.105 | Open Rec: | No |  |

| Market Cap: | $3,113,717 | WC % of Mkt Cap: | -62% |

| Working Cap: | ($1,935,386) | As of: | 9/30/2023 |

| Issued: | 29,654,449 | Insider %: | 0.0% | | Diluted: | 39,062,179 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | George Drazenovic (CEO), Jiang Yu (Chair), Jaisun Garcha (CFO), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Oct 14, 2020: 1:1 Name Change from Bard Ventures Ltd (CBS-V) |

| Recent News - Dec 18, 2023: Completes Annual General Meeting and Re Elects Board of Directors |

|

![]() |

|