| |

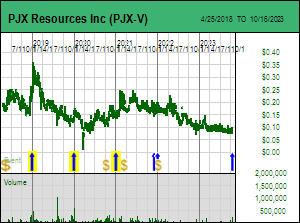

Tracker - October 17, 2023: Speculative Value Rating for PJX Resources Inc

PJX Resources Inc has been confirmed effective October 16, 2023 with a Bottom-Fish Spec Value rating at $0.09 based on emerging evidence that a Sullivan style zinc-lead-silver exhalative horizon with size potential is present on the 100% owned Dewdney Trail project in southeastern British Columbia. So far PJX has only found mineralized boulders within a talus field on the slope of a mountain, but the exhalative nature of the boulders is very different from the nearby Estella vein deposit, and the physical setting is such that a massive sulphide horizon must outcrop somewhere up the mountain slope underneath the talus debris which consists mostly of younger barren sediments from higher up the mountain. The PJX prospecting crew is racing against winter to establish upslope cutoff for the zinc-lead-silver boulders and possibly find mineralized bedrock. But that may not be necessary. A 2021 geophysical survey has already indicated that this area is underlain by a magnetic high potentially caused by pyrrhotite, the magnetic iron sulphide associated with the Sullivan deposit. This data is being reprocessed by another group to achieve more granularity to allow spotting a drill program even if the exact bedrock source remains hidden under talus. The size of this magnetic anomaly offers substantially greater scale potential than the Kootenay King "puddle" 5 km to the south if it is part of a zinc-lead-silver rich Sullivan style system. Sullivan itself has only a modest surface exposure and its 160 million tonnes were mostly underground mined. PJX has initiated permitting for a drill program in May 2024 when the mountain side will be reasonably clear of snow and ice. It only has to consult with one First Nations group in this area, and this is a group with a history of cooperation with the resource sector, so there is a lower reconciliation risk than usual though given the current Canadian government's hostility towards resource extraction one must keep the NoCanDo risk in mind. The drilling delay until May 2024 gives PJX time to boost its $500,000 working capital with a new financing and also time for bottom-fishers to accumulate positions during bear market conditions. About 28% of the 133.2 million issued are held by insiders, of which management is 3% while the rest are a couple of long time timber baron supporters. In addition Osisko Gold Royalties which acquired a 0.5% NSR on all the properties in 2021 may still own its 6,250,000 shares which are now below the reporting threshold and may remain supportive of PJX. There is an overhang of 29,118,182 warrants between $0.20-$0.30 of which all but 9,350,400 expire in December 2023 unless extended again which boosts fully diluted to 171.8 million shares. PJX does not face any immediate rollback risk, and the two other main property groups are strong enough for the junior to participate in a resource junior bull cycle even if Dewdney Trail fails to materialize into a major Sullivan Two discovery. At 171.8 million FD and $0.09 the market is implying a value of only CAD $15 million for a Sullivan Two outcome at Dewdney Trail. PJX Resources Inc has been confirmed effective October 16, 2023 with a Bottom-Fish Spec Value rating at $0.09 based on emerging evidence that a Sullivan style zinc-lead-silver exhalative horizon with size potential is present on the 100% owned Dewdney Trail project in southeastern British Columbia. So far PJX has only found mineralized boulders within a talus field on the slope of a mountain, but the exhalative nature of the boulders is very different from the nearby Estella vein deposit, and the physical setting is such that a massive sulphide horizon must outcrop somewhere up the mountain slope underneath the talus debris which consists mostly of younger barren sediments from higher up the mountain. The PJX prospecting crew is racing against winter to establish upslope cutoff for the zinc-lead-silver boulders and possibly find mineralized bedrock. But that may not be necessary. A 2021 geophysical survey has already indicated that this area is underlain by a magnetic high potentially caused by pyrrhotite, the magnetic iron sulphide associated with the Sullivan deposit. This data is being reprocessed by another group to achieve more granularity to allow spotting a drill program even if the exact bedrock source remains hidden under talus. The size of this magnetic anomaly offers substantially greater scale potential than the Kootenay King "puddle" 5 km to the south if it is part of a zinc-lead-silver rich Sullivan style system. Sullivan itself has only a modest surface exposure and its 160 million tonnes were mostly underground mined. PJX has initiated permitting for a drill program in May 2024 when the mountain side will be reasonably clear of snow and ice. It only has to consult with one First Nations group in this area, and this is a group with a history of cooperation with the resource sector, so there is a lower reconciliation risk than usual though given the current Canadian government's hostility towards resource extraction one must keep the NoCanDo risk in mind. The drilling delay until May 2024 gives PJX time to boost its $500,000 working capital with a new financing and also time for bottom-fishers to accumulate positions during bear market conditions. About 28% of the 133.2 million issued are held by insiders, of which management is 3% while the rest are a couple of long time timber baron supporters. In addition Osisko Gold Royalties which acquired a 0.5% NSR on all the properties in 2021 may still own its 6,250,000 shares which are now below the reporting threshold and may remain supportive of PJX. There is an overhang of 29,118,182 warrants between $0.20-$0.30 of which all but 9,350,400 expire in December 2023 unless extended again which boosts fully diluted to 171.8 million shares. PJX does not face any immediate rollback risk, and the two other main property groups are strong enough for the junior to participate in a resource junior bull cycle even if Dewdney Trail fails to materialize into a major Sullivan Two discovery. At 171.8 million FD and $0.09 the market is implying a value of only CAD $15 million for a Sullivan Two outcome at Dewdney Trail.

Headed by CEO John Keating, PJX has spent the past decade assembling three claim groups within what it calls the "Vulcan Gold Belt": the Gold Shear-Eddy-Zinger Parker group which straddles placer gold bearing creeks whose source has never been identified and which Keating believes has potential for giant intrusion related gold systems such as Muruntau and Sukhoi Log, the DD-Moby Dick-Vine group to the south underlain by Purcell Basin rocks that include the Sullivan time horizon and have potential for zinc-lead-silver Sullivan type SEDEX deposits, and the Dewdney Trail group to the east which also straddles unexplained placer gold bearing gold creeks, has potential for Sullivan type deposits but within a different basin setting, and more recently has been explored for intrusion related copper-gold systems.

The Dewdney Trail block, which is east of the Rocky Mountain Trench, has received the least exploration attention, but that changed 2021 after PJX optioned 100% of 14 crown grant claims covering the former Estella underground mine whose vein yielded 109,518 tonnes of 9.0% zinc, 4.7% lead and 58.4 g/t silver. To vest for 100% PJX must pay Imperial Metals $250,000 over 5 years and grant a 2% NSR that can be bought back for $2 million.

The Estella acquisition plugged holes in an area PJX wanted to explore for Cretaceous aged or younger intrusion related copper-gold-silver systems (starting 145 million years ago), not the elusive Sullivan Two which would have formed during the Precambrian about 1.47 billion years ago. The discovery and exploration of the vein-style Estella deposit and stratiform Kootenay King deposit 5 km to the south during the past century had already attracted extensive exploration seeking a Sullivan scale sister without success, pretty much the same outcome as in the Purcell Basin to the west. If there was a Sullivan Two to find it would be beneath barren cover rocks requiring complex vectoring drill strategies such as Eagle Plains attempted in 2023 at its Vulcan project.

The boots PJX put onto the ground during the summer of 2023 failed to come up with evidence of copper-gold-silver mineralization, but in September literally stumbled onto zinc-lead-silver mineralized boulders within a 50 m by 150 m area several hundred metres southeast of the Estella Mine within the base of a talus covered mountain slope that represents 500 vertical metres of sedimentary stratigraphy slightly younger than that which hosts the Sullivan deposit to the west.

These boulders assayed high zinc-lead-silver grades and included the kitchen sink of other metals present at Sullivan and not your conventional Sedex system. This could have been another Estella style vein, but when PJX sawed the boulders in half the geologists were stunned to see sulphide bedding and fragmentals that only forms within a marine setting near a hydrothermal vent. That something like this could be outcropping and never found has members of the Cominco Brotherhood crossing their breasts and mumbling about the Second Coming of Sullivan.

|