| | Metals Investor Forum November 12-13, 2016 Index

Publisher: Kaiser Research Online

Author: Copyright 2016 John A. Kaiser

|

| |

KRO Theme Index: Metals Investor Forum November 2016 Index

| Index Criteria: |

| Index Method: Each member of a KRO Index is assigned a value of $1,000 when added to the index, which is divided by the closing stock price on the inclusion date to arrive at a quantity of shares which remains constant during the life of the index. In the event of a split or consolidation, the quantity is adjusted by that ratio. If a company is divided into separate entities, the surviving entity that meets the index criteria has its quantity recalculated by dividing the prior day value by the subsequent closing price of the surviving entity. If a company is delisted pursuant to a takeover bid or merger, the value on the delisting day remains part of the index and the total members will include that company. The same applies to companies which have lost their eligibility. The value of the index is the total value divided by the number of members, which will be 1000 at the official start date. The value of the TSXV Index on the offcial start date is normalized to 1000, and the resulting factor is used to adjust the TSXV Index for comparison purposes. |

| Index Start Date | November 11, 2016 | Current Date | May 8, 2018 |

| Index End Date |

| Current Value | 974.7 |

| Index backdated to | January 2, 2015 | Total Members | 27 |

| Metals Investor Forum November 2016 Index - Members as of May 8, 2018 |

|---|

| Ceased to be index members due to delisting or ineligibility - their value is frozen as of the end date and included in the daily index calculation. |

|---|

| Underwent a rollback or split which resulted in an adjustment to the share quantity used in the member's index value calculation. |

|---|

| Company | Active | Start | End | Quantity | Weight | Value | Chg |

|---|

| Adamera Minerals Corp (ADZ-V) | Yes | 11/11/2016 |

| 15,385 | 3.2% | 846 | (15.4%) |

| Almadex Minerals Ltd (AMZ-V) | Yes | 11/11/2016 |

| 775 | 4.5% | 1,186 | 18.6% |

| Ashanti Gold Corp (AGZ-V) | Yes | 11/11/2016 |

| 2,381 | 1.4% | 381 | (61.9%) |

| Atlantic Gold Corp (AGB-V) | Yes | 11/11/2016 |

| 1,136 | 8.1% | 2,136 | 113.6% |

| Auryn Resources Inc (AUG-T) | Yes | 11/11/2016 |

| 413 | 2.7% | 702 | (29.8%) |

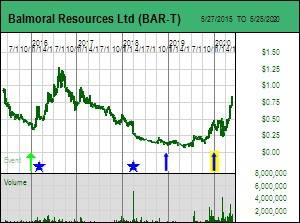

| Balmoral Resources Ltd (BAR-T) | Yes | 11/11/2016 |

| 1,205 | 1.1% | 277 | (72.3%) |

| Black Sea Copper & Gold Corp (BLS-V) | Yes | 11/11/2016 |

| 3,571 | 1.2% | 321 | (67.9%) |

| Callinex Mines Inc (CNX-V) | Yes | 11/11/2016 |

| 1,587 | 1.4% | 373 | (62.7%) |

| Cordoba Minerals Corp (CDB-V) | Yes | 11/11/2016 |

| 1,299 | 0.8% | 221 | (77.9%) |

| Ely Gold Royalties Inc (ELY-V) | Yes | 11/11/2016 |

| 5,263 | 2.2% | 579 | (42.1%) |

| GMV Minerals Inc (GMV-V) | Yes | 11/11/2016 |

| 2,326 | 1.7% | 442 | (55.8%) |

| Golden Predator Mining Corp (GPY-V) | Yes | 11/11/2016 |

| 1,266 | 2.6% | 684 | (31.6%) |

| Integra Gold Corp (ICG-V) | Yes | 11/11/2016 | 7/17/2017 | 1,639 | 5.3% | 1,393 | 39.3% |

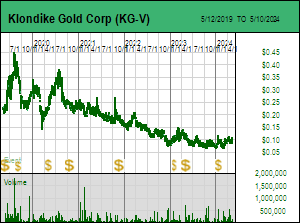

| Klondike Gold Corp (KG-V) | Yes | 11/11/2016 |

| 5,882 | 5.3% | 1,382 | 38.2% |

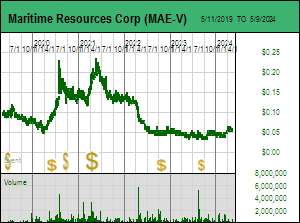

| Maritime Resources Corp (MAE-V) | Yes | 11/11/2016 |

| 4,348 | 1.9% | 500 | (50.0%) |

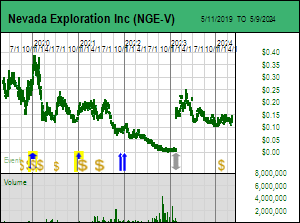

| Nevada Exploration Inc (NGE-V) | Yes | 11/11/2016 |

| 2,381 | 2.3% | 595 | (40.5%) |

| Nighthawk Gold Corp (NHK-T) | Yes | 11/11/2016 |

| 2,564 | 5.7% | 1,513 | 51.3% |

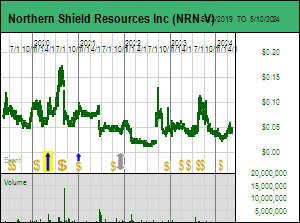

| Northern Shield Resources Inc (NRN-V) | Yes | 11/11/2016 |

| 7,407 | 0.8% | 222 | (77.8%) |

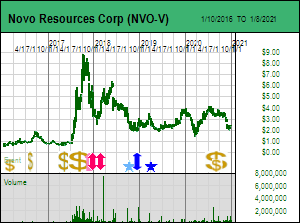

| Novo Resources Corp (NVO-V) | Yes | 11/11/2016 |

| 909 | 19.1% | 5,018 | 401.8% |

| Orezone Gold Corp (ORE-V) | Yes | 11/11/2016 |

| 1,587 | 4.8% | 1,270 | 27.0% |

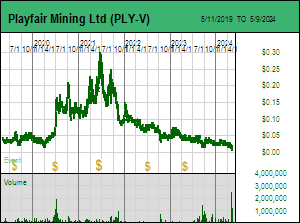

| Playfair Mining Ltd (PLY-V) | Yes | 11/11/2016 |

| 9,091 | 1.9% | 500 | (50.0%) |

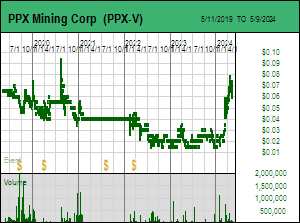

| PPX Mining Corp (PPX-V) | Yes | 11/11/2016 |

| 11,765 | 4.0% | 1,059 | 5.9% |

| Precipitate Gold Corp (PRG-V) | Yes | 11/11/2016 |

| 5,556 | 1.2% | 306 | (69.4%) |

| San Marco Resources Inc (SMN-V) | Yes | 11/11/2016 |

| 5,714 | 4.3% | 1,143 | 14.3% |

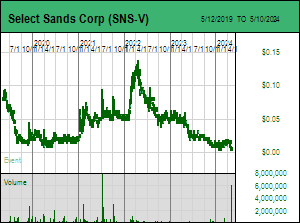

| Select Sands Corp (SNS-V) | Yes | 11/11/2016 |

| 1,087 | 1.5% | 408 | (59.2%) |

| Serengeti Resources Inc (SIR-V) | Yes | 11/11/2016 |

| 5,556 | 3.3% | 861 | (13.9%) |

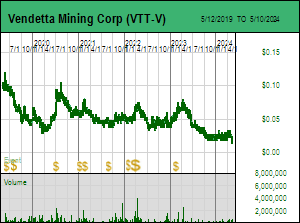

| Vendetta Mining Corp (VTT-V) | Yes | 11/11/2016 |

| 9,524 | 7.6% | 2,000 | 100.0% |

Metals Investor Forum November 2016 Index - Market Activity for May 8, 2018

Open Bottom-Fish or Spec Value Hunter Recommendation - Click for Recommendation Status Open Bottom-Fish or Spec Value Hunter Recommendation - Click for Recommendation Status |

| Company |

|

Volume |

High |

Low |

Close |

Chg |

MI% |

RS% |

W% |

| Adamera Minerals Corp (ADZ-V) |

|

35,000 |

$0.055 |

$0.055 |

$0.055 |

$0.000 |

0.0% |

0.1% |

3% |

| Almadex Minerals Ltd (AMZ-V) |

|

26,300 |

$1.610 |

$1.430 |

$1.530 |

$0.040 |

2.7% |

2.8% |

5% |

| Ashanti Gold Corp (AGZ-V) |

|

46,000 |

$0.170 |

$0.160 |

$0.160 |

($0.010) |

-5.9% |

-5.7% |

1% |

| Atlantic Gold Corp (AGB-V) |

|

1,160,900 |

$1.900 |

$1.830 |

$1.880 |

$0.010 |

0.5% |

0.7% |

8% |

| Auryn Resources Inc (AUG-T) |

|

44,600 |

$1.725 |

$1.670 |

$1.700 |

$0.030 |

1.8% |

1.9% |

3% |

| Balmoral Resources Ltd (BAR-T) |

|

231,400 |

$0.230 |

$0.215 |

$0.230 |

$0.005 |

2.2% |

2.4% |

1% |

| Black Sea Copper & Gold Corp (BLS-V) |

|

1,000 |

$0.090 |

$0.090 |

$0.090 |

($0.005) |

-5.3% |

-5.1% |

1% |

| Callinex Mines Inc (CNX-V) |

|

327,800 |

$0.240 |

$0.230 |

$0.235 |

($0.005) |

-2.1% |

-1.9% |

1% |

| Cordoba Minerals Corp (CDB-V) |

|

194,000 |

$0.175 |

$0.160 |

$0.170 |

$0.015 |

9.7% |

9.8% |

1% |

| Ely Gold Royalties Inc (ELY-V) |

|

8,500 |

$0.110 |

$0.105 |

$0.110 |

$0.000 |

0.0% |

0.1% |

2% |

| GMV Minerals Inc (GMV-V) |

|

0 |

$0.000 |

$0.000 |

$0.190 |

$0.000 |

0.0% |

0.0% |

2% |

| Golden Predator Mining Corp (GPY-V) |

|

212,300 |

$0.560 |

$0.450 |

$0.540 |

$0.095 |

21.3% |

21.5% |

3% |

| Klondike Gold Corp (KG-V) |

|

103,000 |

$0.245 |

$0.235 |

$0.235 |

($0.005) |

-2.1% |

-1.9% |

5% |

| Maritime Resources Corp (MAE-V) |

|

246,000 |

$0.115 |

$0.105 |

$0.115 |

$0.005 |

4.5% |

4.7% |

2% |

| Nevada Exploration Inc (NGE-V) |

|

12,500 |

$0.250 |

$0.250 |

$0.250 |

$0.000 |

0.0% |

0.1% |

2% |

| Nighthawk Gold Corp (NHK-T) |

|

95,800 |

$0.630 |

$0.590 |

$0.590 |

($0.020) |

-3.3% |

-3.1% |

6% |

| Northern Shield Resources Inc (NRN-V) |

|

0 |

$0.000 |

$0.000 |

$0.030 |

$0.000 |

0.0% |

0.0% |

1% |

| Novo Resources Corp (NVO-V) |

|

177,600 |

$5.730 |

$5.430 |

$5.520 |

($0.120) |

-2.1% |

-2.0% |

19% |

| Orezone Gold Corp (ORE-V) |

|

0 |

$0.000 |

$0.000 |

$0.800 |

$0.000 |

0.0% |

0.0% |

5% |

| Playfair Mining Ltd (PLY-V) |

|

2,000 |

$0.055 |

$0.055 |

$0.055 |

($0.005) |

-8.3% |

-8.2% |

2% |

| PPX Mining Corp (PPX-V) |

|

104,300 |

$0.095 |

$0.090 |

$0.090 |

$0.000 |

0.0% |

0.1% |

4% |

| Precipitate Gold Corp (PRG-V) |

|

65,500 |

$0.055 |

$0.055 |

$0.055 |

$0.000 |

0.0% |

0.1% |

1% |

| San Marco Resources Inc (SMN-V) |

|

0 |

$0.000 |

$0.000 |

$0.200 |

$0.000 |

0.0% |

0.0% |

4% |

| Select Sands Corp (SNS-V) |

|

589,100 |

$0.375 |

$0.335 |

$0.375 |

$0.040 |

11.9% |

12.1% |

2% |

| Serengeti Resources Inc (SIR-V) |

|

25,500 |

$0.160 |

$0.150 |

$0.155 |

$0.005 |

3.3% |

3.5% |

3% |

| Vendetta Mining Corp (VTT-V) |

|

12,200 |

$0.210 |

$0.210 |

$0.210 |

($0.005) |

-2.3% |

-2.2% |

8% |

| MI% = change in member's index value, RS% = difference in change between overall index and member index values, W% = value weight of member |

| Adamera Minerals Corp, led by CEO and President Mark Kolebaba, is the successor to the amalgamation of Uranium North Resources Corp on a 5:1 and Diamonds North Resources Ltd on 7.5:1 basis effective February 19, 2013. Although Adamera still has interests in various diamond and uranium properties in Canada's Arctic, the new focus since 2012 has been the Republic Graben area of northeastern Washington where Adamera is revisiting old gold-silver vein districts which have not been seriously explored during the past couple decades. The goal is to explore them at depth and for parallel structures, eventually either providing future mill feed for Kinross' Buckhorn Mine whose depletion is expected in 2016-17, if the resources are small, or developing them as standalone projects if rich and large enough. |  |

| Issued: | 125,733,595 | Working Capital: | $628,294 |

| Diluted: | 150,751,595 | As Of: | December 31, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.07 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 15,385 |

|

|  |

| Issued: | 53,828,869 | Working Capital: | $4,406,849 |

| Diluted: | 60,418,764 | As Of: | December 31, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $1.29 |

| Membership backdated to | August 14, 2015 | Membership Quantity | 775 |

|

| Ashanti Gold Corp listed on the CDNX as Buffalo Mines Ltd by Yorkton IPO on Mar 13, 1997, changed its name to Gulf Shores Resources Ltd on Mar 19, 1999 to reflect its shift into oil and gas exploration, consolidated its stock 30:1 on June 20, 2014, and changed its name to Ashanti on Aug 15, 2016 to reflect its shift into gold exploration with an option to earn 75% of the Anumso project in Ghana from AIM listed Goldplat plc and 658.5% of the Kossanto East project in Mali from AIM listed Alecto Minerals plc. In Oct 2016 Ashanti announced an LOI to acquire 100% of Red Back's (Kinross) interest in the Kwahu Oda, Asnakare and New Abirem licenses in Ghana. Ashanti Gold is headed by CEO Timothy McCutcheon. |  |

| Issued: | 37,602,135 | Working Capital: | $933,403 |

| Diluted: | 48,065,405 | As Of: | November 30, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.42 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 2,381 |

|

| Atlantic Gold Corp changed its name from Spur Ventures in August 2014. The company is led by CEO and Chairman Steven Dean. In April 2014 the company announced it would be merging with ASX-listed Atlantic Gold NL and focusing on Atlantic's Touquoy and Cochrane Hill gold projects located in the Meguma terrane of Nova Scotia. |  |

| Issued: | 197,188,140 | Working Capital: | ($24,003,425) |

| Diluted: | 252,098,226 | As Of: | December 31, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.88 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 1,136 |

|

| Auryn Resources Inc listed on the TSXV on October 17, 2008 as a capital pool called Georgetown Capital Corp which completed its qualifying transaction in February 2011 by optioning the Tanacross porphyry prospect in Alaska from Full Metal Minerals Ltd after Ivan Bebek and Shawn Wallace acquired control of the shell in late 2009. About $700,000 was spent on Tanacross during 2011, but the option was dropped in early 2012 due to poor results. Georgetown changed its name to Auryn Resources Inc on October 11, 2013 and is currently a shell looking for a project in Eurasia. |  |

| Issued: | 85,858,441 | Working Capital: | $3,473,000 |

| Diluted: | 90,691,157 | As Of: | December 31, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $2.42 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 413 |

|

| Led by President and CEO Darin Wagner, Balmoral Resources Ltd is focused on gold exploration on its properties straddling the Detour Trend within Canada's Abitibi Belt. The flagship project is the Martiniere system where Balmoral is delineationg a high grade gold deposit. Balmoral also owns the Fenelon gold deposit. |  |

| Issued: | 138,510,776 | Working Capital: | $9,075,682 |

| Diluted: | 157,366,976 | As Of: | December 31, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.83 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 1,205 |

|

| Black Sea Copper & Gold Corp is the successor to Alternative Earth Resources Inc is which completed a 1.24:1 rollback and name change on Sept 28, 2016 as part of an RTO of Bulgarian projects for 23.2 million shares. Alternative Earth itself is the successor Nevada Geothermal Power Inc following a 5:1 rollback on April 1, 2013 and another 2:1 rollback on Aug 5, 2016. During 2003-2011 the junior acquired and developed geothermal power projects in California and Nevada under the leadership of Brian Fairbank with over $50 million in equity and $150 million in debt financing before losing the assets due to operating losses. In 2014 AER abandoned its remaining dud geothermal projects and sold the rest to Ormat Nevada Inc for $1.5 million. Black Sea is headed by CEO & President Vince Sorace and is focused on Zlatusha and Kalabak, both early stage copper-gold prospects with porphry and epithermal potential in the West Tethyan Belt. The Junior was also trying to secure projects in Serbia. |  |

| Issued: | 43,966,275 | Working Capital: | $854,601 |

| Diluted: | 58,787,109 | As Of: | December 31, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.28 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 3,571 |

|

| Callinex Mines Inc was listed on the TSXV on July 14, 2011 following a spin-out of the exploration projects held by Callinan Royaltes Corp on the basis of 1 Callinex share for 4.5 Callinan shares. Led by CEO Max Porterfield and Chairman Mike Muzylowski, the company's portfolio is focused in the Flin Flon VMS district of Manitoba. The flagship project, Pine Bay, was optioned 100% in 2009 |  |

| Issued: | 78,298,708 | Working Capital: | $4,604,253 |

| Diluted: | 88,803,708 | As Of: | December 31, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.63 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 1,587 |

|

| Cordoba Minerals Corp listed on the TSXV via IPO on October 14, 2010 as WesGold Minerals Inc, with grassroots Yukon exploration play called Snowcap optioned from Radius Gold, a related company also controlled by CEO Simon Ridgeway. Snowcap yielded dud drill results in early 2011 and the focus shifted to Colombia in June 2011 through an option to acquire 51% of the Cordoba copper-gold IOCG/porphyry project from Tod Turley for $4 million (paid) and $15 million exploration over 30 months. Upon Cordoba vesting for 51% Turley's Minatura Intl LLC can put the remaining 49% to Cordoba in exchange for a 49% equity stake in Cordoba. Wesgold changed is name to Cordoba Minerals Corp on April 30, 2012. Peter Thiersch is the president. |  |

| Issued: | 206,438,643 | Working Capital: | $642,213 |

| Diluted: | 226,023,299 | As Of: | July 31, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.77 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 1,299 |

|

| Ely Gold and Minerals changed its name from Ivana Ventures on July 2008. The company is focused on Nevada, where it has two projects in the Battle Mountain Trend. Ely's Mt. Hamilton stage, where Solitario Exploration & Royalty Corp is earning 80%, is an modest-sized advanced project, hosting a 400,000 gold ounce resource in all categories, where a feasibility study and production decision are expected early in 2012. |  |

| Issued: | 76,055,475 | Working Capital: | $2,755,452 |

| Diluted: | 83,480,475 | As Of: | December 31, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.19 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 5,263 |

| GMV Minerals, led by President and CEO Ian Klassen, is focused on its Shoreham property in Guyana, an early-stage gold prospect. |  |

| Issued: | 33,528,206 | Working Capital: | $1,092,998 |

| Diluted: | 41,315,418 | As Of: | December 31, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.43 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 2,326 |

|

| Northern Tiger was a spinout of the Yukon assets of Firestone Ventures that is focused on the Sonora Gulch project amongst its portfolio of Dawson Range properties. Northern Tiger is led by CEO Greg Hayes and has an exploration alliance with Minto Explorations, a subsidary of Capstone Mining, which has a 13% interest in the company. Northern Tiger's flagship is the gold-copper-silver Sonora Gulch property where exploration has indicated a 2km long mineralized trend that in initial drilling has yielded results as high as 26 meters of 5 grams per tonne gold and 11.9 grams silver. |  |

| Issued: | 109,045,587 | Working Capital: | $3,456,454 |

| Diluted: | 151,675,938 | As Of: | December 31, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.79 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 1,266 |

|

| Klondike Gold Corp owns 100% of several projects collectively known as the Klondike District covering much of the area where the Klondike Gold Rush yielded 20 million ounces mainly from placer deposits. The goal is to identify bedrock hosted gold mineralization whose development would benefit from the nearby Dawson City infrastructure. Klondike Gold was once headed by Dick Hughes but is now headed by CEO Peter Tallman with Frank Giustra as the largest disclosed shareholder. In April 2017 Klondike Gold raised $2 million through 10 million flow-thru units at $0.20 |  |

| Issued: | 95,733,876 | Working Capital: | $6,607,300 |

| Diluted: | 122,972,600 | As Of: | November 30, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.17 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 5,882 |

|

| Maritime, led by President and CEO Eric Norton, is focused on gold exploration at its 100% optioned, past-producing Green Bay project in Newfoundland. |  |

| Issued: | 68,888,629 | Working Capital: | ($14,278) |

| Diluted: | 94,225,452 | As Of: | September 30, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.23 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 4,348 |

|

| Nevada Exploration Inc is the exploration vehicle for an innovative gold prospecting approach developed by Wade Hodges and Ken Tullar during the past decade to look for blind gold deposits buried beneath the gravels of Nevada's basins. NGE has collected over 6,000 water samples in northern Nevada. Several dozen potential hotspots have been identified, of which NGE has a 100% interest in Grass Valley just south of the Cortez Hills Mine and in South Grass Valley 30 km to the south. Both are blind targets with coincident gold and Carlin type pathfinder element anomalies. Key to Nevada 2.0 is John Muntean's "subduction slab rollback" theory which suggests that Carlin-type gold deposits were created from 45-25 million years over a 300 km stretch of northern Nevada where the older overthrusting of Lower Plate carbonates by Upper Plate siltstones created favorable deposit settings wherever deep-seated faults exist. The subsequent extension that created the basin and range topography buried half of Nevada's potential gold endowment under difficult to explore basin gravels. Most of Nevada's 300 million ounce known gold endowment has been found in the exposed ranges or by projecting structures and favorable host rocks under shallow gravel cover. The other half lies under gravel in places where the ranges offer no clues about nearby hidden riches. Finding the missing half of Nevada's gold represents the greatest gold exploration frontier in North America. NGE has pioneered the only effective way to "see" gold through gravel cover. In 2017 NGE deployed its custom Scorpion Rig to collect 3D samples on its Kelly Creek project east of the former 5 million oz Lone Tree Mine to outline a large blind hydrothermal system under gravel cover which it intends to drill in 2018. It has also established a drill ready groundwater based target at South Grass Valley. |  |

| Issued: | 55,424,068 | Working Capital: | $752,244 |

| Diluted: | 70,907,702 | As Of: | January 31, 2018 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.42 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 2,381 |

|

| Jan 19, 2018 | Discovery Watch with HoweStreet.com - 0:14:50 |

| Dec 8, 2017 | Discovery Watch with HoweStreet.com - 0:00:00 |

| Oct 13, 2017 | Discovery Watch with HoweStreet.com - 0:00:00 |

| Sep 13, 2017 | Discovery Watch with HoweStreet.com - 0:13:00 |

| Jun 23, 2017 | Discovery Watch with HoweStreet.com - 0:21:13 |

| Sep 19, 2016 | Bottom-Fish Comment: NGE rolls out its new Scorpion rig |

| Jul 4, 2016 | Bottom-Fish Comment: Bottom-Fish Recommendation Strategy for Nevada Exploration Inc |

| Oct 26, 2015 | Special Interest Comment: NGE's Grass Valley play emerges from the McEwen morgue alive and well |

| Sep 1, 2015 | Bottom-Fish Comment: Recommendation Strategy for Nevada Exploration Inc |

| Aug 11, 2015 | Bottom-Fish Comment: Ex-Uranerz Chairman leads rescue of NGE and its Nevada gold-in-groundwater exploration strategy |

| Nighthawk Gold Corp, led by CEO and President David Wiley, is an exploration junior focused on the Indin Lake Gold Camp, located approximately 200 kilometres north of Yellowknife, Northwest Territories. The company's flagship within the camp is the Colomac deposit, where it has a 2.1 million ounce gold resource in the inferred category (40 million tonnes grading 1.67 g/t Au) with exploration continuing at Colomac and at surrounding targets. |  |

| Issued: | 134,380,491 | Working Capital: | $7,497,556 |

| Diluted: | 148,274,667 | As Of: | July 31, 2016 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.39 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 2,564 |

|

| Northern Shield Resources Inc started out has a diamond exploration venture which went public in 2003 through a capital pool transaction. The junior headed by Ian Bliss was focused on till sampling for kimberlite indicator minerals in the southern part of the James Bay Lowlands when the recovery of chromite in the Highbank Lake area led to the recognition of a new layered intrusive complex in 2004. A chemical similarity with South Africa's Bushveld complex attracted Implats in 2005 which optioned 60% of the project's PGE potential. Although minor PGE mineralization has been intersected, no Bushveld style reefs have yet been found, and Northern Shield is still trying to sort out the geometry. In late 2007 in the wake of Noront's Eagle One discovery in the McFauld's Lake region to the north Northern Shield staked the large Eastbank property to the east of Highbank to cover what management believes to be another major layered intrusive complex obscured by a veneer of limestone. Northern Shield also owns the smaller Wabassi ultramafic intrusive complex to the south and has optioned East West's adjacent Max property on which it conducted a drill program during the summer of 2008. |  |

| Issued: | 205,144,921 | Working Capital: | $1,443,221 |

| Diluted: | 223,965,407 | As Of: | September 30, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.14 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 7,407 |

|

| Novo Resources Corp listed on the CSE by IPO as Galliard Resources Corp on June 11, 2010, changed its name to Novo on June 29, 2011 and listed on the TSXV on May 27, 2015. In 2011 Novo changed its focus to paleo placer targets in the Marble Bar and Nullagine sub-basins of Australia's Pilbara Craton. Quinton Hennigh became CEO and made Beatons Creek the flagship. Newmont became a major shareholder in 2013. Novo developed a protocol for establishing a resource estimate for the nuggetty Beatons Creek deposit and by 2016 had given up the search for a Wits 2.0 scale system in favor of developing Beatons as a small open pit mine. Newmont also gave up and signalled its wish to sell. In April 2017 Novo raised $18 million through a private placement at $0.66 whose funds were earmarked to complete a PEA for Beatons by the end of 2017. Hennigh took note of what ASX-listed Artemis Resources Ltd described as an immature conglomerate of mafic clasts which hosted water melon seed shaped and sized gold nuggets. Hennigh was quick to realize that this was the Wits 2.0 quarry he was seeking, though 350 km northwest of his Pilbara focus. He applied for 7,000 sq km, negotiated an 80% deal on the Comet Well property where the bed daylights along an 7 km strike, and did a 50% deal with Artemis for the conglomerate hosted gold potential of its holdings in the region which included Purdy's Reward. In July Novo unveiled its new focus and the Wits 2.0 Hypothesis, supposedly killed by past Aussie exploration, was reborn. In August Kirkland Lake bought a 9.9% stake from Newmont and invested $56 million in a private placement of 14 million units at $4. In September Novo began a combination scout drilling and large diameter drill bulk sampling campaign with the dual purpose of delineating the extent of the gold bearing conglomerate bed and establishing a protocol for reliably measuring the gold grade. In Nov Novo concluded the chosen LDD approach would not work and is bulk sampling the exposed bed. |  |

| Issued: | 146,298,877 | Working Capital: | $73,390,050 |

| Diluted: | 198,628,207 | As Of: | October 31, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $1.10 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 909 |

|

| Apr 30, 2018 | Discovery Watch with HoweStreet.com - 0:06:56 |

| Apr 25, 2018 | SVH Tracker: More delays for Novo's Comet Well project in the Pilbara |

| Mar 19, 2018 | Discovery Watch with HoweStreet.com - 0:00:00 |

| Mar 16, 2018 | SVH Tracker: What just happened to Novo at Friday's close? |

| Feb 23, 2018 | Discovery Watch with HoweStreet.com - 0:15:35 |

| Feb 22, 2018 | SVH Tracker: Recommendation Strategy for Novo Resources Corp |

| Dec 22, 2017 | Discovery Watch with HoweStreet.com - 0:00:00 |

| Dec 21, 2017 | SVH Tracker: Has Novo shackled or unleashed Pilbara Wits 2.0? |

| Dec 15, 2017 | Discovery Watch with HoweStreet.com - 0:24:21 |

| Nov 27, 2017 | SVH Tracker: Moriarty dangles from a piece of rope cut two thirds by Brent Cook |

| Orezone Gold is an Africa-focused gold explorer that emerged from Iamgold's February 2009 takeover of Orezone Resources in order to acquire control of Orezone's 5 million gold ounce, construction-stage Essakane project in Burkina Faso. As part of the acquisition agreement, Orezone Gold was created as the vehicle for Orezone Resources' non-core assets, and the company began trading on February 25, 2009, the day Orezone Resources was delisted. Amongst Orezone Gold's assets are three advanced gold projects in Burkina Faso including Bombore with 926,000 ounces of measured and indicated resources and 1.78 million of inferred resources. |  |

| Issued: | 154,050,364 | Working Capital: | $12,971,346 |

| Diluted: | 167,001,364 | As Of: | September 30, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.63 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 1,587 |

|

| Playfair Mining, led by CEO Don Moore and President Neil Briggs, is focused on several Tungsten projects in Canada. In Newfoundland, Playfair's Grey River projects hosts an inferred resource of 852,000 tonnes grading 0.86% W03 for 16 million pounds, while its Risby project in the Yukon Territory hosts an inferred resource of 8.5 million tonnes grading 0.48% W03 for 89.3 million pounds. After an updated resource estimate at Grey River in late 2011 showing 1.1 million inferred tonnes grading 0.73% WO3 for 18.8 million pounds, the company plans an updated PEA at the project during 2012. In November 2013 the company announced it would be undergoing a 10:1 rollback as part of a transaction to acquire an early-stage gold prospect in Ireland. |  |

| Issued: | 51,318,094 | Working Capital: | $80,438 |

| Diluted: | 55,948,094 | As Of: | November 30, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.11 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 9,091 |

|

| Peruvian Precious Metals Corp, led by CEO and President Brian Maher, is focused on exploring and developing the Igor property, located in Peru. Igor is a high-sulfidation epithermal precious metals property where in 2012 the company established an inferred resource estimate of 448,000 gold ounces and 16.5 million silver ounces in 7.1 million tonnes grading 1.94 g/t Au and 71.8 g/t Ag. The company continues to explore at Igor and is considering going forward with an underground bulk sample program. |  |

| Issued: | 447,898,617 | Working Capital: | $3,779,392 |

| Diluted: | 574,828,483 | As Of: | December 31, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.09 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 11,765 |

|

| Precipitate Gold went public in May 2012 after completing a $2.2 million IPO at $0.40. The company is led by |  |

| Issued: | 75,692,575 | Working Capital: | $1,538,732 |

| Diluted: | 94,002,696 | As Of: | November 30, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.18 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 5,556 |

|

| San Marco Resources Inc listed on the TSXV on Dec 18, 2007 as a Haywood IPO with the former Alwin copper mine in BC's Highland Valley as the flagship project. In June 2009 control shifted to Robert Willis and Tookie Angus who refocused San Marco into Mexico. From 2010-2012 the focus was on the Tecomate and Los Carlos gold-silver prospects followed by the Angeles project, a former high grade copper-gold-silver mine. Exeter optioned Angeles in Mar 2013 but dropped out a year later. In May 2014 San Marco optioned the Cuatro de Mayo silver-gold prospect. On Jan 5, 2015 San Marco did a 5:1 rollback and raised $648,000 at $0.05 from insiders and brokers. The Cuatro de Mayo project was beefed up with the acquisition of the nearby Mariana property from Argonaut. In Mar 2016 San Marco teamed up with Richard Osmond's GlobeTrotters Resource Group to apply a proprietary remote sensing strategy in Sonora state of Mexico which GlobeTrotters had successfully applied in Peru looking for porphyry systems. Insiders and brokers bankrolled the new initiative with a $439,000 PP at $0.05 in Apr 2016. The strategy involves processing Aster data (spectral absorption) with a filtering algorithm customized to spot alteration related to porphyry or epithermal systems. In May 2016 they formalized a 4 year alliance whereby GlobeTrotters would retain a 2% NSR on any projects acquired by San Marco, and 20% of any amount received from a project's sale to a third party. During H2 of 2016 San Marco processed the Aster data and with the help of its Sonora database generated 30 priority targets for acquisition over the next 12 months. San Marco continues to hold the Cuatro de Mayo (renamed Mariana), which has yielded some Aster anomalies, a remnant of Angeles available for farmout, Chunibas which it intends to drill in Q1 of 2017, and the Alwin project. In September 16 San Marco announced the acquisition of new projects generated by the Aster strategy. |  |

| Issued: | 64,715,832 | Working Capital: | $1,603,341 |

| Diluted: | 79,688,082 | As Of: | November 30, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.18 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 5,714 |

|

| Select Sands changed its name from La Ronge Gold in November 2014, reflecting the company's focus on mineral sands properties providing material for the oil and gas industry. Previously, the company was known as La Ronge Gold and was focused on gold in Saskatchewan's La Ronge belt, and prior to that was known as Chalice Diamond. Chalice Diamond Corp. was created as the vehicle for the diamond assets previously held by Golden Chalice Resources Inc. Under an arrangement between the two companies, shareholders of Golden Chalice Resources Inc. received one share of Chalice Diamond Corp. for every three shares of Golden Chalice Resources Inc. they owned upon the listing of Chalice Diamond in November 2007. In May 2014 the company signed a definitive agreement to acquire the assets and business of Canfrac Sands Ltd., a private company producing and selling frac sand in the Western Canada sedimentary basin. |  |

| Issued: | 87,003,316 | Working Capital: | $7,310,800 |

| Diluted: | 97,342,429 | As Of: | September 30, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.92 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 1,087 |

|

| Serengeti Resources Inc started off as a VSE junior called Dual Resources Ltd of which Ian Park became CEO in 1989. Dual changed its name to Serengeti Diamonds Ltd on Jan 7, 1994 to reflect a diamond focus on Tanzania that ended in 2000. Serengeti changed its name to Serengeti Minerals Ltd on Apr 23, 1999 and dabbled with dot-com acquisitions in 1999-2000 before conducting a 15:1 rollback on Mar 22, 2001. In 2002 Serengeti optioned the Holman diamond prospect on Victoria Island but dropped out in late 2003. In July 2004 Serengeti acquired five projects in British Columbia's Quesnel Trough from David Moore and Myron Osatenko who respectively became CEO and Expl VP. Geophysical surveys on the Kwanika project led to a high grade copper-gold discovery that enabled Serengeti to raise $20 million at $3 plus in May 2007. An initial resource estimate for the Central Zone was published in Feb 2009 and a PEA in Feb 2013. The PEA envisioned a 15,000 tpd scenario open-pit mining the lower grade upper parts of the Central and South Zones, and block-caving the richer deeper part of the Central Zone. The plan targeted less than a third of the global resource. CapEx was $364 million and OpEx $21.20/t. Using base case $3.63/lb Cu and $1,427/oz Au the pre-tax NPV at 5% was $263 million and IRR 13%. In July 2014 Kwanika attracted the attention of Daewoo Intl Corp, the trading arm of South Korea's Posco. Daewoo envisioned a central milling facility fed by potential deposits from 5 nearby properties owned by Seregenti of which Kwanika would be the heart. An option deal was not completed until March 7, 2016; Daewoo can earn 35% by spending $8.2 million over 3 years, plus certain concentrate offtake rights. After an updated PEA in April 2017 Daewoo committed to earning 35% by putting up another $7 million which closed in Nov 2017. During 2017 Serengeti drilled IP targets on the 100% owned UDS project adjacent to the Kemess Mine in British Columbia, and the 56.3% owned Milligan West project. |  |

| Issued: | 86,385,121 | Working Capital: | $538,830 |

| Diluted: | 99,680,221 | As Of: | November 30, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.18 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 5,556 |

|

| Jan 19, 2018 | Discovery Watch with HoweStreet.com - 0:22:45 |

| Jan 15, 2018 | Discovery Watch with HoweStreet.com - 0:11:33 |

| Oct 6, 2017 | Discovery Watch with HoweStreet.com - 0:00:00 |

| Oct 5, 2017 | SVH Tracker: Recommendation Strategy for Serengeti Resources Inc |

| Aug 1, 2017 | Discovery Watch with HoweStreet.com - 0:00:00 |

| Apr 7, 2017 | Discovery Watch with HoweStreet.com - 0:05:10 |

| Oct 20, 2016 | SVH Tracker: Serengeti's UDS delivers Plan B exploration play for 2017 |

| Sep 22, 2016 | SVH Tracker: Serengeti's Kwanika IP target intact and more prospective |

| Aug 10, 2016 | SVH Tracker: Recommendation Strategy for Serengeti Resources Inc |

| Mar 31, 2008 | Tracker 2008-16: Spectacular Kwanika hole supports new theory but does not signal a sweet spot starter pit |

| Vendetta Mining Corp listed on the TSXV on Oct 18,2010 by Wolverton IPO to explore the Honeymoon East VMS prospect in southern British Columbia. In November 2013 Vendetta optioned 100% of the Pegmont lead-zinc-silver project in Queensland of Australia. Headed by CEO Michael Williams and Peter Voulgaris, Vendetta's goal is to demonstrate that the Broken Hill style Pegmont system has a 10-15 million tonne resource of 9% plus combined lead-zinc ore that could be acquired by a nearby zinc producer such as South32's Cannington Mine. Resource Capital Funds has been a key backer in the 3 financing rounds in 2014-2016, including the private placement of 50 million units at $0.05 in May 2016. The 2016 program confirmed the model of a folded mineralized horizon which sees the zinc grade approaching the lead grade in the downdip southeast direction. A metallurgical study was launched in Q4 of 2016 to support an updated resource estimate expected in Q1 of 2017, followed by a PEA by the end of 2017 for which Vendetta will have to raise $3-$4 million. |  |

| Issued: | 119,396,491 | Working Capital: | $324,270 |

| Diluted: | 167,174,819 | As Of: | November 30, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.11 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 9,524 |

|

| Index Members Delisted or Closed Out |

|---|

| Integra Gold changed its name from Kalahari Resources and rolled back its shares on a 1:10 basis in December 2010. Integra is led by CEO and President John de Jong and is focused on exploration and development of its high-grade Lamaque Gold Project in Val-d'Or, Quebec. |  |

| Issued: | 486,274,000 | Working Capital: | $24,896,000 |

| Diluted: | 513,630,000 | As Of: | March 31, 2017 |

| Membership Start Date | November 11, 2016 | Price at Start | $0.61 |

| Membership End Date | July 17, 2017 | Price at End | $0.85 |

| Membership backdated to | January 2, 2015 | Membership Quantity | 1,639 |

|

| |

| | You can return to the Top of this page

|

|