| Kaiser Watch July 21, 2023: Capture Brazil potash market with carbon capture? |

| Jim (0:00:00): Why is Verde Agritech's carbon capture news potentially a big deal? |

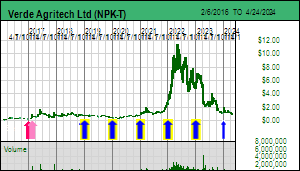

Verde Agritech Ltd announced on July 19, 2023 that an independent study by Newcastle University's David Manning, a soil scientist, has established that key products such as K Forte applied to fields in their current form naturally capture carbon dioxide at a rate of 120 kg CO2 per tonne of K Forte. That would mean K Forte at the current installed production capacity of 3,000,000 tpa would sequester 360,000 tonnes of CO2 annually while still delivering potassium and other nutrients to farm crops. If Verde Agritech achieved its production goal of 50 million tpa, which would replace about 50% of Brazil's potash consumption, 90% of which is imported as potassium chloride (KCl), a side effect would be sequestering 6 million tonnes of CO2 annually into an inert form similar to what FPX Nickel Corp hopes to achieve through ultramafic rocks rich with the magnesium mineral brucite. The next step is to establish the carbon footprint of K Forte through a "life cycle analysis" of CO2 generated by quarrying, grinding, shipping and applying K Forte, which is being done by an unnamed but "leading" Canadian consultancy firm. CEO Cristiano Veloso thinks the analysis could be ready within 3-4 weeks. The difference between the 120 kg of CO2 that K Forte sequesters and what it generates could be packaged into a marketable carbon credit sold internationally.

Verde Agritech has in the past mentioned "enhanced rock weathering" as an area of interest for its "greensand" product, a silicate called glauconite whose 6 billion tonne plus resource grades 8%-12% K2O. Similar glauconite deposits exist elsewhere in the world but their grade tends to range 3%-6% K2O, so to achieve the same potassium fertilizer effect a farmer would have to apply 2-3 times as much material as K Forte, which itself requires 5-6 times the volume as conventional potassium chloride. The fact that K Forte is currently ground into a powder form that has to be applied separately from other fertilizers such as nitrogen and phosphorous is an additional marketing obstacle. The farmers prefer to apply blended fertilizers which are supplied by blenders who insist on a granular form. Verde Agritech has indicated it is doing research on creating a granular form of K Forte which would open up the blenders as a distribution and marketing network. Veloso has told me that the granulated form would not change the CO2 sequestration rate because the granules would disintegrate once applied to the soil (granulation means binding the powder, not grinding to a coarser size).

The ERW news is timely because 2023 has been a rough year for the Brazilian farm community due to flat crop prices and higher interest rates, and that means it will be a disappointing year for NPK. We already know that revenues will be substantially lower than 2022 because the FOB Vancouver potash price had dropped to $328/t KCl at the end of June and NPK follows a KCl parity pricing strategy. The big question for NPK will be its ability to grow sales volume toward the 3 million tpa installed capacity. The TSX deadline for H1 financials with a December 31 yearend is August 14. Potash is the one key fertilizer farmers can leave out for a couple years, and in this regard Verde Agritech could have a difficult time growing sales in 2023, especially in a high interest rate environment where the K Forte producer cannot afford the credit terms demanded by farmers. The company does use modest discounts for volume and repeat business, but that is not enough to motivate farmers to try something new, especially when they are suffering financial distress.

The CO2 sequestration news is a big deal because it takes time to measure the sequestration process and until Professor Manning completed his study the ERW concept was just an idea. Additional verification studies will need to be done, but the next milestone is the K Forte carbon footprint data which is easier to collect. I suspect internally NPK already knows the numbers, which will be helped out by the fact that its electricity comes from hydropower. Once we know how much net CO2 a tonne of K Forte sequesters the company can start work on structuring a carbon credit linked to each tonne of K Forte sold. If Verde Agritech succeeds in creating a marketable carbon credit, it will have a killer market penetration strategy for Brazil that could eventually go far beyond supplying 5o% of Brazil's potash consumption.

The ERW news also explains the peculiar resolution NPK included in its AGM banning the sale of company products in 218 municipalities in 9 states covering 2,232,000 sq km. This area covers the northwestern part of Brazil where the Amazon is undergoing illegal deforestation to create land for farming and ranching. NPK's K Forte deposit is based in Minas Gerais and serves the southeastern part of Brazil where farming is concentrated. Because K Forte becomes less competitive with KCl the greater the distance it has to be transported, banning these distant states came across like pointless virtue signaling. But in light of the ERW news it is a preemptive move to guarantee that the carbon credits do not have a hidden carbon cost. The reason ERW could be a killer market penetration strategy is that carbon credits will be sold in a parallel market to international companies seeking to offset their carbon footprints, which would include technology giants such as Google, Microsoft and Meta. The farmers are unlikely to care about climate change and carbon footprints, but they are well versed in the language of money. Verde Agritech could use the carbon credit to sell K Forte at a substantial discount to KCl in K2O equivalence terms. Potassium chloride is a salt and has no CO2 sequestration potential so can never compete with a carbon credit linked pricing strategy.

Carbon capture, utilization and storage (CCUS) is being talked about ever more as a necessary part of the Net Zero Emissions goal for 2050. (Utilization is only a fraction of this concept - permanent sequestering is the main goal.) The Economist had an article on May 21, 2023 (Can carbon removal become a trillion-dollar business?) which discusses "direct air capture" as technology which sucks CO2 out of the air and injects into some sort of rock reservoir where it is permanently sequestered. The IEA's Energy Technology Perspectives 2023 report published in January has a section about CCUS which mainly deals with capturing carbon at source and transporting it by pipeline and/or ship to destinations suitable for storing the CO2 underground. The IEA says that worldwide CO2 capture is currently only 44 million tonnes but needs to expand 2,627% to 1.2 billion tonnes by 2030, and 14,000% to 6.2 billion tonnes by 2050.

Big oil, which has plenty of experience transporting CO2 for injection into oil fields for enhanced oil recovery, is getting interested in repurposing their pipelines, not just for hydrogen, but also CO2 captured at source such as natural gas powered electricity plants. Depleted oil fields could be turned into CO2 storage reservoirs. Direct air capture would require building a plant on top of the underground reservoir and suck the CO2 out of the air, which has CapEx costs and energy costs. The problem with this approach is that according to the Economist article it cost $600/tonne CO2 in 2011 compared to the EU emission-trading system where 1 tonne costs $100. Engineering has reduced the cost further, and CCS could become a reality if government policy lowers emission limits, forcing more CO2 emitters to buy carbon credits. What makes Verde Agritech's carbon credit proposal so interesting is that it is a form of direct air capture with no extra cost involved. And replacing potassium chloride with K Forte would preserve the fertility of Brazil's soil for generations. |

Verde Agritech Ltd (NPK-T)

Favorite

Good Spec Value |

|

|

| Cerrado Verde |

Brazil - Other |

9-Production |

K |

Potash Price and Supply Charts |

Map showing Brazil states affected by NPK Sales Ban |

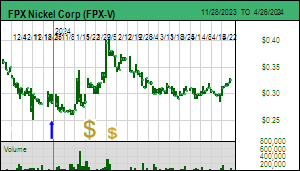

| Jim (0:12:21): Why do you think Toyota may be FPX Nickel's mystery investor? |

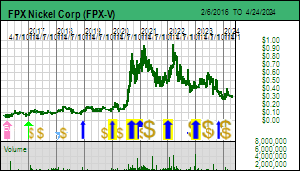

FPX Nickel Corp surprised the market last November when it raised $12 million at $0.50 with a strategic investor which requested anonymity. This was at a premium to the market and did not include any warrants or flow-thru benefits. The investor ended up with 9.95% and the right to maintain 9.9% by participating in any future financings but no offtake rights of any nature. In May FPX raised $16 million from Outokumpu at $0.60, again at a premium to market with no warrants, but Outokumpu did secure the right to purchase up to 60,000 tonnes of nickel (7,500 tpa) at market prices. This offtake right was important to Outokumpu because it specializes in making low carbon footprint stainless steel; with Indonesia now producing more than 50% of global nickel supply with the help of coal-powered electricity clean nickel may become quite scarce in the future. Outokumpu also stayed at 9.9% with a two year standstill. The mystery investor elected to invest another $1.95 million at $0.60 to maintain its 9.95% interest. FPX shareholders are perplexed about the secrecy and from various comments CEO Martin Turenne has made we can pretty much rule out that the investor is a mining company, a high net worth individual, or a financial institution. This has led to speculation that it is a downstream nickel user such as a chemical company that makes battery precursor materials, a battery maker or even a car maker. However, such entities have made investments in resource projects and never had reason to keep such an investment secret, and investors generally shrugged at names like Tesla. When Martin insisted the market would be impressed by the identity and that I would then understand why the investor wanted to remain secret, that pretty much ruled out downstream fabricators.

I began to wonder if the investor might be a technology company like Apple or Google which is not yet in the carmaking business but is working on self-driving car technology. FPX Nickel has put a fair amount of effort into developing a flow-sheet to make nickel-sulphate for the battery market, even though it is not clear that this would add to profitability of mining Decar and would certainly add complexity. The mystery investor appeared interested in the nickel sulphate potential, especially from a secure jurisdiction and with a low or even zero net carbon footprint. Apple or Google, which might never commercialize self-driving cars, might be interested in supporting a project like Decar which would not come on stream until 2030 or later. When FPX Nickel formed an alliance in April with JOGMEC to explore for awaruite deposits elsewhere in the world I began to wonder if the mystery investor was a Japanese carmaker.

Toyota, the world's biggest carmaker, was not on my list of suspects because Toyota has resisted developing electric vehicles. Instead it has stuck with hybrids while it worked on a future generation of hydrogen fuel cell powered cars. That changed when in June Toyota announced that it hoped to be selling an electric vehicle as early as 2027 with a range of 1,200 km and a 10 minute charge time. Such a long range and short charging time would deal with the range anxiety North American drivers suffer and accelerate adoption of electric vehicles. A Financial Times July 6, 2023 article explained the basis for Toyota's boast, which was that Toyota has developed a lithium ion battery with a solid state electrolyte that allows lithium metal to substitute for graphite in the anode. Toyota apparently accomplished this not with a new configuration, but rather with a manufacturing breakthrough that reduces the cost of making a solid state electrolyte that avoids the dendrite growth problem which causes short circuits and thermal runaway. Chinese EV makers and Tesla are relying on lithium-iron-phosphate batteries for cars targeting the mass market. A LFP battery uses lithium, iron and phosphate in the cathode and graphite in the anode.

Toyota's solid state battery will initially be part of a higher end electric vehicle and, although the cathode material has not been disclosed, nickel is a prime candidate. If the cost breakthrough is of a manufacturing nature, it is conceivable that further cost reductions will emerge as the solid state batteries get commercialized, similar to what happened with solar panels which are a lot cheaper today and not because the price of raw materials has declined. By 2030 Toyota may be ready to turn its best-selling Corolla model into an affordable electric vehicle superior to the cheap LFP cars Ford, Tesla, Volkswagen and their Chinese competitors hope will coax North Americans into giving up their gasoline powered cars. Given that Toyota has lagged its competitors in designing and marketing electric vehicles, it is understandable that it would not want to tip its hand by disclosing it has bought 9.95% of a junior with a nickel project at the prefeasibility stage. Unlike the Chinese carmakers who hope to export their cars to American consumers, Toyota has a history of making its cars in the United States. If nickel is part of the cathode of its solid state lithium ion battery, it would make sense to support a project like Decar which promises to be a long lived nickel mine with a low carbon footprint and in a secure jurisdiction that qualifies for Inflation Reduction Act subsidies. If it turns out nickel is not part of the solid state battery cathode, then my guess that Toyota is the mystery investor is most likely wrong. |

FPX Nickel Corp (FPX-V)

Favorite

Good Spec Value |

|

|

| Decar |

Canada - British Columbia |

6-Prefeasibility |

Ni |

Nickel Price and Warehouse Stocks Chart |

Nickel Supply Evolution Chart |

CO2 sequestration diagram for Decar mine waste |

| Jim (0:19:53): Any news on the James Bay forest access restrictions? |

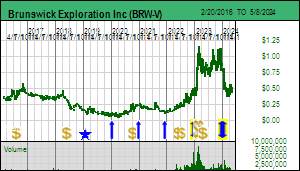

In last week's episode I was optimistic that forest access bans would be lifted for Quebec's James Bay region but the western half remained closed as did key transportation corridors such as the Trans Taiga Road. Projects such as PMET's Corvette and Brunswick's Mirage are outside the closed area, but getting boots onto the ground is a problem because helicopters are still under requisition to support the firefighters. CEO Marie-Josie Girard of Dios Exploration Inc tells me that while the East Clarkie and Nemiscau North projects are outside the access ban, they need helicopters because their second order sleuthing has developed precise targets. She has the contractor scheduled to start in mid August and believes there is plenty of time to make or break all the targets they have developed. I'm not sure they will be in a position to drill this fall but if they find any decent sized LCT-type pegmatites they could be drilling in Q1 of 2024.

Most of the projects of Brunswick Exploration Inc in the James Bay region are in closed areas, but the one that matters most, Mirage, is open. However, it is located 300 km from Nemiscau as the crow flies and the Trans Taiga remains closed. Mirage is only 100 km north of the Renard diamond mine so perhaps Brunswick can stage out of Renard to track down the bedrock source of its 1,700 m by 200 m spodumene bearing boulder field.

In the case of the Cheechoo project Sirios Resources Inc managed to extract its planned bulk sample for metallurgical testing, but the crew spent only 3 hours investigating the area up-ice from the gold deposit where a spodumene boulder was found when it was told to quit because of the fire bans. Sirios is stuck in a holding pattern with a persistent seller at $0.055 while it negotiates with Fury Gold Mines Ltd to acquire its 50.022% stake in the Eleonore South JV in which Newmont owns 49.978%. The problem with this situation is that Newmont has a right of first refusal if Fury and Sirios reach a deal. Most likely Fury will want a combination of cash and stock because the stock would allow Fury to participate in any upside once Sirios consolidates the entire area 100%. The most recent resource estimate gives Cheechoo 67.4 million tonnes indicated and inferred at 0.87 g/t gold (1.9 million ounces), but this estimate understates the reality because the pit shell can only be extended to the property line. This reduced intrusion related gold system has a potential resource in the 4-5 million ounce range, with at least 75% on the 100% owned Cheechoo property. With the whole being worth more than the sum of the parts, Fury would like stock, but if Newmont exercises its right of first refusal it would only pay the deemed cash value, denying Fury any future upside. Once Sirios owns 50.022% it would become operator, and it would make sense to approach Newmont with a deal to acquire its 49.978% stake, possibly for stock that takes its 12% Sirios equity stake up to 19.9%. As owner of the Eleonore underground mine it is the natural future purchaser of Cheechoo, assuming it does not sell Eleonore to a smaller producer.

There is also the bizarre potential that the northern half of the Cheechoo property which straddles the contact between the Opinaca and La Grande geological subprovinces hosts a decent sized pegmatite grading 1% Li2O or better which at $10/lb lb lithium carbonate would have a rock value of $545/tonne, equivalent to 8-9 g/t gold. In contrast the Cheechoo deposit has a rock value of only $55/tonne. The Eleonore South JV covers different geology and would not have LCT-type pegmatite potential. Sirios could split the pegmatite potential ground into a separate property and sell the consolidated Cheechoo gold project to Newmont.

Sirios did put out an update in early July about the Maskwa property which has been repurposed as a lithium play. Back in 2016 Sirios formed a 50:50 JV with Sphinx Resources called the Cheechoo-Eleonore Trend which was a conceptual play. They conducted till sampling which did not deliver much joy and in 2018 Sirios sold its 50% stake to Quebec Precious Metals Corp, a company related to Sphinx by way of Normand Champigny. Dominique Doucet revisited the area in 2020 with the idea that they should have been looking at the subprovince contact for intrusion related gold systems, which in this area was perpendicular to the Cheechoo-Eleonore "trend". Sirios conducted a till survey in 2020 seeking gold and tungsten grains whose 3 lines did yield gold and tungsten grains at the down ice limit of the property. Although the property does have anomalous lithium lake bottom sediment values these do not mean much because Maskwa was covered by the Tyrell Sea during a prior round of global warming. But tantalum is a heavy element (density 16.4 compared to 0.53 for lithium) it would have been recovered during heavy mineral screening (gold is 19.3). So they went back to samples and counted the tantalum grains which are anomalous. The only problem I have with the results is that all 3 lines perpendicular to the ice direction have similar elevated values, so no obvious vectoring. The source could be to the northeast on somebody else's property, or there could be several pegmatites near the subprovince contact. Maskwa is well inside the part of James Bay still closed to access, but for now Sirios is focused on trying to acquire the Newmont/Fury property next door to Cheechoo.

As an aside, I asked Dominque if Sirios still had the till sampling data from the 2000s when Sirios and Dios co-funded a regional survey with the gold targets going to Sirios and the diamond targets to Dios. That led to the Pontax lithium discovery now owned by Cygnus and Stria. He did, but only in paper form. The Cheechoo property offers first order pegmatite discovery potential because nobody ever looked hard at the lithium potential. Dios, in contrast has digitized its copy of the till survey data set and scrutinized it for clues to less obvious pegmatites, what I call second order exploration. Sirios would have have to walk the entire Maskwa and Cheechoo properties to find outcropping first order pegmatites. In contrast Dios has used multiple data sets including satellite imagery to pinpoint likely pegmatite locations. So even with a late boots on the ground start in August Dios could leapfrog other juniors who need to look at everything in order to find anything. |

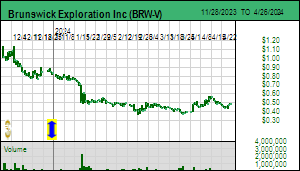

Brunswick Exploration Inc (BRW-V)

Favorite

Fair Spec Value |

|

|

| Mirage |

Canada - Quebec |

2-Target Drilling |

Li |

Dios Exploration Inc (DOS-V)

Bottom-Fish Spec Value |

|

|

| Nemiscau-North |

Canada - Quebec |

1-Grassroots |

Li |

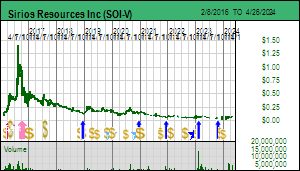

Sirios Resources Inc (SOI-V)

Bottom-Fish Spec Value |

|

|

| Cheechoo |

Canada - Quebec |

4-Infill & Metallurgy |

Au Li |

James Bay Forest Access Ban as July 17 |

Maps of the Cheechoo gold project with LCT pegmatite potential |

Yellow Gold Cheechoo Resource Estimate & White Gold Rock Value Matrix |

Origin of the Maskwa Project repurposed as a liithium play |

Comparison of Maskwa 2020 Till Survey Results |

| Disclosure: JK owns Brunswick, Dios, FPX Nickel and Verde Agritech; FPX Nickel and Verde Agritech are Good Spec Value rated Favorites, Brunswick is a Fair Spec Value rated Favorite; Dios and Sirios are Bottom-Fish Spec Value rated |