| |

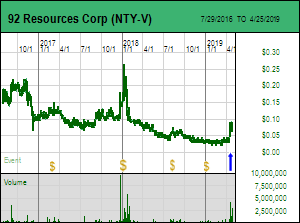

Tracker - April 25, 2019: 92 Resources Corp creeps closer to Mythril copper zone

92 Resources Corp announced an important amendment on April 24, 2019 to its September 4, 2018 FCI East option agreement with Osisko Mining Inc that includes the FCI West block at no additional cost. In 2018 NTY spent over 4 months negotiating the deal which allows it to earn a 75% interest in FCI East by issuing 2 million shares and spending $2.2 million over 3 years to earn 50%, and spending another $2 million over an unspecified time period to earn 75%. Virginia Gold Mines Inc explored the area in 1998-2007 and its spinout, Virginia Mines Inc, optioned FCI to Komet Resources Inc in late 2012 which underwent a switch from bathroom vanity maker to the resource sector and a management change that included Bob Wares as chairman. Komet drilled 6 holes in 2013 but dropped the option in H1 of 2015 as it switched its attention to Burkina Faso. When Osisko Gold Royalties Ltd acquired Virginia Mines on June 19, 2015 it inherited Virginia's property portfolio. But since Osisko Gold was a royalty company on October 5, 2016 it optioned the entire Virginia property portfolio to Osisko Mining for $32 million exploration over 7 years while retaining a sliding 1.5%-3.5% NSR on precious metals and 2% on other metals. That royalty applies to anything nearby that Osisko Mining might acquire. This agreement has been amended several times. Based on Osisko Gold's 2018 annual report Osisko Mining has spent $10.3 million of the $15.6 million required to be spent by Oct 2020 to vest for 50%, with a total of $26 million due by 2023 for 100%. Until Osisko Mining did the FCI East deal in 2018 it never explicitly listed FCI as part of the James Bay earn group, though it may have been inside the "other" category. To me this is a bit worrisome. 92 Resources Corp announced an important amendment on April 24, 2019 to its September 4, 2018 FCI East option agreement with Osisko Mining Inc that includes the FCI West block at no additional cost. In 2018 NTY spent over 4 months negotiating the deal which allows it to earn a 75% interest in FCI East by issuing 2 million shares and spending $2.2 million over 3 years to earn 50%, and spending another $2 million over an unspecified time period to earn 75%. Virginia Gold Mines Inc explored the area in 1998-2007 and its spinout, Virginia Mines Inc, optioned FCI to Komet Resources Inc in late 2012 which underwent a switch from bathroom vanity maker to the resource sector and a management change that included Bob Wares as chairman. Komet drilled 6 holes in 2013 but dropped the option in H1 of 2015 as it switched its attention to Burkina Faso. When Osisko Gold Royalties Ltd acquired Virginia Mines on June 19, 2015 it inherited Virginia's property portfolio. But since Osisko Gold was a royalty company on October 5, 2016 it optioned the entire Virginia property portfolio to Osisko Mining for $32 million exploration over 7 years while retaining a sliding 1.5%-3.5% NSR on precious metals and 2% on other metals. That royalty applies to anything nearby that Osisko Mining might acquire. This agreement has been amended several times. Based on Osisko Gold's 2018 annual report Osisko Mining has spent $10.3 million of the $15.6 million required to be spent by Oct 2020 to vest for 50%, with a total of $26 million due by 2023 for 100%. Until Osisko Mining did the FCI East deal in 2018 it never explicitly listed FCI as part of the James Bay earn group, though it may have been inside the "other" category. To me this is a bit worrisome.

Unless there exists an Osisko Gold carveout of the FCI claims from the general James Bay agreement, giving Osisko Mining clear title to FCI East and West, we must be cautious that NTY could vest in nothing if Osisko Mining does not spend another $15.7 million over the next 4 years on what are early stage projects in the James Bay region. The risk increases when we consider that Osisko Mining is transferring all its non-core assets into a halted shell called Chantrell Ventures Corp which will be renamed O3 Mining Corp after a 40:1 rollback and $18 million financing at $3.88. Osisko Mining will remain the largest shareholder of O3, and will likely spin those shares out if it gets a friendly offer for its Urban-Windfall gold project. The key assets of O3 will be the Marban and Garrison gold deposits; it is hard to imagine O3 spending $15.7 million on Virginia's James Bay leftovers when its purpose is to enhance the optionality value of these deposits, if indeed the James Bay portfolio is included in the O3 transfer. It is almost inconceivable that the situation I describe is the reality, but I have gone through the corporate filings of these companies and do not see a documented shift of FCI ownership from Virginia Mines to Osisko Mining. Since I am going by the assumption that Mythril is going to spawn a Great Canadian Area Play in which the FCI-Corvette package has a serious shot at hosting a world class deposit, I asked NTY's CEO Adrian Lamoureux about this situation. He has read me the pertinent part of the agreement which asserts that a subsidiary of Osisko Mining has clear title. But I would like to hear how this came about so that there are no down-the-road lawsuit surprises about title. The offset to the risk that Osisko Gold actually still has title to FCI is that if a discovery is made on FCI West or East NTY may single-handedly blow through $15.7 million over the next 4 years, enabling Osisko Mining to vest on all the other James Bay properties without spending another penny, and thus enabling NTY to vest for 75%. As for why did Osisko decide to add FCI West to the FCI East agreement without extracting any additional consideration? I suspect it is because Osisko or O3 will still end up with a 25% net interest but will not have to spend any money that would distract from its role as owner of advanced gold deposits.

Ignoring all this title risk hand-wringing, why is the FCI West property important to NTY? The diagram above depicts the geological trends within FCI West and East. We already know about the pegmatite dyke trend within the greenstones (amphibolites) whose spodumene mineralization is the host for lithium. FCI East covers about 75% of the pegmatite trend, with the rest on the 100% NTY owned Corvette property. The 2018 Far East deal gives NTY a chance to outline a potentially economic lithium bedrock deposit. At the moment lithium is in the market doghouse, the price of lithium carbonate having dropped more than 50% from its 2016 peak. We also know about the potential for greenstone hosted orogenic gold mineralization, whose 10 km strike potential on FCI West has been explored but could benefit from closer scrutiny. We do not know much about the potential of the northern part of the Corvette property and its geology is mapped as amphibolites which are not the host for the Mythril copper mineralization on Midland's ground to the west.

But when we stand back and look at the latest regional map Midland has published for the Mythril area, it is clear that Midland has staked a 40 km east-west trend covering different mapped rock types that is interrupted by a triangular pre-existing claim package known as NTY's Corvette whose base covers about 10 km of the trend. At this stage Midland's technical team knows a lot more about the potentially relevant geology for a new style of copper deposit than guided the lithium focused staking behind Corvette. This may be a classic example of being in the right place for all the wrong reasons.

Superficially the main value of the 75% option on the FCI West block is its location just 5 km south of the 4 km east-west Mythril IP chargeability anomaly of which the western 2 km segment has just had a dozen angled holes drilled into it. While 5 km does not seem far, FCI West might as well be on another planet. If the first round of drilling delivers good results that prompt Midland Exploration Inc to move higher, the market should be chasing Azimut Exploration Inc onto whose Pikwa property the IP anomaly projects. But while paging through Midland's recent 66 page presentation I nearly fell off my chair when I came to slide 44 which depicts the magnetics of the Mag-EM survey completed earlier this year, the one that did not yield any "strong EM conductors" over the IP defined Mythril zone on top of which the copper enriched boulders and outcrop have been found. When Azimut completed its survey on both Pikwa and the western part of Mythril, it also failed to come up with any "strong EM conductors" except way too far west to be interesting for now. But what are these 4 white circles Midland has drawn on its mag map and labeled "new conductors"? Three are to the south of the IP anomaly and closer to the FCI West boundary than the IP trend. All of a sudden the "copper trend" with the Tyrone-T9 prospect that is marked on the FCI West property in NTY's new map becomes interesting. The fourth conductor is on the southeastern corner where the FCI East claim begins. These are probably subtle conductors that showed up with deeper processing of the Mag-EM survey data, something that Azimut is still working on. At this stage of the game it makes no sense for Midland to paint these circles onto its map unless they mean something important, possibly a target under cover rocks which would not yield frost heaved copper boulders or soil geochemical anomalies. It is possible Gino Roger is just having some fun, yanking the chain of Osisko who until this week owned the FCI West claim. But now that wee little NTY has 75% of FCI West, that chain can end up yanking the stock a long way. It may turn out that Midland did not intersect barnburner intervals of continuous high grade copper mineralization in the first round of drilling, but its understanding about what might be going on at depth has likely leapt an order of magnitude beyond what everybody else has gleaned from what Midland allowed into the public domain.

Market activity in Midland and Azimut has become very quiet as we approach the arrival of the first Mythril assays, possibly next week, though more likely in the second week of May. In contrast it has become considerably more active in NTY during the past week, albeit only in volume terms. The 103 million fully diluted implies a value of $7-$9 million for the 100% and 75% net blocks compared to 5 times higher for Azimut and 10 times higher for Midland. The market is afraid of so-so drill results that suck the air out of expectations. I do not think we will get dud results, though I also suspect we will not get no brainer discovery holes (happy to be proven wrong on that count). I think the situation will be something like October 1994 when Diamond Fields drilled a linear target to the west of an outcrop of the Reid Brook Intrusive where a government geologist had taken a sample that did not run anything interesting, but when Friedland's prospectors, Chris Verbiski and Al Chislett took their own sample, it had run good nickel-copper values. The October 1994 drill program intersected high grade nickel-copper magmatic style mineralization within a dyke-like structure. It took the stock to $12 but the widths did not support the valuation and the stock looked like another Friedland promotion. Diamond Fields conducted a Mag-EM survey which identified a ring-like anomaly to the east which was drilled in Q1 of 1995. The geologists were frustrated because the ring did not yield anything interesting. Then somebody suggested, drill the "non-conductive" hole in the middle of the ring. Maybe the conductivity is zero because it is so high it is off the scale and registering as nothing. That hole yielded 100 m of engine block that ran 4% nickel and 3% copper. The geophysical context and the mineralization style enabled everybody to do a quick tonnage calculation of about 30 million tonnes, which is what the Ovoid turned out to be, a world class discovery which Inco bought out for $4 billion 18 months later. Similar blind mineralization known as the Eastern Deeps was found to the east. The scale and surprise shock was so big that Voisey's Bay became a Great Canadian Area Play even though Diamond Fields had map-staked all the ground with similar host geology. I think Midland will accomplish something similar over the next six months in terms of a world class discovery, but it is not clear at this stage what is the right geology. And unlike Labrador where all the ground is open, lots of ground in the James Bay region is already owned for other reasons. That is why I have pre-emptively set up a James Bay Plan Nord Resource Center to help everybody track the evolution of a Great Canadian Area Play from a near standing start. 92 Resources Corp is now positioned as the third best and most liquid bet that Midland will deliver a world class copper discovery that brings a flood of exploration capital in a very underexplored part of Quebec.

|