Home / Research Tools

Research Tools

| | Corporate Profile: IC Potash Corp

Publisher: Kaiser Research Online

Author: Copyright 2013 John A. Kaiser

|

| |

IC Potash Corp (ICP-T)

| IC Potash, previously the uranium explorer Trigon Exploration, is a potash developer led by Chairman George Poling and CEO and President Sidney Himmel. The company is focused on the southwestern United States where its flagship Ochoa project in Lea county, New Mexico, originally partially acquired in May of 2008 and fully acquired in late 2009, was the subject of a November 2011 PFS that forecast a 40+ year, 10,000 TPD underground mine life with average annual production of 568,000 tons of sulphate of potash per year and 275,000 tons of sulphate of potash magnesia. Initial capex was estimated at $709 million, operating costs of $147 per ton of product, and the after-tax project NPV was $1,286-million using a discount rate of 10 per cent, with an IRR of 26%, using a LOM average selling price of $623/ton of sulphate of potash. The company estimates that, pending successful permitting, construction could begin in late 2013, and be completed during a 24 month period. In April 2012 the company announced an offtake agreement with Yara International ASA for 30% of production from Ochao, with Yara taking a 19.9% stake in the company at $1.32. |

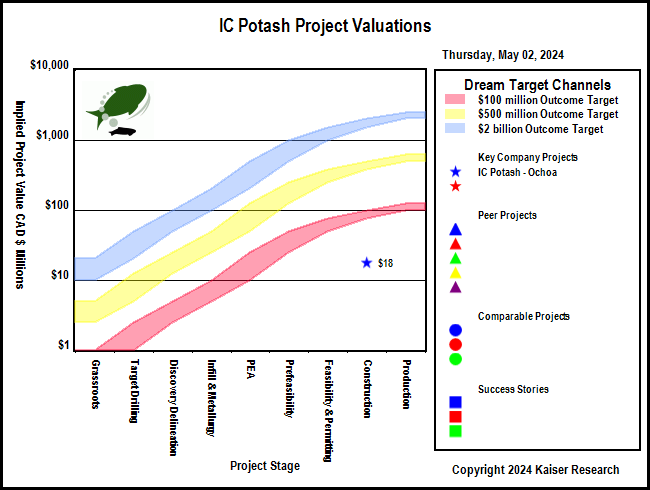

Key to Understanding IPV Charts and Spec Value Hunter Tables

| An IPV Chart is a graphical presentation of a Spec Value Hunter table that has been constructed according to the Rational Speculation Model developed by John Kaiser. The IPV Chart allows speculators to identify which projects offer poor, fair or good speculative value in both absolute and relative terms. The speculative value depends on the project stage, the project's implied value as calculated by the company's fully diluted capitalization, stock price and net project interest, and the dream target deemed appropriate for the project. A dream target is what a project would be worth in discounted cash flow terms once in production. |

| Green background indicates the dream target judged appropriate for this play by John Kaiser - otherwise unranked. |

Poor Speculative Value -   |

Fair Speculative Value -  |

Good Speculative Value -   |

Note:   narrow arrows indicate IPV is outside the fair value channel but within 25% of the fair value limits narrow arrows indicate IPV is outside the fair value channel but within 25% of the fair value limits |

| Click on the company name to view the company profile, the project name to view project details. |

| Click on the project icon if its background is shaded to get the IPV Chart for that company. |

IC Potash Project Valuations

| Company | Project | Country | Stage | IPV $

MM |

$100 | UPV

$500 |

$2000 | Target Metals | Deposit Style |

| Key Company Projects |

|

IC Potash Corp (ICP-T) | Ochoa |  | United States | Construction |

$18 |  |  |

| Potash | Evaporite |

|

|

| Peer Projects |

|

|

|

|

|

|

| Comparable Projects |

|

|

|

|

| Success Stories |

|

|

|

|

| |

| | You can return to the Top of this page

|

|