| |

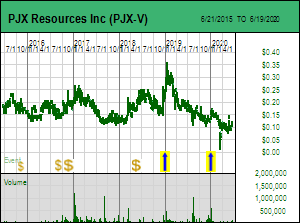

Tracker - June 22, 2020: David Pighin volunteers as Captain Ahab for Moby Dick hunt at DD

PJX Resources Inc announced on June 22, 2020 that it has optioned up to 75% of the DD project to MG Capital Corp to continue the Sullivan 2 Hunt in the Panda Basin of southeastern British Columbia. MG Capital completed its qualifying transaction as a capital pool on November 20, 2019 by issuing 32 million shares to acquire privately held DLP Resources Inc, named after David Leo Pighin, who spent much of his career with Cominco (Teck) during which he became one of the top experts on Sullivan and the endless quest for a sister deposit. Although MG Capital is headed by CEO Jim Stypula who led earlier Sullivan 2 hunts through Chapleau and Kokanee, including the Vine project now owned by PJX, the geological visionary behind MG Capital is David Pighen despite his modest title "project geologist". In fact he and a partner are the original stakers of the DD project which they optioned in 2015 to PJX for 250,000 shares over 5 years and an NSR that PJX can buy out. PJX optioned the DD property to Teck in May 2016 on terms that could have earned Teck 75% by spending $8 million by 2024. An MT survey revealed a deep anomaly into which Teck drilled a hole in 2018 that it stopped at a depth of 1,425 m when it encountered a gabbro sill with anomalous sphalerite and pyrrhotite which Teck chose to interpret as the explanation for the MT anomaly. Teck sat on the option until late 2019 before finally deciding to drop the option. The PJX farmout to MG Capital is a much stronger deal than PJX got from Teck which suggests that David Pighin strongly disagrees with Teck's interpretation of the deep hole's outcome. PJX Resources Inc announced on June 22, 2020 that it has optioned up to 75% of the DD project to MG Capital Corp to continue the Sullivan 2 Hunt in the Panda Basin of southeastern British Columbia. MG Capital completed its qualifying transaction as a capital pool on November 20, 2019 by issuing 32 million shares to acquire privately held DLP Resources Inc, named after David Leo Pighin, who spent much of his career with Cominco (Teck) during which he became one of the top experts on Sullivan and the endless quest for a sister deposit. Although MG Capital is headed by CEO Jim Stypula who led earlier Sullivan 2 hunts through Chapleau and Kokanee, including the Vine project now owned by PJX, the geological visionary behind MG Capital is David Pighen despite his modest title "project geologist". In fact he and a partner are the original stakers of the DD project which they optioned in 2015 to PJX for 250,000 shares over 5 years and an NSR that PJX can buy out. PJX optioned the DD property to Teck in May 2016 on terms that could have earned Teck 75% by spending $8 million by 2024. An MT survey revealed a deep anomaly into which Teck drilled a hole in 2018 that it stopped at a depth of 1,425 m when it encountered a gabbro sill with anomalous sphalerite and pyrrhotite which Teck chose to interpret as the explanation for the MT anomaly. Teck sat on the option until late 2019 before finally deciding to drop the option. The PJX farmout to MG Capital is a much stronger deal than PJX got from Teck which suggests that David Pighin strongly disagrees with Teck's interpretation of the deep hole's outcome.

MG Capital must pay $250,000 and spend $4 million over 4 years to earn 50%, at which point it either forms a 50:50 JV with PJX, or it elects to earn 75% by funding delivery of a bankable "commercial" feasibility study within 8 years of the original agreement. The second part of the deal that allows MG Capital to go to 75% is a very strong provision for PJX because to delineate a SEDEX zinc-lead-silver deposit at a depth of 1,500 m or so and demonstrate bankable feasibility, all within 8 years, would cost over $50 million. However, it can also be seen as a sweet deal for MG Capital because Teck saved the hole so that somebody else can deepen it. The Sullivan deposit occurs at the contact between the Lower and Middle Aldridge formations and it has become dogma that if other Sullivan type deposits formed in this sedimentary package they would all have formed at the same time horizon called the LMC. The argument at DD is that Teck's 1,425 m hole never encountered the LMC, so it must be beneath the gabbro body. The gabbro intrusions have no orebody potential and are younger intrusions in the sedimentary basin which often exploited lithological zones of weakness to form laterally extensive sills, but could just as easily have followed vertical structures and, heaven forbid, digested a relative of Sullivan. Other deep holes drilled beyond the DD claim indicate that alteration with anomalous zinc-lead mineralization is present within the LMC which thickens in the vicinity of the DD property, suggesting that DD is ground zero for Sullivan 2.

The plan is to deepen the Teck hole several hundred metres to see if the LMC is beneath the gabbro sill and hosts a massive sulphide body that explains the MT anomaly. Teck's geologists obviously think that deepening the hole will only reveal more gabbro that explains the MT anomaly. It may cost only several hundred thousand dollars to deepen the hole, and if MG Capital is lucky, Sullivan 2 is just beneath the gabbro sill. In that case PJX made a mistake optioning DD to MG Capital. However, if MG Capital is only half lucky, the drill will confirm that the gabbro is a sill just above the LMC, but the LMC is only intensely altered with very anomalous zinc-lead values, requiring MG Capital to drill expensive additional deep holes to track down the precise location of Sullivan 2 just as PJX keeps having to do at the Vine project where the MT anomaly seems to bob and weave its self-explanation out of the deep holes' paths. PJX's CEO John Keating in that case escapes the role of Captain Ahab which falls to David Pighin. If MG Capital is really unlucky it deepens the hole but loses it before making or breaking the LMC hypothesis.

I have assigned a Bottom-Fish Spec Value rating to MG Capital Corp based on its status as a new vehicle to pursue David Pighin's property visions in southeast British Columbia backed by experienced market players. Of the 3 projects acquired through the QT only the Aldridge 1&2 groups are a Sullivan 2 target. The other two properties, Hungry Creek and Redburn Lake, are sediment hosted copper-cobalt-silver targets occurring within the Purcell Basin. MG Capital is still missing proper financing which speculative interest in deepening the DD hole could facilitate. PJX Resources Inc is a Bottom-Fish Spec Value rated Favorite which gets a free ride on the DD project which suffered from a news blackout while under option to Teck and once it was back 100% it served as a potential money pit distraction from the Sullivan 2 hunt at Vine and the Vulcan Gold Belt district play Keating is trying to jump start with its package of claims that fed regional placer creeks with gold whose origin has never been explained. Ssee Tracker September 11, 2019 for background - last year's small drill program showed that the David Shear fades at depth. Handing off up to 75% of DD to Captain Pighin is a positive development for PJX which needs to give its Vulcan Gold Belt story a higher profile, something that John Keating insists he is working on.

|