| | KRO 2015 Spec Value Hunter Index

Publisher: Kaiser Research Online

Author: Copyright 2015 John A. Kaiser

|

| |

KRO Theme Index: KRO 2015 Spec Value Hunter Index

| Index Criteria: |

| Index Method: Each member of a KRO Index is assigned a value of $1,000 when added to the index, which is divided by the closing stock price on the inclusion date to arrive at a quantity of shares which remains constant during the life of the index. In the event of a split or consolidation, the quantity is adjusted by that ratio. If a company is divided into separate entities, the surviving entity that meets the index criteria has its quantity recalculated by dividing the prior day value by the subsequent closing price of the surviving entity. If a company is delisted pursuant to a takeover bid or merger, the value on the delisting day remains part of the index and the total members will include that company. The same applies to companies which have lost their eligibility. The value of the index is the total value divided by the number of members, which will be 1000 at the official start date. The value of the TSXV Index on the offcial start date is normalized to 1000, and the resulting factor is used to adjust the TSXV Index for comparison purposes. |

| Index Start Date | January 2, 2015 | Current Date | December 31, 2015 |

| Index End Date |

| Current Value | 849.9 |

| Index backdated to | January 2, 2014 | Total Members | 16 |

| KRO 2015 Spec Value Hunter Index - Members as of December 31, 2015 |

|---|

| Ceased to be index members due to delisting or ineligibility - their value is frozen as of the end date and included in the daily index calculation. |

|---|

| Underwent a rollback or split which resulted in an adjustment to the share quantity used in the member's index value calculation. |

|---|

| Company | Active | Start | End | Quantity | Weight | Value | Chg |

|---|

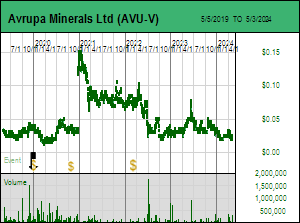

| Avrupa Minerals Ltd (AVU-V) | Yes | 1/2/2015 |

| 3,125 | 2.5% | 344 | (65.6%) |

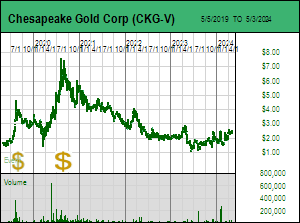

| Chesapeake Gold Corp (CKG-V) | Yes | 1/2/2015 |

| 481 | 6.2% | 847 | (15.3%) |

| Eastmain Resources Inc (ER-T) | Yes | 1/2/2015 |

| 4,255 | 10.6% | 1,447 | 44.7% |

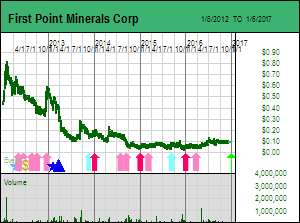

| First Point Minerals Corp (FPX-T) | Yes | 1/2/2015 |

| 22,222 | 8.2% | 1,111 | 11.1% |

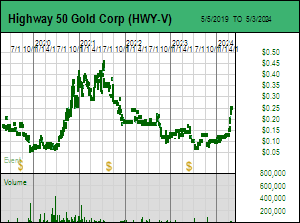

| Highway 50 Gold Corp (HWY-V) | Yes | 1/2/2015 |

| 3,636 | 1.7% | 236 | (76.4%) |

| InZinc Mining Ltd (IZN-V) | Yes | 1/2/2015 |

| 11,111 | 5.3% | 722 | (27.8%) |

| Midas Gold Corp (MAX-T) | Yes | 1/2/2015 |

| 2,174 | 5.0% | 674 | (32.6%) |

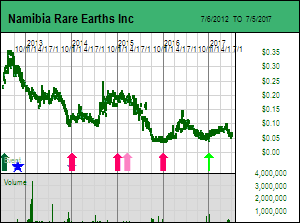

| Namibia Rare Earths Inc (NRE-T) | Yes | 1/2/2015 |

| 5,128 | 1.7% | 231 | (76.9%) |

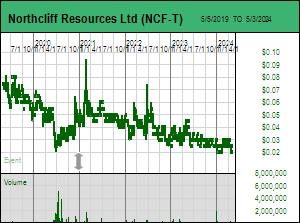

| Northcliff Resources Ltd (NCF-T) | Yes | 1/2/2015 |

| 4,878 | 3.0% | 415 | (58.5%) |

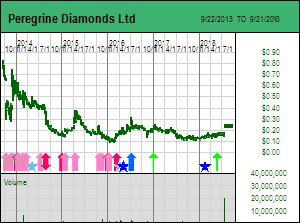

| Peregrine Diamonds Ltd (PGD-T) | Yes | 1/2/2015 |

| 5,405 | 5.4% | 730 | (27.0%) |

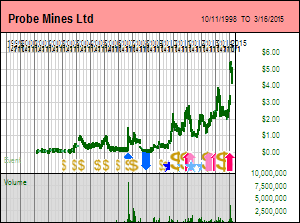

| Probe Mines Ltd (PRB-V) | Yes | 1/2/2015 | 3/16/2015 | 318 | 10.1% | 1,377 | 37.7% |

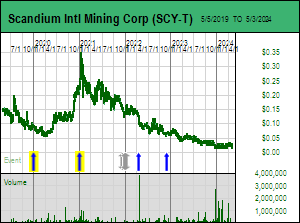

| Scandium Intl Mining Corp (SCY-T) | Yes | 1/2/2015 |

| 11,111 | 11.8% | 1,611 | 61.1% |

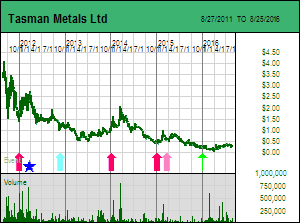

| Tasman Metals Ltd (TSM-V) | Yes | 1/2/2015 |

| 2,151 | 4.1% | 559 | (44.1%) |

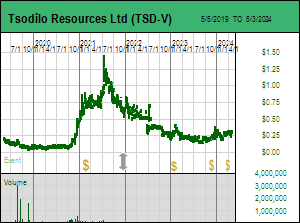

| Tsodilo Resources Ltd (TSD-V) | Yes | 5/15/2015 |

| 1,333 | 7.1% | 960 | (4.0%) |

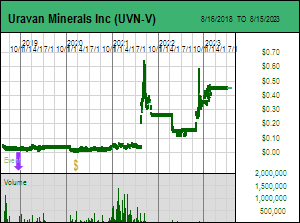

| Uravan Minerals Inc (UVN-V) | Yes | 1/2/2015 |

| 20,000 | 14.7% | 2,000 | 100.0% |

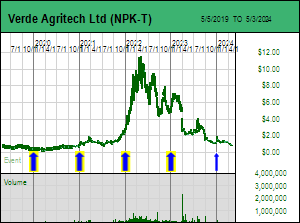

| Verde Potash plc (NPK-T) | Yes | 1/2/2015 |

| 1,818 | 2.5% | 336 | (66.4%) |

KRO 2015 Spec Value Hunter Index - Market Activity for December 31, 2015

Open Bottom-Fish or Spec Value Hunter Recommendation - Click for Recommendation Status Open Bottom-Fish or Spec Value Hunter Recommendation - Click for Recommendation Status |

| Company |

|

Volume |

High |

Low |

Close |

Chg |

MI% |

RS% |

W% |

| Avrupa Minerals Ltd (AVU-V) |

|

8,000 |

$0.110 |

$0.105 |

$0.110 |

$0.000 |

0.0% |

2.4% |

3% |

| Chesapeake Gold Corp (CKG-V) |

|

8,900 |

$1.800 |

$1.750 |

$1.760 |

($0.100) |

-5.4% |

-3.0% |

6% |

| Eastmain Resources Inc (ER-T) |

|

14,000 |

$0.345 |

$0.335 |

$0.340 |

($0.005) |

-1.4% |

1.0% |

11% |

| First Point Minerals Corp (FPX-T) |

|

5,000 |

$0.050 |

$0.050 |

$0.050 |

$0.005 |

11.1% |

13.5% |

8% |

| Highway 50 Gold Corp (HWY-V) |

|

0 |

$0.000 |

$0.000 |

$0.065 |

$0.000 |

0.0% |

0.0% |

2% |

| InZinc Mining Ltd (IZN-V) |

|

14,000 |

$0.065 |

$0.060 |

$0.065 |

$0.005 |

8.3% |

10.7% |

5% |

| Midas Gold Corp (MAX-T) |

|

12,100 |

$0.310 |

$0.300 |

$0.310 |

$0.010 |

3.3% |

5.7% |

5% |

| Namibia Rare Earths Inc (NRE-T) |

|

0 |

$0.000 |

$0.000 |

$0.045 |

$0.000 |

0.0% |

0.0% |

2% |

| Northcliff Resources Ltd (NCF-T) |

|

10,000 |

$0.085 |

$0.085 |

$0.085 |

$0.000 |

0.0% |

2.4% |

3% |

| Peregrine Diamonds Ltd (PGD-T) |

|

64,900 |

$0.135 |

$0.130 |

$0.135 |

($0.010) |

-6.9% |

-4.5% |

5% |

| Scandium Intl Mining Corp (SCY-T) |

|

11,900 |

$0.145 |

$0.145 |

$0.145 |

$0.005 |

3.6% |

6.0% |

12% |

| Tasman Metals Ltd (TSM-V) |

|

21,100 |

$0.260 |

$0.245 |

$0.260 |

$0.020 |

8.3% |

10.7% |

4% |

| Tsodilo Resources Ltd (TSD-V) |

|

0 |

$0.000 |

$0.000 |

$0.720 |

$0.000 |

0.0% |

0.0% |

7% |

| Uravan Minerals Inc (UVN-V) |

|

144,500 |

$0.125 |

$0.090 |

$0.100 |

($0.025) |

-20.0% |

-17.6% |

15% |

| Verde Potash plc (NPK-T) |

|

32,900 |

$0.195 |

$0.185 |

$0.185 |

$0.000 |

0.0% |

2.4% |

2% |

| MI% = change in member's index value, RS% = difference in change between overall index and member index values, W% = value weight of member |

| KRO 2015 Spec Value Hunter Index News Releases for December 27, 2015 to January 2, 2016 |

|---|

| No Company News Releases |

|---|

| Avrupa Minerals Ltd, headed by CEO Paul Kuhn, is a Europe-focused prospect generator that has prospects in Portugal, the former East Germany and Kosovo. Kuhn has targeted old mining districts in Europe where he is either rethinking the geology, as is the case with the Iberian Pyrite Belt prospects in Portugal where his reinterpretation of the stratigraphic sequence that hosts world-class Neves Corvo style VMS deposits has attracted Antofagasta as a partner, applying alternative deposit models to districts such as Germany's Erzgebirge where tungsten rather than gold was the historic target metal, or picking up prospects in a region like Kosovo which not long ago was a battleground. The flagship play is the Alvalades JV in which Antofagasta can earn up to 80%, leaving Avrupa with a carried through production 20% net interest. Antofagasta has spent US $6.3 million to vest for 60%, but lost interest in further expenditure during 2015 despite a breakthrough Cu-Zn-Sn-Ag VMS discovery in February 2014 which confirms that this post-mineral covered 30 km segment is fertile like the exposed rest of the 240 km IPB. In June 2015 Avrupa optioned up to 80% of the Alvito copper-gold IOCG prospect in Portugal to Lowell Copper Ltd. Avrupa will net 15% in the Covas tungsten project in Portugal if Blackheath Resources Inc spends euro 2,651,000 by March 2017 (euro 1.3 million spent by Q1 of 2015). An initial 43-101 tungsten resource was published in March 2015 for this former producing deposit. In Kosovo Avrupa nets 15% in the Slivovo polymetallic project if Byrnecut Intl Ltd delivers a PFS by April 2017. Slivovo yielded a high grade gold discovery hole in Q4 of 2014 that followup work indicated had modest tonnage potential. Slivovo also has an epithermal target called Xzemail. Avrupa owns 85% of the Oelsnitz project in Germany's Erzgebirge for which it is seeking a farmout partner. |  |

| Issued: | 55,475,797 | Working Capital: | $731,659 |

| Diluted: | 97,354,031 | As Of: | September 30, 2015 |

| Membership Start Date | January 2, 2015 | Price at Start | $0.32 |

| Membership backdated to | January 2, 2014 | Membership Quantity | 3,125 |

|

|

| Chesapeake Gold Corp, headed by CEO Randy Reifel, owns 100% of th Metates gold-silver-zinc deposit in Mexico's Durango state for which it delivered a PFS in 2013 for a 120,000 tpd open-pit mine with an autoclave and SXEW plant that would produce 16,470,000 oz gold, 397 million oz silver and 3.6 billion lbs zinc over a 25 year mine life. The open pit operation would produce a concentrate through froth flotation at the minesite, transport the concentrate through a 127 km slurry pipeline to the Ranchito site in Sinaloa state where there is an abundant supply of limestone and land suitable for infrastructure, process the refractory sulphides through a pressure oxidation autoclave, produce gold-silver dore through cyanidation, and high purity zinc ingots through SX-EW. The LOM average grade would be 0.5 g/t gold, 14.2 g/t silver and 0.17% zinc. The high CapEx of US $4.36 billion and a base case price of $1,350 gold were deemed unrealistic and in 2014 Chesapeake initiated work on a revised PFS that will include a desalination plant to deal with higher Mexican water tariffs. The revised PFS is expected in Q4 of 2015. |  |

| Issued: | 44,416,366 | Working Capital: | $25,259,500 |

| Diluted: | 48,014,366 | As Of: | September 30, 2015 |

| Membership Start Date | January 2, 2015 | Price at Start | $2.08 |

| Membership backdated to | January 2, 2014 | Membership Quantity | 481 |

|

|

| Eastmain Resources Inc has been focused on Quebec exploration under the leadership of CEO Don Robinson since listing on the TSX on November 1, 1996. The flagship from the start has been the Eau Claire (Clearwater) project in the James Bay area of central Quebec which started out as a JV with SOQUEM until Eastmain secured 100% in 2002. Over $30 million has been spent outlining a multi-million ounce medium grade quartz-tourmaline vein system whose amenability to mine development has been problematic until 2014 when Eastmain came up with a domain model that recognizes three structural controls for the gold mineralization. In April 2015 Eastmain updated its resource estimate, presenting 6,797,000 tonnes of 4.05 g/t gold as an M+I pit constrained resource representing 885,000 ounces, and an inferred underground resource of 4,402,000 tonnes of 4.16 g/t representing 588,000 ounces. A $2 million program is planned for 2015 to produce a PEA for an open-pit operation and expand the open-pittable resource within the 7.5 km belt. Eastmain also owns 100% of the Eastmain Mine project south of the Renard diamond project on which others have spent $40 million to outline a small copper-silver-gold resource. A $1 million drill program of 7,500 m is planned for 2015. Eastmain also has a 36.5% interest in the Eleonore South project with partners Goldcorp and Azimut. |  |

| Issued: | 133,039,815 | Working Capital: | $4,580,106 |

| Diluted: | 140,308,420 | As Of: | July 31, 2015 |

| Membership Start Date | January 2, 2015 | Price at Start | $0.24 |

| Membership backdated to | January 2, 2014 | Membership Quantity | 4,255 |

|

|

| First Point Minerals Corp, led by founders Peter Bradshaw and Ron Britten and run by CEO Jim Gilbert, is focused on the discovery and development of a very low grade type of nickel deposit characterized by a nickel-iron alloy mineral called "awaruite", a form of natural stainless steel created when ultramafic rocks of an ophiolite nature undergo a metamorphism that squeezes the nickel out of the olivine lattice. Metallurgical studies indicate that this nickel-iron alloy is recoverable through gravity and magnetic separation methods if the grain size is large enough. Cliffs Natural Resources Inc spent $22 million from 2010-2013 to deliver a PEA for a 114,000 tpd open pit mine with a gravity-magnetic separation flow-sheet that would produce 37,000 tonnes of nickel annually in the form of a nickel-magnetite concentrate that steelmakers could use directly as a feedstock for stainless. The 24 year mine life was based on an I+I resource of 925 million tonnes of 0.118% nickel (Davis Tube) with a recovery of 82%. The deposit is located in central British Columbia within reasonable proximity of rail and power infrastructure. After vesting for 60% Cliffs undertook to produce a PFS by the end of 2015 to earn 65%, but was blindsided in 2014 by a proxy battle launched by a hedge fund that did not see the iron ore collapse coming. The hedge fund ousted management in 2014 and has been trying to sell the 60% for cash, but given weak nickel prices since mid 2014 has found no takers. First Point hopes to regain control of the project but until it does so on favorable terms is conserving cash and treading water. Efforts to source similar deposits around the world failed, though the Mich deposit in northern British Columbia appears similar to Decar. |  |

| Issued: | 105,804,339 | Working Capital: | $1,052,838 |

| Diluted: | 117,849,924 | As Of: | September 30, 2015 |

| Membership Start Date | January 2, 2015 | Price at Start | $0.05 |

| Membership backdated to | January 2, 2014 | Membership Quantity | 22,222 |

|

|

| Highway 50 Gold Corp is the current Nevada exploration vehicle for John and Gordon Leask whose prior Nevada junior, White Knight Resources, was acquired by Rob McEwen's US Gold in 2006. The Leasks have a penchant for deep conceptual geological speculation as they try to reconstruct the likely genesis of major goldfields. They acquired control of the predecessor shell company Tatmar Ventures Inc in 2007 but made their first Nevada move in 2010 through the 100% lease of the Golden Brew project 100 km southwest of the Cortez Trend near the old Quito gold mine. Golden Brew saw 4 drill holes in 2011 that tested basin gravel covered targets interpreted as horsted Lower Plate rocks related to anomalously gold bearing jasperoids in the range front. The bedrock proved deeper than expected, so Highway 50 extended the structural model to the northeast and staked the Porter Canyon claims over the shallow pediment west of Quito. A 2011 drill program encountered mineralized debris in the gravel cover management interpreted as a lag deposit from a nearby bedrock source, but a drill program in early 2015 was unsuccessful. The source of the lag deposit remains unresolved, though it may be under gravel north of the structurally defined target area. The Golden Brew property has been optioned 50% to Regulus Resources Inc with a possible drill program in Q4 of 2015 if drill permits are obtained. The Porter Canyon and Golden Brew targets coincide with the corners of the Eastgate Trough where they intersect with regional structures interpreted as deep-seated. The discovery of a high grade Carlin-type gold deposit on either of these blind "under cover", "off-trend" targets would have major implications for northern Nevada. |  |

| Issued: | 26,697,570 | Working Capital: | $1,146,533 |

| Diluted: | 36,094,595 | As Of: | September 30, 2015 |

| Membership Start Date | January 2, 2015 | Price at Start | $0.28 |

| Membership backdated to | January 2, 2014 | Membership Quantity | 3,636 |

|

|

| InZinc Mining Ltd listed on the TSXV by IPO on Apr 15, 1999 as Berland Resources Ltd with a Timmins gold prospect. Berland changed its name to Lithic Resources Ltd with a 2:1 rollback on June 7, 2002 and attracted RCF as a new backer until it sold its position in 2009 leaving CEO Chris Staargaard completely in charge. On Feb 19, 2014 Lithic changed its name to InZinc to reflect its focus on the West Desert (then called Crypto) zinc skarn deposit in Utah that it acquired in June 2005 from Eurozinc Mining Corp of which RCF was a heavy backer. During the zinc boom of 2006-2008 InZinc conducted infill drilling to deliver a resource estimate in 2009 that became the basis for a negative PEA in August 2011 that recommended InZinc double the deposit size or find higher grade ore in order to make West Desert viable as a 3,500 tpd underground mine at a base case price of $1.10/lb zinc. With zinc back below $0.90/lb InZinc languished until mid 2012 when it attracted Kerry Curtis and Wayne Hubert as new backers. InZinc published a new PEA in April 2014 that achieved a US $258.1 million after-tax NPV at 8% with a 23% IRR at $1/lb zinc by turning the magnetite waste product into a saleable by-product along with copper, gold, silver and indium. The 6,500 tpd underground mine with a capex of US $247 million was based on a resource that gave it a 15 year mine life. The next step will be a $3-$5 million delineation drill program to establish the limits of the deposit ahead of proceeding with a feasibility study management thinks it can do for $15 million. The PEA does not include a potentially open-pittable zinc oxide resource. The deposit is open laterally and at depth. No work is planned until a breakout in the zinc price supports a higher valuation and enables InZinc to raise $3 million without heavy dilution. |  |

| Issued: | 72,205,419 | Working Capital: | $850,260 |

| Diluted: | 79,722,238 | As Of: | September 30, 2015 |

| Membership Start Date | January 2, 2015 | Price at Start | $0.09 |

| Membership backdated to | January 2, 2014 | Membership Quantity | 11,111 |

|

|

| Midas Gold Corp is working on a prefeasability study for its 100% owned Golden Meadows gold-antimony project in Idaho for which a 2012 PEA proposed a 20,000 tpd open pit, milling, pressure oxidation and cyanidation plan to recover 4.9 million oz gold over 15 years, with a flotation circuit to produce a separate antimony concentrate from antimony enriched zones. The project cosnsist of 3 deposits with refractory sulphide ore within a larger mineralized system that has room for the development of future additional zones. The site is a historic mining district where antimony-tungsten were recovered in WWII, mercury until 1963, and oxide gold until 1997 through heap leaching. The property has historic reclamation liabilities, some of which the Golden Meadows plan would remediate. There is a risk that environmental regulators might prefer to leave the area undisturbed in its present form, but the offset would the strategic importance of the antimony by-product in the event that China becomes an unreliable supplier of antimony. Midas Gold listed on the TSX in July 2011 and is led by President and CEO Stephen Quin and Chairman Peter Nixon. A PFS is expected in mid 2014. |  |

| Issued: | 160,829,280 | Working Capital: | $6,514,315 |

| Diluted: | 194,315,519 | As Of: | September 30, 2015 |

| Membership Start Date | January 2, 2015 | Price at Start | $0.46 |

| Membership backdated to | January 2, 2014 | Membership Quantity | 2,174 |

|

|

| Namibia Rare Earths Inc, led by President and CEO Gerald McConnell, listed on the TSX on April 14, 2011 after completing a $25 million IPO at $0.80 to fund its 100% owned Lofdal rare earths project in Nambia. NRE is controlled by Endeavour Mining Inc, which inherited Lofdal when it made a takeover bid in September 2010 for Etruscan Resources Inc which valued Etruscan at $216 million. Lofdal was an IOCG prospect for Etruscan in 2005-2008, but the exploration focus shifted to the carbonatite complex whose overall light rare earth footprint exhibited localized heavy rare earth enrichment. Endeavour spun out Lofdal as a separate company to take advantage of the rare earth boom which the junior largely missed because it did not publish an initial 43-101 resource estimate until July 2012. NRE did establish an indicated and inferred resource of 1,650,000 tonnes grading 0.56%-0.62% TREO in a 10-25 m thick dyke with a 650 m strike measured downdip 150 m in Area 4 but known to extend at least 250 m. Although low tonnage and low grade the Area 4 deposit has 85% heavy rare earths due to the mineral xenotime. Two metallurgical holes testing low and grade parts of the deposit where drilled in 2012 with a metallurgical study expected by the end of 2012. If the fine-grained, zircon interwoven xenotime lends itself to a cost effective flow-sheet that facilitates thorium removal, NRE will proceed with additional infill and expansion drilling and a PEA in 2013. |  |

| Issued: | 77,828,500 | Working Capital: | $2,425,203 |

| Diluted: | 84,992,500 | As Of: | August 31, 2015 |

| Membership Start Date | January 2, 2015 | Price at Start | $0.20 |

| Membership backdated to | January 2, 2014 | Membership Quantity | 5,128 |

|

|

| Northcliff Resources Ltd was a private company in the Hunter Dickenson stable that in August 2010 acquired an option to earn 70% in Geodex's Sisson tungsten-moly project in New Brunswick for $16 million in exploration and development spending or the completion of a feasiblity study, with an obligation to seek debt financing on behalf of both partners. Sisson has a measured and indicated resource of 175 million tonnes grading 0.094% WO3 and 0.03% Mo and a March 2009 PEA that called for a 20,000 tonne per day open pit mine with a 20 year mine life, an NPV (8%) of $372 million, and $339 million in initial capex. In May 2012 an agreement was reached to acquire the remaining 30% of Sisson for 16 million NCF shares, $1 million cash, and the return of 3.3 million Geodex shares. The feasibility study which will expand the PEA throughput and include an APT processing plant is expected in mid November 2012. |  |

| Issued: | 106,465,781 | Working Capital: | $1,727,845 |

| Diluted: | 114,832,361 | As Of: | July 31, 2015 |

| Membership Start Date | January 2, 2015 | Price at Start | $0.21 |

| Membership backdated to | January 2, 2014 | Membership Quantity | 4,878 |

|

|

| Peregrine Diamonds Ltd is an advanced diamond exploration junior headed by Eric Friedland, with Robert Friedland as a 24% shareholder, which spent over $50 million between 2005-2008 on the 71.7% owned DO27 pipe in the NWT south of the Diavik and Ekati diamond mines before shifting its focus to the now 100% owned Chidliak project on South Baffin Island in 2009 where former partners and Peregrine have since spent over $50 million finding 71 kimberlites. Of these the CH6, CH7, and CH44 are the subject of a $15 million bulk sampling program in 2015 designed to yield resource estimates with macro grades and carat values that will form the basis for a PEA in Q1 of 2016. During 2013 Peregrine collected a 404 tonne surface bulk sample from the CH6 pipe which yielded 1,013.5 carats for an indicated grade of 258 cpht and a modeled value range of $162-$236 per carat. The CH7 and CH44 pipes have grade potential in the order of 100 cpht. The 3 pipes have an in situ potential of 30 million carats. The project is sufficiently funded to deliver the PEA; if justified, management plans to fund a feasibility study by bringing on board a minority partner or even advance Chidliak on a 100% basis if market conditions allow. The DO27 pipe has an I+I resource of 28 million tonnes of 94 cpht with a carat value modeled at $51 per carat in 2008, which was deemed insufficient to support a standalone mine. The goal is to sell or JV DO27 as future mill feed for the nearby Ekati or Diavik mines. Peregrine has exclusive rights to BHP's Canadian diamond database and plans a new round of grassroots exploration. In 2015 Peregrine acquired rights to 574,600 hectares of diamond licenses in Botswana's Central Kalahari Game Reserve which in recent years the government has reopened to diamond exploration. |  |

| Issued: | 282,663,598 | Working Capital: | $7,761,904 |

| Diluted: | 378,567,997 | As Of: | June 30, 2015 |

| Membership Start Date | January 2, 2015 | Price at Start | $0.19 |

| Membership backdated to | January 2, 2014 | Membership Quantity | 5,405 |

|

|

| Scandium Internaional Mining Corp is the successor to EMC Metals Corp, itself the specialty metals sucessor of Golden Predator Mines Inc which listed on the TSX on March 24, 2008 after being spun out from Energy Metals Corp as part of the latter's takeover by Uranium One Inc. Headed by a team of highly qualified former BHP employees, of whom CEO George Putnam and CTO Willem Duyvestyn joined in 2010 and 2009, SCY is now focused on bringing the 98.5% owned Nyngan deposit into production. A PEA published in October 2014 envisioned a 240 tpd open-pit mine with an HPAL flow sheet that would produce 36 tonnes of scandium oxide annually over a 20 year mine life from a substantially larger resource. The PEA projected a CAPEX of US $77.4 million and an after-tax NPV of US $175 million at 10% with an IRR of 40.3% using a $2,000/kg scandium oxide price. SCY is working to deliver a definitive feasibility study and mining permit by Q1 of 2016. The goal is to commission the mine in 2017 and demonstrate to the scandium end user community that scandium can indeed be profitably produced and sold at $2,000/kg or less from a primary mine that can be scaled to accommodate any demand. Scandium is an obscure metal of which only 10-15 tonnes is produced annually with a value of $20-$50 million depending on the price used. It all comes as by-product supply from uranium ISL, titanium dioxide waste stream stripping and the Bayan Obo rare earth mine. Because scandium enhances aluminum by making it stronger, corrosion resistant, does not degrade aluminum's conductivity, allows weld joints to be as strong as the material, and be made into a 3D printing powder, there exists enormous latent demand for applications seeking energy efficiency such as the aircraft, automotive and rail industries. On Augu 24, 2015 SCY achieved the US $2 million equity financing threshold needed to convert a US $2.5 million debenture into a 20% interest in the Nyngan and Honeybugle projects that is carried until a production decision. |  |

| Issued: | 225,047,200 | Working Capital: | $1,118,751 |

| Diluted: | 243,157,200 | As Of: | September 30, 2015 |

| Membership Start Date | January 2, 2015 | Price at Start | $0.09 |

| Membership backdated to | January 2, 2014 | Membership Quantity | 11,111 |

|

|

| Tasman Metals Ltd was established on Oct. 22, 2009 through the amalgamation of Ausex Capital Corp. and Lumex Capital Corp., both capital pool companies, and a private company, Tasman Metals Ltd. The company, led by CEO and President Mark Saxon and Chairman David Henstridge, is focused on strategic metals in Europe, with a particular emphasis on Scandinavia, where it is the 100% owner of seven iron ore exploration claims close to the iron mines of the Kiruna district and 29 claims and claim applications for strategic metals, including rare earth elements (REE) in Sweden, Finland and Norway. Tasman's flagship is the Norra Karr peralkaline intrusive in southern Sweden which Boliden had explored as a zirconium prospect during the seventies but never drilled. Tasman delivered an inferred resource estimate of 60,500,000 tonnes of 0.54% TREO and 1.72% Zr2O3. Heavy rare earths represent 53% of the TREO grade. The primary mineral is eudialyte which dissolved readily but has historically posed a recovery problem because of the tendency of the dissolved silica to form a gel. Tasman plans to deliver a flowsheet that solves this problem, along with a PEA, in H1 of 2012. |  |

| Issued: | 66,141,922 | Working Capital: | $2,478,303 |

| Diluted: | 71,898,264 | As Of: | August 31, 2015 |

| Membership Start Date | January 2, 2015 | Price at Start | $0.47 |

| Membership backdated to | January 2, 2014 | Membership Quantity | 2,151 |

|

|

| Tsodilo Resources Ltd listed on the TSX on Dec 20, 1996 as Trans Hex Intl Ltd to serve as the exploration arm of alluvial diamond producer Trans Hex Group. On July 31, 2002 Trans Hex exchanged its shares for all assets except the Nxau Nxau kimberlite field in northwestern Botswana and the junior changed its name to Tsodilo under the management of James Bruchs. The diamond search took Tsodilo eastwards into a Kalahari sand covered area now recognized as having the same basin stratigraphy as the Central African Copper Belt in Zambia and Congo. Since 2010 Tsodilo has focused on the Xaudum project where it has outlined a 100% owned iron resource and in 2013 farmed out 70% of the non-iron potential to copper producer First Quantum which spent $14 million confirming its conceptual model for sediment hosted copper deposits and generating priority drill targets. First Quantum began drilling these targets in May 2015 in what will be the make or break culmination of a $20 million "under cover" exploration strategy seeking 2% plus copper deposits containing 5 million or more tonnes of copper. In late 2014 Tsodilo won a competitive auction for the BK16 diamond pipe in the Orapa field, an apparently low grade body discovered by De Beers and which various groups have tried to evaluate. Tsodilo, hoping to establish that BK16 is a smaller version of Lucara's Karowe pipe, undertook a delineation drill program in 2015 designed to set the stage for a LDD bulk sample program whose goal is to demonstrate a higher grade than past work indicated and establish the carat value. During 2015 Tsodilo also plans to drill a target on the Werda property in southern Botswana near the Jwaneng diamond mime. |  |

| Issued: | 33,542,784 | Working Capital: | ($275,090) |

| Diluted: | 39,418,970 | As Of: | September 30, 2015 |

| Membership Start Date | May 15, 2015 | Price at Start | $0.75 |

| Membership backdated to | May 15, 2015 | Membership Quantity | 1,333 |

|

|

| Uravan Minerals Inc is a uranium explorer led by CEO Larry Lahusen which has developed a remote sensing exploration tool that involves collecting clay samples in the Athabasca Basin and geochemically analyzing them for radiogenic lead isotopes as well as other uranium deposit related pathfinder elements. The method is based on the theory that microbes digest sulphides associated with uranium deposits at the basement-sandstone unconformity and emit gases that serve as a transport medium for elements liberated from the deposit. These gases travel from depths of 1,500 m along fracture systems where they are absorbed by clay particles at the surface. Uravan has worked with Queens' Facility for Isotope Research to develop protocols for establishing anomalies and has successfully conducted case study surveys over the Cigar Lake and Centennial deposits. The Centennial studyy completed in 2013 was a major success in that it clearly outlined a uranium deposit at an 800 m depth whose physical location is offset from graphite conductors. An airborne geophysical survey on the Stewardson project yielded two anomalies associated 2 conductorst. Cameco, which can earn 70%, drilled 2 holes on target Area on conductor C with negative results interpreted as indicative of a deeper basement hosted deposit out of economic reach. During 2015 Cameco plans to drill 2 holes on target Area B on conductor C which has multiple dataset support for an unconformity hosted uranium deposit. Uravan holds 100% of the Outer Ring project which has a geochemical anomaly and needs a geophysical survey. If Stewardson yields a major discovery, it will qualify as proof of concept for an exploration tool developed by Uravan that can be applied to the deeper parts of the Athabasca Basin. |  |

| Issued: | 38,544,012 | Working Capital: | $728,034 |

| Diluted: | 41,679,012 | As Of: | September 30, 2015 |

| Membership Start Date | January 2, 2015 | Price at Start | $0.05 |

| Membership backdated to | January 2, 2014 | Membership Quantity | 20,000 |

|

|

| Verde Potash plc listed on the TSXV on Nov 27, 2007 as Amazon Mining Holding plc with various Brazilian gold projects that the junior's CEO, Cris Veloso, abandoned after staking the 100 km Verdete Slate belt potassium silicate rocks in 2008 in Minas Gerais state of Brazil. Amazon changed its name to Verde Potash plc on April 26, 2011. Verde Potash has since outlined an I+I resource of 3.32 billion tonnes grading 8.9% K2O with a thickness ranging 15-80 metres within an overall 15 billion tonne footprint. The junior has isolated a proven and probable reserve of 7,020,000 tonnes at 10.85% that forms the basis for a Mar 2014 PFS for the production of 330,000 tpa of ThermoPotash, a slow release potash fertilizer blend that targets the market for imported premium potash such as potassium nitrate, namely salt-intolerant crops and crops seeking organic status. The PFS projected an after-tax NPV of US $146 million at 10% with an IRR of 23.5% for a 30 year mine life. Although this is a modest cash flow scenario, it is really itself a conceptual project that can be scaled up substantially if the agricultural sector adopts ThermoPotash. Government agency debt for 90% of projected CAPEX of US $114 million that is contingent on a final feasibility study and an environmental license has been granted. The problem is that Brazil's permitting system is dysfunctional, made worse by the current political malaise linked to the weak economy and the Petrobras corruption scandal. The ThermoPotash 200 tpd "Flex Plant" will also be able to double as a pilot plant for the process Verde Potash developed to convert the Verdete Slate into conventional potassium clhoride (KCl). |  |

| Issued: | 37,617,430 | Working Capital: | $4,298,000 |

| Diluted: | 40,362,430 | As Of: | September 30, 2015 |

| Membership Start Date | January 2, 2015 | Price at Start | $0.55 |

| Membership backdated to | January 2, 2014 | Membership Quantity | 1,818 |

|

|

| Index Members Delisted or Closed Out |

|---|

| Probe Mines Ltd, headed by CEO David Palmer, is focused on the 100% owned Borden gold project in the Kapuskasing area of Ontario southwest of Timmins. Borden was a 2010 grassroots discovery for which an open-pittable resource of 4.3 million ounces at 0.5 g/t cutoff was reported in 2012. In late 2012, however, the exploration focus shifted to a new style of Archean lode mineralization at the eastern end of the Borden zone which had a significantly higher grade. The High Grade Zone (HGZ), which is an underground mining target, had been traced for 1,100 m as of the end of 2013 and is the focus of a winter ice drilling campaign during H1 of 2014 to test an additional 1,000 m of potential strike. An initial resource estimate is expected in Q2 of 2014, followed by a PEA in Q3, which would form the basis for an underground drilling campaign as part of a PFS for an underground 2,000-3,000 tpd mine. In the Ring of Fire region of northern Ontario, Probe owns the Black Creek chromite project with a resource of 8 million tonnes grading 40% Chromium (7.4 billion pounds). The possibility that Cliffs might eventually buy Black Creek has diminished since Cliffs suspended development work in 2013 due to the failure of the government to address First nations and infrastructure issues. |  |

| Issued: | 90,794,727 | Working Capital: | $34,454,460 |

| Diluted: | 111,162,227 | As Of: | October 31, 2014 |

| Membership Start Date | January 2, 2015 | Price at Start | $3.14 |

| Membership End Date | March 16, 2015 | Price at End | $4.33 |

| Membership backdated to | January 2, 2014 | Membership Quantity | 318 |

|

|

| |

| | You can return to the Top of this page

|

|