Home / Research Tools

Research Tools

| | Corporate Profile: Alchemist Mining Inc

Publisher: Kaiser Research Online

Author: Copyright 2013 John A Kaiser

|

| |

Alchemist Mining Inc (AMS-V)

| Alchemist Mining Inc, which listed on the TSXV as a CPC called NY85 Capital Inc on July 28, 2011, completed its qualifying transaction in May 2012 through the acquisition of an option on the Carscallen project in Ontario's Porcupine District. Although the company subsequently abandoned the Carscallen property, it continued to explore for gold in the Porcupine District, currently at its flagship Mondotta exploration property. On January 27, 2014 Alchemist conducted a 5:1 rollback after CEO Keith Anderson concluded that having only 4 million shares issued would be the only way to finance the company. In March 2014 the company indicated it was looking for new projects, "in various sectors, including resources, agricultural, technology, as well as the medical industry." Dal Brynelsen joined the board on May 16, 214 so that Alchemist's search for new projects unrelated to the resource sector could benefit from Brynelsen's "30 years of experience in the mining industry." In August 2014 the company delisted from the TSXV, choosing to list its shares on the Canadian Securities Exchange. |

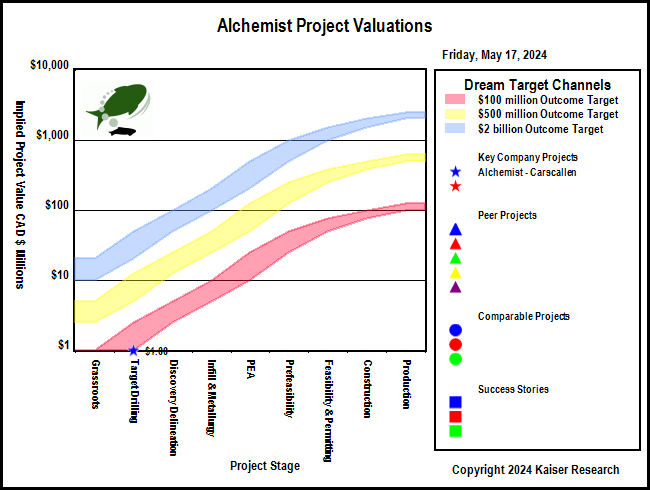

Key to Understanding IPV Charts and Spec Value Hunter Tables

| An IPV Chart is a graphical presentation of a Spec Value Hunter table that has been constructed according to the Rational Speculation Model developed by John Kaiser. The IPV Chart allows speculators to identify which projects offer poor, fair or good speculative value in both absolute and relative terms. The speculative value depends on the project stage, the project's implied value as calculated by the company's fully diluted capitalization, stock price and net project interest, and the dream target deemed appropriate for the project. A dream target is what a project would be worth in discounted cash flow terms once in production. |

| Green background indicates the dream target judged appropriate for this play by John Kaiser - otherwise unranked. |

Poor Speculative Value -   |

Fair Speculative Value -  |

Good Speculative Value -   |

Note:   narrow arrows indicate IPV is outside the fair value channel but within 25% of the fair value limits narrow arrows indicate IPV is outside the fair value channel but within 25% of the fair value limits |

| Click on the company name to view the company profile, the project name to view project details. |

| Click on the project icon if its background is shaded to get the IPV Chart for that company. |

Alchemist Project Valuations

| Company | Project | Country | Stage | IPV $

MM |

$100 | UPV

$500 |

$2000 | Target Metals | Deposit Style |

| Key Company Projects |

|

Alchemist Mining Inc (AMS-V) | Carscallen |  | Canada | Target Drilling |

$1 |  |  |

| Gold | Vein / Shear |

|

|

| Peer Projects |

|

|

|

|

|

|

| Comparable Projects |

|

|

|

|

| Success Stories |

|

|

|

|

| |

| | You can return to the Top of this page

|

|