Home / Companies / KRO Profile

KRO Profile

|

|

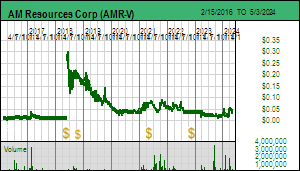

| Price: | $0.180 | Open Rec: | No |  |

| Market Cap: | $544,273 | WC % of Mkt Cap: | -100% |

| Working Cap: | ($546,493) | As of: | 3/31/2016 |

| Issued: | 3,023,740 | Insider %: | 17.6% | | Diluted: | 3,178,740 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | John Fiorino (CEO), Mark Lawson (CFO), Neil Downey (VP EX), |

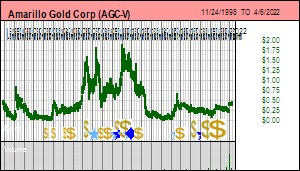

| Delisted: Acero Martin is led by President and CEO Stewart Jackson and Chairman Michael Scholz and is focused on its flagship Pinaya project in Southern Peru. Pinaya is a skarn-hosted deposit with an initial NI 43-101-compliant indicated resource of 29.13 million tonnes grading 0.53 g/t Au and 0.42 per cent Cu (498,000 ounces Au and 269 million pounds Cu), and an inferred resource of 12.72 million tonnes grading 0.41 g/t Au and 0.41 per cent Cu (168,000 ounces Au and 115 million pounds Cu). In September 2009 shareholders approved a 4:1 rollback. In the Yukon the company owns the Red Mountain gold project in the Tintina Belt which, after being incative for several years, returned a 500 meter intercept of 0.75 gram per tonne gold in September 2010. In January 2011 the company announced it had agreed to merge with Capella Resources on terms to be negotiated, but the transaction was subsequently cancelled. |

| Last Corporate Change - Aug 29, 2016: Takeover Bid at $0.18 - A holding company (1079170 BC Ltd) controlled by John Fiorino, the CEO of AM Gold, acquired AM Gold for a cash payment of 17 cents per share. |

| Recent News - Aug 29, 2016: 1079170 B.C. Ltd. Completes going Private Transaction Of AM Gold Inc. |

|

![]() |

|

|

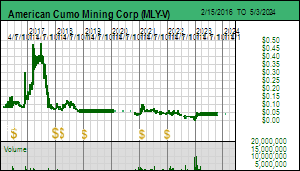

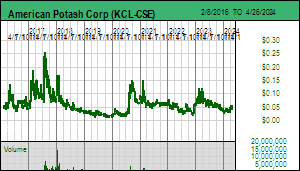

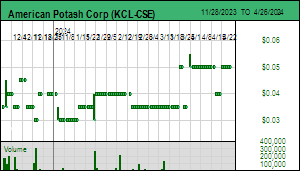

| Price: | $0.040 | Open Rec: | No |  |

| Market Cap: | $4,502,393 | WC % of Mkt Cap: | 6% |

| Working Cap: | $278,730 | As of: | 9/30/2021 |

| Issued: | 112,559,826 | Insider %: | 10.5% | | Diluted: | 151,209,826 | Story Type: | Resource: Discovery Exploration |

| Key People: | David Grondin (CEO), Arnab De (CFO), Patrick Musampa (CFO), |

SV Rating: Unrated SV Rating: Unrated |

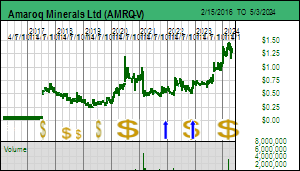

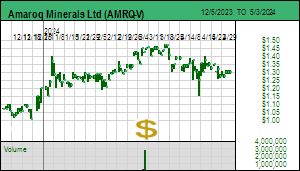

| Last Corporate Change - May 15, 2018: 50:1 Name Change from NQ Exploration Inc (NQE-V) |

| Recent News - Apr 18, 2024: Completes Compilation Work with the Discovery of 94 New Pegmatites for a Total of 281 Pegmatites on its 1,500 km Land Package in Austria |

|

![]() |

|

|

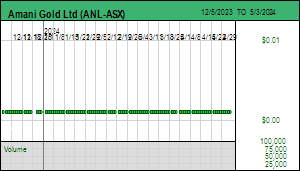

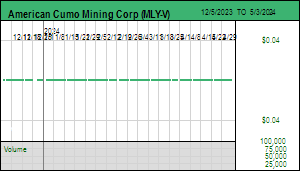

| Price: | $0.001 | Open Rec: | No |  |

| Market Cap: | $23,293,441 | WC % of Mkt Cap: | 134% |

| Working Cap: | $31,267,303 | As of: | 6/30/2023 |

| Issued: | 23,293,441,125 | Insider %: | 4.6% | | Diluted: | 33,859,621,760 | Story Type: | Resource: Discovery Exploration |

| Key People: | Qinming Yu (Chair), Susmit Mohanlah Shah (Sec), |

SV Rating: Unrated SV Rating: Unrated |

|

![]() |

|

|

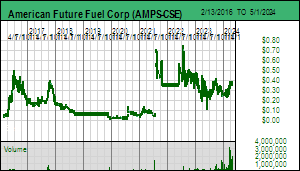

| Price: | $0.010 | Open Rec: | No |  |

| Market Cap: | $472,376 | WC % of Mkt Cap: | -187% |

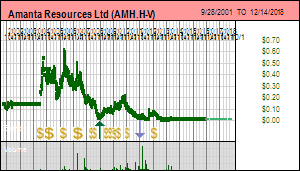

| Working Cap: | ($884,854) | As of: | 11/30/2013 |

| Issued: | 47,237,642 | Insider %: | 44.1% | | Diluted: | 69,682,879 | Story Type: | Resource: Discovery Exploration |

| Key People: | Gerald D. Wright (CEO), Gail Y. Wright (CFO), |

| Delisted: Amanta Resources Ltd is a southeast Asia focused junior headed by the team of mining engineer Gerry Wright and geologist Pieter Bakker, both of whom have extensive experience with Thailand where Amanta has been active since 2004. Amanta has targeted tungsten and gold projects in Thailand where it hopes to develop the Mae Lama high grade tungsten deposit as a small scale mine. But in 2008 Amanta's focus shifted to the relatively untapped exploration frontier of neighboring Laos when a two year effort to secure a concession came to fruition with the granting of the 20,000 ha Luang Namtha concession covering part of the Yulong copper porphyry belt. Amanta's network of Thai and Vietnamese geologists has identified a promising new high grade copper-silver prospect within the Luang Namtha property. In July 2010 Amanta also announced it had formed a joint venture with CNP Exploration and Mining Import Export Co. Ltd., an established Lao construction and mining company, where Amanta will hold an 80% interest in projects the joint venture intends to acquire. In July 2014 the company was suspended by the British Columbia Securities Commission or failing to file a comparative financial statement and a Form 51-102F1 management's discussion and analysis for the period ended Feb. 28, 2014. |

| Last Corporate Change - Dec 14, 2018: Defunct Delisting - Failure to pay NEX Listing Maintenance Fee |

| Last KRO Comment - Jan 6, 2009: Recommendation Strategy for Amanta Resources Ltd |

| Recent News - Dec 1, 2016: ASC Delinquent Filer; Annual Financial Statements |

|

![]() |

|

|

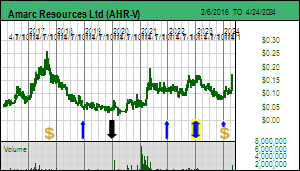

| Price: | $0.210 | Open Rec: | No |  |

| Market Cap: | $35,303,828 | WC % of Mkt Cap: | 4% |

| Working Cap: | $1,482,000 | As of: | 6/30/2013 |

| Issued: | 168,113,466 | Insider %: | 25.6% | | Diluted: | 178,114,446 | Story Type: | Resource: Producer |

| Key People: | Peter John Spivey (CEO), John F. G. McGloin (Chair), Pete Gardner (CFO), Catherine Apthorpe (Sec), |

| Delisted: Cluff Gold is a London-based gold producer focused on Africa, where it has projects in Sierra Leone, Mali, and Ghana, and producing mines in Cote d'Ivoire and Burkina Faso. Cluff, which is listed on the AIM in London and listed on the TSX in February 2009, is led by CEO Algy Cluff and Chairman Nicholas Berry. The company's flagship is its 78% owned Kalsaka mine in Burkina Faso that has 600,000 measured and indicated gold ounces, and 150,000 inferred ounces and is expected to produce at a 60,000 ounce annual rate. Cluff's other producing mine is Angovia in Cote d'Ivoire where the company has established a 500,000 ounce gold resource in all categories, divided between oxide and sulphide ores. By mid-2009 Cluff anticipates producing at a 100,000 ounce annual rate, and has a long term goal of producing 300,000 ounces annually. In October 2013 the company chose to voluntarily delist form the TSX, citing minimal trading activity of the company's shares in Toronto. Amara continues to trade on London Stock Exchange. |

| Last Corporate Change - Oct 25, 2013: Voluntary Delisting - |

| Recent News - Jun 12, 2014: Cancellation Of Reporting Issuer Status In Canada |

|

![]() |

|

| Price: | $0.165 | Open Rec: | No |  |

| Market Cap: | $34,930,978 | WC % of Mkt Cap: | 6% |

| Working Cap: | $2,222,042 | As of: | 12/31/2023 |

| Issued: | 211,702,894 | Insider %: | 14.1% | | Diluted: | 229,687,057 | Story Type: | Resource: Discovery Exploration |

| Key People: | Diane Nicolson (CEO), Robert A. Dickinson (Chair), Jeannine P. M. Webb (CFO), Michael Lee (CFO), Paul Johnston (VP EX), |

SV Rating: Bottom-Fish Spec Value - as of December 29, 2023: Amarc Resources Ltd was made a Fair Spec Value rated 2023 Favorite at $0.15 on December 30, 2022 based partly on its British Columbia focused copper exploration plays, two of which, Joy and Duke, are funded by majors Freeport McMoran and Boliden who can earn up to 70% by spending $105 million and $90 million respectively. Freeport optioned the Joy copper-gold porphyry project in May 2021 and has spent about $20 million to the end of 2022. The 48,200 ha Joy project adjoins to the north of the Kemess Mine now operated by Centerra Gold. Freeport, which drilled 15,427 m in 2022 for which results were still pending at the start of 2023, is delineating the Pine copper-gold system and testing district wide targets. Boliden optioned the 67,800 ha Duke project in November 2022 and immediately initiated a winter drill program. Duke, located 50 km north of the former Bell and Granisle copper mines in the Babine Lake region, is an emerging copper-molybdenum-silver discovery Amarc made in 2017. Amarc is operator of both projects. The company is headed by CEO Diane Nicolson and Chairman Bob Dickinson who with 29 million shares representing 16% is Amarc's largest shareholder. Amarc has for two decades been focused on grassroots exploration in British Columbia during a period when Northern Dynasty's now beleaguered Pebble copper-gold project in Alaska dominated the attention of the HDI group. Amarc appeared on track for a major emerging discovery in 2014 when it assembled the IKE copper-molybdenum-silver district located in southwestern British Columbia between Taseko's stalled New Prosperity copper-gold project and the Bralorne gold project to the south. IKE, which does not yet have a resource estimate, was first optioned to Thompson Creek in 2015 which dropped out after Centerra Gold...(see Profile for full Overview) SV Rating: Bottom-Fish Spec Value - as of December 29, 2023: Amarc Resources Ltd was made a Fair Spec Value rated 2023 Favorite at $0.15 on December 30, 2022 based partly on its British Columbia focused copper exploration plays, two of which, Joy and Duke, are funded by majors Freeport McMoran and Boliden who can earn up to 70% by spending $105 million and $90 million respectively. Freeport optioned the Joy copper-gold porphyry project in May 2021 and has spent about $20 million to the end of 2022. The 48,200 ha Joy project adjoins to the north of the Kemess Mine now operated by Centerra Gold. Freeport, which drilled 15,427 m in 2022 for which results were still pending at the start of 2023, is delineating the Pine copper-gold system and testing district wide targets. Boliden optioned the 67,800 ha Duke project in November 2022 and immediately initiated a winter drill program. Duke, located 50 km north of the former Bell and Granisle copper mines in the Babine Lake region, is an emerging copper-molybdenum-silver discovery Amarc made in 2017. Amarc is operator of both projects. The company is headed by CEO Diane Nicolson and Chairman Bob Dickinson who with 29 million shares representing 16% is Amarc's largest shareholder. Amarc has for two decades been focused on grassroots exploration in British Columbia during a period when Northern Dynasty's now beleaguered Pebble copper-gold project in Alaska dominated the attention of the HDI group. Amarc appeared on track for a major emerging discovery in 2014 when it assembled the IKE copper-molybdenum-silver district located in southwestern British Columbia between Taseko's stalled New Prosperity copper-gold project and the Bralorne gold project to the south. IKE, which does not yet have a resource estimate, was first optioned to Thompson Creek in 2015 which dropped out after Centerra Gold...(see Profile for full Overview) |

| Last KRO Comment - Jan 26, 2023: KW Excerpt: Kaiser Watch January 26, 2023: Amarc Resources Ltd (AHR-V) |

| Recent News - Apr 16, 2024: Introduces The JO Porphyry Copper Gold Discovery In The Duke District |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Ike |

100% WI |

|

Canada |

Southwest BC |

3-Discovery Delineation |

$38 |

Copper Molybdenum Silver Gold |

Porphyry  |

|

Duke |

30% TC |

|

Canada |

Central BC |

2-Target Drilling |

$126 |

Copper Gold Silver Molybdenum |

Porphyry  |

|

Joy |

30% TC |

|

Canada |

Toodoggone |

3-Discovery Delineation |

$126 |

Copper Gold |

Porphyry  |

|

Hearne |

100% WI |

|

Canada |

Northern BC |

2-Target Drilling |

$38 |

Copper |

Porphyry  |

![]() |

|

|

| Price: | $0.435 | Open Rec: | No |  |

| Market Cap: | $167,942,057 | WC % of Mkt Cap: | 15% |

| Working Cap: | $24,800,456 | As of: | 12/31/2021 |

| Issued: | 386,073,694 | Insider %: | 43.7% | | Diluted: | 411,288,694 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Michael Mutchler (CEO), Rowland Uloth (Chair), |

| Delisted: Amarillo Gold is a Brazil-focused junior led by CEO Buddy Doyle and Chairman Robert Landis that controls a sizeable exploration package as well as the 1.3 million gold ounce Posse deposit on the Mara Rosa project in Brazil's Mara Rosa state. A PFS completed for Mara Rosa in November 2011 modeled an open-pit project with a seven year mine life producing 124,000 gold ounces annually, with intial capex of $184 million, cash operating costs of $524 per gold ounce, and an after tax NPV(5%) of 178 million, giving an IRR of 26.6%. Amarillo expects to complete a BFS for Mara Rosa in 2012, and could potentially produce its first gold from the project in 2014. |

| Last Corporate Change - Apr 6, 2022: Plan of Arrangement at $0.44 |

| Recent News - Apr 5, 2022: Plan of Arrangement, Remain Halted, Delist |

|

![]() |

|

|

| Price: | $1.350 | Open Rec: | No |  |

| Market Cap: | $440,632,992 | WC % of Mkt Cap: | 7% |

| Working Cap: | $28,895,835 | As of: | 9/30/2023 |

| Issued: | 326,394,809 | Insider %: | 8.8% | | Diluted: | 335,521,684 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Eldur Olafsson (CEO), Graham Stewart (Chair), James Gilbertson (VP EX), Justinas Matusevicius (VP OP), Anna Solotova (Sec), |

SV Rating: Bottom-Fish Spec Value - as of November 29, 2022 SV Rating: Bottom-Fish Spec Value - as of November 29, 2022 |

| Last Corporate Change - Jul 12, 2022: 1:1 Name Change from AEX Gold Inc (AEX-V) |

| Recent News - Apr 16, 2024: Director/PDMR Shareholding |

|

![]() |

|

|

| Price: | $0.015 | Open Rec: | No |  |

| Market Cap: | $3,515,942 | WC % of Mkt Cap: | -790% |

| Working Cap: | ($27,784,388) | As of: | 3/31/2014 |

| Issued: | 234,396,111 | Insider %: | 11.9% | | Diluted: | 248,559,407 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Brian P. Kirwin (CEO), Douglas Wood (VP EX), |

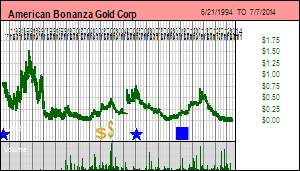

| Delisted: American Bonanza Gold Corp., led by CEO Brian Kirwin, is developing and exploring gold projects in Canada and the United States. The main objective is to develop the advanced stage 100% owned Copperstone gold property in Arizona, which contains a 10.7 g/t gold resource with 335,000 ounces of gold in the measured and indicated categories and 66,000 ounces of gold in the inferred category, where a February 2010 feasibility study was completed for an underground operation the company is aiming to place into production in 2011 and achieve full production rates by year-end 2012. American Bonanza also has gold projects in Quebec and Nevada, as well as a joint venture with Agnico-Eagle on the Northway-Noyon project in quebec's Casa Berardi area. In April 2014 the company announced it had agreed to be acquired by Kerr Mines on the basis of 0.53 of a Kerr Mines common share in exchange for each American Bonanza common share, roughly a $4 million valuation. |

| Last Corporate Change - Jul 7, 2014: Takeover Bid at $0.02 - |

| Recent News - Dec 3, 2014: OSC Re American Bonanza Gold Corp |

|

![]() |

|

|

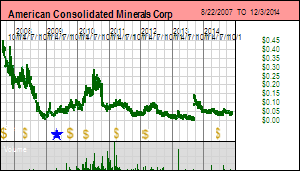

| Price: | $0.040 | Open Rec: | No |  |

| Market Cap: | $702,768 | WC % of Mkt Cap: | -59% |

| Working Cap: | ($412,052) | As of: | 6/30/2014 |

| Issued: | 17,569,191 | Insider %: | 11.7% | | Diluted: | 19,900,607 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Bryson Goodwin (Pres), Gary Arca (CFO), |

| Delisted: AmericanConsolidated Minerals was formerly a copper exploration company focused on the American southwest that completed its IPO in August 2007. Led by CEO Robert Eadie, in January 2009 the company completed an amalgamation with Lebon Gold Mines Ltd. and Golden Oasis Exploration Corp at which its name was changed to American Consolidated Minerals Corp. The company has three gold projects in Nevada and in August 2011 completed the acquisition of an option for a 50% interest in the Sierra Rosario precious metals exploration property in Mexico. In August 2014 the company announced it had signed a letter of intent to be acquired by Starcore International Mines Ltd on the basis of one Starcore common share for every three AJC common shares held. |

| Last Corporate Change - Dec 3, 2014: Plan of Arrangement at $0.04 |

| Recent News - Dec 3, 2014: Plan of Arrangement, Delist |

|

![]() |

|

|

| Price: | $0.140 | Open Rec: | No |  |

| Market Cap: | $61,992,636 | WC % of Mkt Cap: | 1% |

| Working Cap: | $560,873 | As of: | 9/30/2023 |

| Issued: | 442,804,542 | Insider %: | 14.2% | | Diluted: | 483,819,542 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Darren Blaney (CEO), Robert Edwards (CFO), Brent Ambrose (VP EX), |

SV Rating: Unrated SV Rating: Unrated |

| Recent News - Apr 15, 2024: Private Placement Non Brokered |

|

![]() |

|

|

| Price: | $0.040 | Open Rec: | No |  |

| Market Cap: | $7,159,486 | WC % of Mkt Cap: | -73% |

| Working Cap: | ($5,195,344) | As of: | 3/31/2019 |

| Issued: | 178,987,155 | Insider %: | 3.3% | | Diluted: | 243,330,380 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Shaun Dykes (CEO), John Moeller (Chair), Ickbal J. Boga (CFO), Trevor Burns (VP CD), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Jan 7, 2013: 1:1 Name Change from Mosquito Cons Gold Mines Ltd (MSQ-V) |

| Last KRO Comment - Jan 15, 2008: Tracker 2008-02: Rising gold price awakens moss covered gold deposit |

| Recent News - May 12, 2022: Name Change |

|

![]() |

|

|

| Price: | $0.650 | Open Rec: | No |  |

| Market Cap: | $66,433,405 | WC % of Mkt Cap: | 4% |

| Working Cap: | $2,942,554 | As of: | 9/30/2023 |

| Issued: | 102,205,238 | Insider %: | 14.6% | | Diluted: | 136,960,746 | Story Type: | Resource: Discovery Exploration |

| Key People: | Anthony Moreau (CEO), Stephen Stewart (Chair), Joel Friedman (CFO), Mark Bradley (VP EX), |

SV Rating: Bottom-Fish Spec Value - as of December 8, 2021 SV Rating: Bottom-Fish Spec Value - as of December 8, 2021 |

| Recent News - Apr 17, 2024: 2024 Exploration Program Underway |

|

![]() |

|

|

| Price: | $0.370 | Open Rec: | No |  |

| Market Cap: | $28,760,992 | WC % of Mkt Cap: | 6% |

| Working Cap: | $1,672,249 | As of: | 12/31/2023 |

| Issued: | 77,732,412 | Insider %: | 16.3% | | Diluted: | 95,895,412 | Story Type: | Resource: Discovery Exploration |

| Key People: | David Suda (CEO), Geoffrey Balderson (CFO), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Jul 8, 2022: 1:1 Name Change from Evolving Gold Corp (EVG-CSE) |

| Recent News - Mar 20, 2024: Premier American Uranium Bolsters Its Leadership in the Industry with the Acquisition of American Future Fuel and Welcomes Renowned Uranium Expert Colin Healey as CEO |

|

![]() |

|

|

| Price: | $2.720 | Open Rec: | No |  |

| Market Cap: | $83,927,028 | WC % of Mkt Cap: | 16% |

| Working Cap: | $13,847,362 | As of: | 7/31/2006 |

| Issued: | 30,855,525 | Insider %: | 16.2% | | Diluted: | 31,105,525 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Peter F. Palmedo (Chair), |

| Delisted: American Gold Capital Corp was launched in 2001 as a Sun Valley Gold LLC controlled vehicle for the acquisition of "out-of-the-money" gold deposits. Its flagship project was the Metates gold-silver deposit in Durango, Mexico. Metates is a low grade system containing at least 3 million ounces gold and 60 million ounces silver. It is hampered by severe challenges such as refractory ore, acid generating rock, rugged terrain and a remote location which require a gold price well in excess of $500 per oz. American Gold also acquired the Talapoosa gold-silver deposit in Nevada. American Gold was delisted on February 23, 2007 following a plan of arrangement with Chesapeake Gold Corp. American Gold shareholders receievd for each share 0.29 Chesapeake shares, 0.145 warrants to buy Chesapeake at $8 for 5 years, and 0.029 Series 1 Class A shares. Each Class A share is convertible into 10 Chesapeake shares if during the next 5 years (with a 1 year extension in certain circumstances) London gold fix averages $850 or more for 90 days. On Feb 14, 2008 Chesapeake gave notice that this condition had been met, and each Class A share was converted into 10 Chesapeake shares. The value of each original American Gold share thus had an equivalent value of $4.52 on that day based on $6.75 Chesapeake and $4.17 warrant price. |

| Last Corporate Change - Feb 26, 2007: Takeover Bid at $2.72 - Delisted pursuant to friendly Cash bid by Chesapeake Gold at $2.72 worth $84,607,028 involving .29 Chesapeake share + .145 warrant + .029 Class A share per 1 AAU |

| Last KRO Comment - Feb 8, 2007: Tracker 2007-01: Imminent merger between American Gold and Chesapeake a marriage made in heaven |

|

![]() |

|

|

| Price: | $0.365 | Open Rec: | No |  |

| Market Cap: | $1,406,169 | WC % of Mkt Cap: | 64% |

| Working Cap: | $901,260 | As of: | 3/31/2018 |

| Issued: | 3,852,517 | Insider %: | 1.8% | | Diluted: | 4,127,517 | Story Type: | Energy: Producer |

| Key People: | James Walchuk (CEO), Roger Foster (CFO), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Dec 19, 2019: Symbol Change |

| Recent News - May 20, 2022: Name Change and Consolidation |

|

![]() |

|

|

| Price: | $0.720 | Open Rec: | No |  |

| Market Cap: | $154,552,186 | WC % of Mkt Cap: | 14% |

| Working Cap: | $21,365,132 | As of: | 11/30/2023 |

| Issued: | 214,655,814 | Insider %: | 2.4% | | Diluted: | 253,505,899 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Simon P. Clarke (CEO), Andrew W. Bowering (Chair), Laurence Stefan (COO), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - May 1, 2018: | | Recent News - Mar 26, 2024: Strengthens Team and Launches Major ESG Initiative in Peru |

|

![]() |

|

|

| Price: | $2.650 | Open Rec: | No |  |

| Market Cap: | $1,006,641,111 | WC % of Mkt Cap: | 5% |

| Working Cap: | $53,239,856 | As of: | 6/30/2021 |

| Issued: | 379,864,570 | Insider %: | 0.0% | | Diluted: | 439,449,570 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Michael Schlumpberger (MD), Harold R, Shipes (Chair), |

| Delisted: |

| Last Corporate Change - Mar 10, 2022: Takeover Bid at $2.65 - Acquired by 5E Advanced Materials Inc on basis of 1 5EA for 10 ABR shares. |

|

![]() |

|

|

| Price: | $0.190 | Open Rec: | No |  |

| Market Cap: | $37,351,730 | WC % of Mkt Cap: | -18% |

| Working Cap: | ($6,621,300) | As of: | 9/30/2023 |

| Issued: | 196,588,051 | Insider %: | 13.7% | | Diluted: | 216,311,931 | Story Type: | Resource: Discovery Exploration |

| Key People: | Warwick Smith (CEO), Joness Lang (Pres), Alnesh Mohan (CFO), Josh Carrons (VP EX), |

SV Rating: Unrated SV Rating: Unrated |

| Recent News - Apr 16, 2024: Closes $4,500,000 Non Brokered Private Placement |

|

![]() |

|

|

| Price: | $0.050 | Open Rec: | No |  |

| Market Cap: | $5,108,122 | WC % of Mkt Cap: | 3% |

| Working Cap: | $151,474 | As of: | 1/31/2024 |

| Issued: | 102,162,449 | Insider %: | 7.1% | | Diluted: | 149,964,449 | Story Type: | Resource: Discovery Exploration |

| Key People: | Dean Besserer (CEO), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Aug 31, 2022: 1:1 Name Change from New Tech Minerals Corp (NTM-CSE) |

| Recent News - Jan 30, 2024: Management Transition |

|

![]() |

|