Home / Companies / KRO Profile

KRO Profile

|

| Price: | $0.140 | Open Rec: | No |  |

| Market Cap: | $29,638,405 | WC % of Mkt Cap: | 7% |

| Working Cap: | $2,222,042 | As of: | 12/31/2023 |

| Issued: | 211,702,894 | Insider %: | 14.1% | | Diluted: | 229,687,057 | Story Type: | Resource: Discovery Exploration |

| Key People: | Diane Nicolson (CEO), Robert A. Dickinson (Chair), Jeannine P. M. Webb (CFO), Michael Lee (CFO), Paul Johnston (VP EX), |

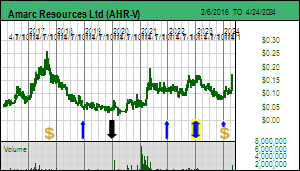

SV Rating: Bottom-Fish Spec Value - as of December 29, 2023: Amarc Resources Ltd was made a Fair Spec Value rated 2023 Favorite at $0.15 on December 30, 2022 based partly on its British Columbia focused copper exploration plays, two of which, Joy and Duke, are funded by majors Freeport McMoran and Boliden who can earn up to 70% by spending $105 million and $90 million respectively. Freeport optioned the Joy copper-gold porphyry project in May 2021 and has spent about $20 million to the end of 2022. The 48,200 ha Joy project adjoins to the north of the Kemess Mine now operated by Centerra Gold. Freeport, which drilled 15,427 m in 2022 for which results were still pending at the start of 2023, is delineating the Pine copper-gold system and testing district wide targets. Boliden optioned the 67,800 ha Duke project in November 2022 and immediately initiated a winter drill program. Duke, located 50 km north of the former Bell and Granisle copper mines in the Babine Lake region, is an emerging copper-molybdenum-silver discovery Amarc made in 2017. Amarc is operator of both projects. The company is headed by CEO Diane Nicolson and Chairman Bob Dickinson who with 29 million shares representing 16% is Amarc's largest shareholder. Amarc has for two decades been focused on grassroots exploration in British Columbia during a period when Northern Dynasty's now beleaguered Pebble copper-gold project in Alaska dominated the attention of the HDI group. Amarc appeared on track for a major emerging discovery in 2014 when it assembled the IKE copper-molybdenum-silver district located in southwestern British Columbia between Taseko's stalled New Prosperity copper-gold project and the Bralorne gold project to the south. IKE, which does not yet have a resource estimate, was first optioned to Thompson Creek in 2015 which dropped out after Centerra Gold...(see Profile for full Overview) SV Rating: Bottom-Fish Spec Value - as of December 29, 2023: Amarc Resources Ltd was made a Fair Spec Value rated 2023 Favorite at $0.15 on December 30, 2022 based partly on its British Columbia focused copper exploration plays, two of which, Joy and Duke, are funded by majors Freeport McMoran and Boliden who can earn up to 70% by spending $105 million and $90 million respectively. Freeport optioned the Joy copper-gold porphyry project in May 2021 and has spent about $20 million to the end of 2022. The 48,200 ha Joy project adjoins to the north of the Kemess Mine now operated by Centerra Gold. Freeport, which drilled 15,427 m in 2022 for which results were still pending at the start of 2023, is delineating the Pine copper-gold system and testing district wide targets. Boliden optioned the 67,800 ha Duke project in November 2022 and immediately initiated a winter drill program. Duke, located 50 km north of the former Bell and Granisle copper mines in the Babine Lake region, is an emerging copper-molybdenum-silver discovery Amarc made in 2017. Amarc is operator of both projects. The company is headed by CEO Diane Nicolson and Chairman Bob Dickinson who with 29 million shares representing 16% is Amarc's largest shareholder. Amarc has for two decades been focused on grassroots exploration in British Columbia during a period when Northern Dynasty's now beleaguered Pebble copper-gold project in Alaska dominated the attention of the HDI group. Amarc appeared on track for a major emerging discovery in 2014 when it assembled the IKE copper-molybdenum-silver district located in southwestern British Columbia between Taseko's stalled New Prosperity copper-gold project and the Bralorne gold project to the south. IKE, which does not yet have a resource estimate, was first optioned to Thompson Creek in 2015 which dropped out after Centerra Gold...(see Profile for full Overview) |

| Last KRO Comment - Jan 26, 2023: KW Excerpt: Kaiser Watch January 26, 2023: Amarc Resources Ltd (AHR-V) |

| Recent News - Apr 16, 2024: Introduces The JO Porphyry Copper Gold Discovery In The Duke District |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Ike |

100% WI |

|

Canada |

Southwest BC |

3-Discovery Delineation |

$32 |

Copper Molybdenum Silver Gold |

Porphyry  |

|

Duke |

30% TC |

|

Canada |

Central BC |

2-Target Drilling |

$107 |

Copper Gold Silver Molybdenum |

Porphyry  |

|

Joy |

30% TC |

|

Canada |

Toodoggone |

3-Discovery Delineation |

$107 |

Copper Gold |

Porphyry  |

|

Hearne |

100% WI |

|

Canada |

Northern BC |

2-Target Drilling |

$32 |

Copper |

Porphyry  |

![]() |

|

| Price: | $0.710 | Open Rec: | No |  |

| Market Cap: | $94,046,116 | WC % of Mkt Cap: | 11% |

| Working Cap: | $9,991,411 | As of: | 9/30/2023 |

| Issued: | 132,459,318 | Insider %: | 17.1% | | Diluted: | 146,640,370 | Story Type: | Resource: Discovery Exploration |

| Key People: | Matti Talikka (CEO), David Lotan (Chair), Mark Serdan (CFO), |

SV Rating: Bottom-Fish Spec Value - as of December 29, 2023 SV Rating: Bottom-Fish Spec Value - as of December 29, 2023 |

| Last KRO Comment - Jun 9, 2023: KW Excerpt: Kaiser Watch June 9, 2023: Aurion Resources Ltd (AU-V) |

| Recent News - Mar 19, 2024: Aurion B2Gold JV Announces New Greenfield Discovery |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Risti |

100% WI |

|

Finland |

Other |

3-Discovery Delineation |

$104 |

Gold |

Shear / Vein  |

|

Kutuvuoma |

30% WI |

|

Finland |

Other |

3-Discovery Delineation |

$347 |

Gold |

Orogenic Vein  |

|

Launi East |

30% TC |

|

Finland |

Other |

2-Target Drilling |

$347 |

Gold |

Orogenic Vein  |

|

Savu |

100% WI |

|

Finland |

Other |

1-Grassroots |

$104 |

Lithium Gold Phosphate Rare-Earth-Metals |

Pegmatite  |

|

Silaskaira |

100% WI |

|

Finland |

Other |

1-Grassroots |

$104 |

Gold |

Orogenic Vein  |

![]() |

|

| Price: | $0.690 | Open Rec: | No |  |

| Market Cap: | $101,940,288 | WC % of Mkt Cap: | 16% |

| Working Cap: | $16,536,448 | As of: | 9/30/2023 |

| Issued: | 147,739,548 | Insider %: | 4.0% | | Diluted: | 168,874,227 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | William R. Willoughby (CEO), Bryan Disher (Chair), Braam Jonker (CFO), |

SV Rating: Bottom-Fish Spec Value - as of December 29, 2023 SV Rating: Bottom-Fish Spec Value - as of December 29, 2023 |

| Last Corporate Change - Jan 30, 2023: 1:1 Name Change from Cypress Development Corp (CYP-V) |

| Last KRO Comment - Jan 6, 2023: KW Excerpt: Kaiser Watch January 6, 2023: Century Lithium Corp (LCE-V) |

| Recent News - Dec 11, 2023: Progress at its Lithium Extraction Facility in Nevada |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Clayton Valley |

100% WI |

|

United States |

Nevada |

7-Permitting & Feasibility |

$117 |

Lithium |

Clay  |

|

Gunman |

20% TC |

|

United States |

White Pine |

3-Discovery Delineation |

$583 |

Zinc Silver |

Carbonate Replacement  |

![]() |

|

| Price: | $0.155 | Open Rec: | No |  |

| Market Cap: | $82,966,960 | WC % of Mkt Cap: | 40% |

| Working Cap: | $32,961,928 | As of: | 10/31/2023 |

| Issued: | 535,270,712 | Insider %: | 38.8% | | Diluted: | 777,220,712 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Kenneth A. Armstrong (CEO), Patrick F. N. Anderson (Chair), Matthew Hird (CFO), |

SV Rating: Bottom-Fish Spec Value - as of December 29, 2023 SV Rating: Bottom-Fish Spec Value - as of December 29, 2023 |

| Last Corporate Change - Jul 27, 2020: 1:1 Name Change from Strongbow Exploration Inc (SBW-V) |

| Last KRO Comment - Jan 6, 2023: KW Excerpt: Kaiser Watch January 6, 2023: Cornish Metals Inc (CUSN-V) |

| Recent News - Apr 16, 2024: Corporate Update South Crofty Tin Project |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

South Crofty |

100% WI |

|

United Kingdom |

Other |

7-Permitting & Feasibility |

$120 |

Tin Copper Zinc |

Vein  |

|

Nickel King |

100% WI |

|

Canada |

Northwest Territories |

4-Infill & Metallurgy |

$120 |

Nickel Copper Cobalt |

Magmatic Segregation  |

|

United Downs |

100% WI |

|

United Kingdom |

Other |

3-Discovery Delineation |

$120 |

Tin Copper |

Vein  |

|

Sleitat |

100% WI |

|

United States |

Alaska |

3-Discovery Delineation |

$120 |

Tin Silver |

Greisen  |

![]() |

|

| Price: | $0.670 | Open Rec: | No |  |

| Market Cap: | $145,916,151 | WC % of Mkt Cap: | 20% |

| Working Cap: | $29,367,912 | As of: | 11/30/2023 |

| Issued: | 217,785,300 | Insider %: | 4.3% | | Diluted: | 221,680,457 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Jean-Sebastien Lavallee (CEO), Eric Zaunscherb (Chair), Steffen Haber (Pres), Nathalie Laurin (CFO), Marcus Brune (VP FI), |

SV Rating: Bottom-Fish Spec Value - as of December 29, 2023 SV Rating: Bottom-Fish Spec Value - as of December 29, 2023 |

| Last Corporate Change - Jun 19, 2019: 1:1 Name Change from Critical Elements Corp (CRE-V) |

| Last KRO Comment - Sep 20, 2023: KW Excerpt: Kaiser Watch September 20, 2023: Critical Elements Lithium Corp (CRE-V) |

| Recent News - Apr 15, 2024: Confirms Major Discovery at Rose West with Multiple Wide Lithium Rich Intercepts |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Rose |

100% WI |

|

Canada |

James Bay |

7-Permitting & Feasibility |

$149 |

Lithium Tantalum |

Pegmatite  |

|

Nisk |

20% TC |

|

Canada |

James Bay |

4-Infill & Metallurgy |

$743 |

Nickel Copper Palladium Potash |

Ultramafic Complex  |

|

Lemare |

25% TC |

|

Canada |

James Bay |

3-Discovery Delineation |

$594 |

Lithium |

Pegmatite  |

|

Arques |

100% WI |

|

Canada |

Quebec |

2-Target Drilling |

$149 |

Rare-Earth-Metals Niobium Tantalum |

Peralkaline Intrusive  |

|

Bourier |

30% TC |

|

Canada |

Quebec |

2-Target Drilling |

$495 |

Lithium |

Pegmatite  |

|

Caumont |

100% WI |

|

Canada |

Quebec |

2-Target Drilling |

$149 |

Copper Nickel Platinum Palladium Gold |

Magmatic Segregation  |

|

Dumulon |

100% WI |

|

Canada |

Quebec |

1-Grassroots |

$149 |

Zinc Lead Gold |

Sedex  |

|

Duval |

70% WI |

|

Canada |

Quebec |

1-Grassroots |

$212 |

Nickel Copper Palladium Platinum |

Magmatic Segregation  |

|

Valiquette |

100% WI |

|

Canada |

Quebec |

2-Target Drilling |

$149 |

Nickel Copper Gold Palladium Platinum |

Magmatic Segregation  |

![]() |

|

| Price: | $0.115 | Open Rec: | No |  |

| Market Cap: | $13,231,581 | WC % of Mkt Cap: | 74% |

| Working Cap: | $9,811,611 | As of: | 9/30/2023 |

| Issued: | 115,057,227 | Insider %: | 10.2% | | Diluted: | 134,454,227 | Story Type: | Resource: Discovery Exploration |

| Key People: | Timothy J. Termuende (CEO), Glen J. Diduck (CFO), Charles C. Downie (VP EX), Darren B. Fach (Sec), |

SV Rating: Bottom-Fish Spec Value - as of December 29, 2023 SV Rating: Bottom-Fish Spec Value - as of December 29, 2023 |

| Last KRO Comment - Jun 9, 2023: KW Excerpt: Kaiser Watch June 9, 2023: Eagle Plains Resources Ltd (EPL-V) |

| Recent News - Mar 28, 2024: Acquires Elizabeth Lake Critical Metals Deposit |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Vulcan |

100% WI |

|

Canada |

Southeast BC |

2-Target Drilling |

$15 |

Zinc Lead Silver |

Sedex  |

|

Olson Lake |

25% TC |

|

Canada |

La Ronge Belt |

2-Target Drilling |

$62 |

Gold |

Orogenic Vein  |

|

Pine Channel |

20% TC |

|

Canada |

Northern Saskatchewan |

2-Target Drilling |

$77 |

Gold |

Mesothermal  |

|

Donna |

100% WI |

|

Canada |

British Columbia |

2-Target Drilling |

$15 |

Gold |

Intrusion Related Gold System  |

|

Adamant |

100% WI |

|

Canada |

Southeast BC |

2-Target Drilling |

$15 |

Rare-Earth-Metals Niobium |

Peralkaline Intrusive  |

|

Findlay |

25% TC |

|

Canada |

Southeast BC |

2-Target Drilling |

$62 |

Lead Zinc |

Sedex  |

|

Iron Range |

20% TC |

|

Canada |

Southeast BC |

2-Target Drilling |

$77 |

Copper Gold Zinc Lead Silver |

IOCG / Sedex  |

|

Dictator |

100% WI |

|

Canada |

Southern BC |

1-Grassroots |

$15 |

Gold Lead Zinc |

Intrusion Related Gold System  |

|

Wollaston |

100% WI |

|

Canada |

Athabasca Basin |

1-Grassroots |

$15 |

Uranium |

Unconformity style  |

|

Acacia |

100% WI |

|

Canada |

Central BC |

2-Target Drilling |

$15 |

Copper Zinc Lead Gold Silver |

VMS  |

|

Elsiar (LCR) |

100% WI |

|

Canada |

Golden Triangle |

2-Target Drilling |

$15 |

Copper Molybdenum Gold |

Porphyry  |

|

Kalum |

100% WI |

|

Canada |

Golden Triangle |

2-Target Drilling |

$15 |

Gold |

Intrusion Related Gold System  |

|

Brownell Lake |

100% WI |

|

Canada |

La Ronge Belt |

4-Infill & Metallurgy |

$15 |

Copper Zinc |

VMS  |

|

Brook |

100% WI |

|

Canada |

Saskatchewan |

1-Grassroots |

$15 |

Lithium |

Pegmatite  |

|

Crooked Lake |

100% WI |

|

Canada |

Saskatchewan |

1-Grassroots |

$15 |

Lithium |

Pegmatite  |

|

Gladman |

100% WI |

|

Canada |

Saskatchewan |

1-Grassroots |

$15 |

Lithium |

Pegmatite  |

|

Hanson Lake |

1.00% NSR |

|

Canada |

Saskatchewan |

1-Grassroots |

$0 |

Lithium |

Pegmatite |

|

Justice |

100% WI |

|

Canada |

Northwest Territories |

2-Target Drilling |

$15 |

Zinc Lead |

Mississippi Valley  |

|

Keg |

100% WI |

|

Canada |

Northwest Territories |

2-Target Drilling |

$15 |

Zinc Lead |

Mississippi Valley  |

|

MM |

100% WI |

|

Canada |

Yukon Territory |

2-Target Drilling |

$15 |

Zinc Lead Copper Silver Rare-Earth-Metals |

VMS  |

|

Old Road |

100% WI |

|

Canada |

Saskatchewan |

1-Grassroots |

$15 |

Lithium |

Pegmatite  |

|

Rusty Springs |

100% WI |

|

Canada |

Yukon Territory |

2-Target Drilling |

$15 |

Zinc Copper |

Stratabound  |

|

Schotts Lake |

100% WI |

|

Canada |

Saskatchewan |

3-Discovery Delineation |

$15 |

Copper Zinc |

VMS  |

|

Dragon Lake |

100% WI |

|

Canada |

Ross River |

2-Target Drilling |

$15 |

Gold |

Sediment Hosted  |

|

Pelly Mountain |

100% Wi |

|

Canada |

Ross River |

1-Grassroots |

$15 |

Zinc Lead Silver Gold |

VMS  |

|

Black Diamond |

100% WI |

|

Canada |

Southeast BC |

2-Target Drilling |

$15 |

Silver Lead Zinc |

Vein  |

|

K9 |

100% WI |

|

Canada |

Southeast BC |

2-Target Drilling |

$15 |

Copper Gold |

Sedex  |

|

Slocan |

1.00% GOR |

|

Canada |

Southeast BC |

2-Target Drilling |

$0 |

Graphite |

|

|

Wildhorse |

100% WI |

|

Canada |

Southeast BC |

2-Target Drilling |

$15 |

Gold |

Vein  |

|

Coyote Creek |

1.00% GOR |

|

Canada |

Southern BC |

2-Target Drilling |

$0 |

Potash Gypsum |

Sediment Hosted |

|

Ice River |

100% WI |

|

Canada |

Southern BC |

2-Target Drilling |

$15 |

Rare-Earth-Metals Niobium |

Intrusive Complex  |

![]() |

|

| Price: | $0.165 | Open Rec: | No |  |

| Market Cap: | $24,548,591 | WC % of Mkt Cap: | 11% |

| Working Cap: | $2,590,169 | As of: | 9/30/2023 |

| Issued: | 148,779,342 | Insider %: | 48.9% | | Diluted: | 156,979,342 | Story Type: | Resource: Discovery Exploration |

| Key People: | Robert T. Boyd (CEO), Teresa Cheng (CFO), Darren O'Brien (VP EX), |

SV Rating: Bottom-Fish Spec Value - as of December 29, 2023 SV Rating: Bottom-Fish Spec Value - as of December 29, 2023 |

| Last KRO Comment - Aug 25, 2023: KW Excerpt: Kaiser Watch August 25, 2023: Endurance Gold Corp (EDG-V) |

| Recent News - Apr 8, 2024: 2024 Exploration Plans, Reliance Gold Project |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Reliance |

100% WI |

|

Canada |

Southwest BC |

3-Discovery Delineation |

$26 |

Gold |

Orogenic Vein  |

|

Bandito |

100% WI |

|

Canada |

Yukon Territory |

2-Target Drilling |

$26 |

Niobium Tantalum Rare-Earth-Metals |

Intrusive Complex  |

|

Olympic |

100% WI |

|

Canada |

Southwest BC |

2-Target Drilling |

$26 |

Gold |

Orogenic Vein  |

|

Elephant Mtn |

100% WI |

|

United States |

Alaska |

2-Target Drilling |

$26 |

Gold |

Intrusion Related Gold System  |

|

Flint Lake |

20.3% WI |

|

Canada |

Ontario |

2-Target Drilling |

$128 |

Gold |

Orogenic Vein  |

|

Rattlesnake Hills |

1.00% NSR |

|

United States |

Wyoming |

3-Discovery Delineation |

$0 |

Gold |

Cripple Creek style |

|

McCord Creek |

100% WI |

|

United States |

Tintina Belt |

1-Grassroots |

$26 |

Gold |

Intrusion Related Gold System  |

![]() |

|

| Price: | $0.380 | Open Rec: | See Strategy |  |

| Market Cap: | $69,774,507 | WC % of Mkt Cap: | 3% |

| Working Cap: | $2,425,798 | As of: | 11/30/2023 |

| Issued: | 183,617,123 | Insider %: | 13.8% | | Diluted: | 198,824,346 | Story Type: | Resource: Discovery Exploration |

| Key People: | Hugh (Mac) Balkam (CEO), Carmelo Marrelli (CFO), John DeDecker (VP EX), M. Robert Myhill (VP FI), William R. Johnstone (Sec), |

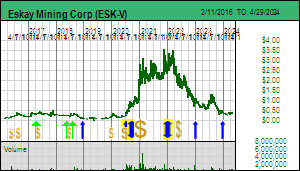

SV Rating: Bottom-Fish Spec Value - as of December 21, 2023 SV Rating: Bottom-Fish Spec Value - as of December 21, 2023 |

| Last Corporate Change - Nov 3, 2009: 1:1 Name Change from Kenrich-Eskay Mining (KRE-V) |

| Last KRO Comment - Jul 28, 2023: KW Excerpt: Kaiser Watch July 28, 2023: Eskay Mining Corp (ESK-V) |

| Recent News - Mar 25, 2024: Grant of Stock Options |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Eskay |

100% WI |

|

Canada |

Golden Triangle |

2-Target Drilling |

$76 |

Gold Silver Copper Lead Zinc |

VMS  |

|

North Mitchell |

80% WI |

|

Canada |

Golden Triangle |

2-Target Drilling |

$94 |

Gold |

Epithermal Vein  |

![]() |

|

| Price: | $0.750 | Open Rec: | No |  |

| Market Cap: | $131,977,418 | WC % of Mkt Cap: | 14% |

| Working Cap: | $18,755,414 | As of: | 9/30/2023 |

| Issued: | 175,969,891 | Insider %: | 2.2% | | Diluted: | 203,117,256 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Paul Harbidge (CEO), Russell D. Ball (Chair), Graham Richardson (CFO), Stacey Pavalova (VP CD), Thomas Bissig (VP EX), |

SV Rating: Bottom-Fish Spec Value - as of December 29, 2023 SV Rating: Bottom-Fish Spec Value - as of December 29, 2023 |

| Last Corporate Change - Nov 3, 2022: New Exchange Listing |

| Last KRO Comment - May 12, 2023: KW Excerpt: Kaiser Watch May 12, 2023: Faraday Copper Corp (FDY-T) |

| Recent News - Apr 10, 2024: Intersects 117.00 Metres at 0.40% Copper Near Surface, Including 23.37 Metres at 0.60% Copper at Old Reliable and Drilling Success Continues at Area 51 |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Copper Creek |

100% WI |

|

United States |

Arizona |

5-PEA |

$152 |

Copper Molybdenum |

Breccia / Porphyry  |

|

Contact |

100% WI |

|

United States |

Elko County |

6-Prefeasibility |

$152 |

Copper Silver |

Contact Intrusive Related  |

![]() |

|

| Price: | $0.295 | Open Rec: | No |  |

| Market Cap: | $80,794,968 | WC % of Mkt Cap: | 39% |

| Working Cap: | $31,462,685 | As of: | 9/30/2023 |

| Issued: | 273,881,246 | Insider %: | 34.6% | | Diluted: | 292,626,246 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Martin Turenne (CEO), Peter M. D. Bradshaw (Chair), Felicia de la Paz (CFO), Tim Bekhuys (VPESG), |

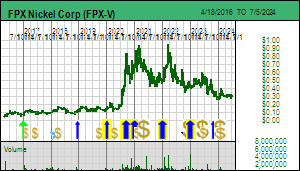

SV Rating: Bottom-Fish Spec Value - as of December 29, 2023 SV Rating: Bottom-Fish Spec Value - as of December 29, 2023 |

| Last Corporate Change - Aug 25, 2017: 1:1 Name Change from First Point Minerals Corp (FPX-V) |

| Last KRO Comment - Feb 28, 2024: KW Excerpt: Kaiser Watch February 28, 2024: FPX Nickel Corp (FPX-V) |

| Recent News - Apr 4, 2024: Establishes Technical Advisory Committee with Representatives from Strategic Investors |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Decar |

100% WI |

|

Canada |

Central BC |

7-Permitting & Feasibility |

$86 |

Nickel |

Ultramafic Complex  |

|

Klow |

40% TC |

|

Canada |

Central BC |

3-Discovery Delineation |

$216 |

Nickel |

Ultramafic Complex  |

|

SAM |

100% WI |

|

Canada |

Central BC |

1-Grassroots |

$86 |

Magnesium |

Ultramafic Complex  |

|

Wale |

100% WI |

|

Canada |

Northern BC |

3-Discovery Delineation |

$86 |

Nickel |

Ultramafic Complex  |

|

Orca |

100% WI |

|

Canada |

British Columbia |

3-Discovery Delineation |

$86 |

Nickel |

Ultramafic Complex  |

|

Mich |

100% WI |

|

Canada |

Whitehorse |

2-Target Drilling |

$86 |

Nickel |

Ultramafic Complex  |

![]() |

|

| Price: | $0.380 | Open Rec: | See Strategy |  |

| Market Cap: | $28,464,348 | WC % of Mkt Cap: | 11% |

| Working Cap: | $3,133,205 | As of: | 9/30/2023 |

| Issued: | 74,906,180 | Insider %: | 9.5% | | Diluted: | 80,508,732 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Robert Hinchcliffe (CEO), Robert D. B. Suttie (CFO), |

SV Rating: Bottom-Fish Spec Value - as of November 30, 2023: Galway Metals Inc is a Fair Spec Value rated Favorite as of December 31, 2021 based on its efforts since 2016 to demonstrate the multi-million ounce district scale gold potential of the 100% owned Clarence Stream project in New Brunswick, and to show that the Estrades polymetallic VMS system in Quebec has significant resource expansion potential at depth and that the 31 km long property can yield an entirely new VMS discovery at the Newiska target about 10 km to the east. Tracker Feb 18, 2020 describes Galway's origin as a spinout from CEO Robert Hinchcliffe's Galway Resources Ltd which was bought out in 2012 for its property near Ventana's La Bodega gold discovery in Colombia and provides background for the Clarence Stream project. Tracker Aug 23, 2021 provides an overview of Galway's recent objectives for the Clarence Stream and Estrades projects. The 60,000 ha Clarence Stream project straddles 65 km of the Appalachian Gold Trend which stretches from the Carolinas through Newfoundland and Ireland into Scandinavia. The key structural feature at Clarence Stream is the east-west oriented Sawyer Brook Fault which cuts through Ordovician and Silurian metasediments that have been intruded by various stocks that served as the heat engines for creating quartz vein hosted stockwork and disseminated gold mineralization of the intrusion related gold system style. Since 2016 Galway has drilled about 130,000 m on top of the 60,000 m drilled by previous owners, most of it focused on the cluster of new zones discovered in late 2017 about 7 km southwest of the existing North and South zones for which 9,586,000 tonnes of 2.17 g/t gold OP and UG mineable (667,000 oz) was estimated in 2017 (M+I+I). Galway established a data cutoff at the end of 2021 for the purpose of delivering an init...(see Profile for full Overview) SV Rating: Bottom-Fish Spec Value - as of November 30, 2023: Galway Metals Inc is a Fair Spec Value rated Favorite as of December 31, 2021 based on its efforts since 2016 to demonstrate the multi-million ounce district scale gold potential of the 100% owned Clarence Stream project in New Brunswick, and to show that the Estrades polymetallic VMS system in Quebec has significant resource expansion potential at depth and that the 31 km long property can yield an entirely new VMS discovery at the Newiska target about 10 km to the east. Tracker Feb 18, 2020 describes Galway's origin as a spinout from CEO Robert Hinchcliffe's Galway Resources Ltd which was bought out in 2012 for its property near Ventana's La Bodega gold discovery in Colombia and provides background for the Clarence Stream project. Tracker Aug 23, 2021 provides an overview of Galway's recent objectives for the Clarence Stream and Estrades projects. The 60,000 ha Clarence Stream project straddles 65 km of the Appalachian Gold Trend which stretches from the Carolinas through Newfoundland and Ireland into Scandinavia. The key structural feature at Clarence Stream is the east-west oriented Sawyer Brook Fault which cuts through Ordovician and Silurian metasediments that have been intruded by various stocks that served as the heat engines for creating quartz vein hosted stockwork and disseminated gold mineralization of the intrusion related gold system style. Since 2016 Galway has drilled about 130,000 m on top of the 60,000 m drilled by previous owners, most of it focused on the cluster of new zones discovered in late 2017 about 7 km southwest of the existing North and South zones for which 9,586,000 tonnes of 2.17 g/t gold OP and UG mineable (667,000 oz) was estimated in 2017 (M+I+I). Galway established a data cutoff at the end of 2021 for the purpose of delivering an init...(see Profile for full Overview) |

| Last Corporate Change - Jan 27, 2023: 3:1 Rollback with no Name Change |

| Last KRO Comment - Sep 23, 2022: KW Excerpt: Kaiser Watch September 23, 2022: Galway Metals Inc (GWM-V) |

| Recent News - Apr 5, 2024: Non Brokered Private Placement and Granting of Options to Employees |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Clarence Stream |

100% WI |

|

Canada |

New Brunswick |

4-Infill & Metallurgy |

$31 |

Gold Antimony |

Intrusion Related Gold System  |

|

Estrades |

100% WI |

|

Canada |

Quebec |

4-Infill & Metallurgy |

$31 |

Zinc Copper Gold Silver |

VMS  |

![]() |

|

| Price: | $0.780 | Open Rec: | No |  |

| Market Cap: | $49,577,189 | WC % of Mkt Cap: | 51% |

| Working Cap: | $25,059,148 | As of: | 9/30/2023 |

| Issued: | 63,560,499 | Insider %: | 37.4% | | Diluted: | 74,540,490 | Story Type: | Resource: Discovery Exploration |

| Key People: | Zachary Flood (CEO), Enoch Kong (CFO), Scott Smits (VP EX), |

SV Rating: Bottom-Fish Spec Value - as of December 29, 2023 SV Rating: Bottom-Fish Spec Value - as of December 29, 2023 |

| Last Corporate Change - Jan 13, 2021: 7:1 Name Change from Northway Resources Corp (NTW-V) |

| Last KRO Comment - Jan 6, 2023: KW Excerpt: Kaiser Watch January 6, 2023: Kenorland Minerals Ltd (KLD-V) |

| Recent News - Apr 17, 2024: Provides 2024 Exploration Update |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Frotet |

20% WI |

|

Canada |

James Bay |

3-Discovery Delineation |

$291 |

Gold |

Orogenic Vein  |

|

Chicobi |

30% TC |

|

Canada |

Abitibi Belt |

2-Target Drilling |

$194 |

Gold |

Orogenic Vein  |

|

Hunter |

30% TC |

|

Canada |

Abitibi Belt |

2-Target Drilling |

$194 |

Copper Zinc Iron Gold Silver |

VMS  |

|

Healy |

70% WI |

|

United States |

Alaska |

2-Target Drilling |

$83 |

Gold |

Orogenic Vein  |

|

Tanacross |

30% TC |

|

United States |

Alaska |

3-Discovery Delineation |

$194 |

Copper Gold Molybdenum |

Porphyry  |

|

O'Sullivan |

30% TC |

|

Canada |

Abitibi Belt |

2-Target Drilling |

$194 |

Gold |

Orogenic Vein  |

|

Chebistuan |

20% TC |

|

Canada |

Chibougamau |

1-Grassroots |

$291 |

Gold |

Orogenic Vein  |

|

Opinaca |

3.00% NSR |

|

Canada |

James Bay |

1-Grassroots |

$0 |

Lithium |

Pegmatite |

|

Rupert |

2.00% NSR |

|

Canada |

James Bay |

1-Grassroots |

$0 |

Lithium |

Pegmatite |

|

Fox River |

2.00% NSR |

|

Canada |

Northern Manitoba |

1-Grassroots |

$0 |

Nickel Palladium Platinum |

Layered Intrusive Complex |

|

Wheatcroft |

3.00% NSR |

|

Canada |

Northern Manitoba |

1-Grassroots |

$0 |

Gold |

Orogenic Vein |

|

Separation Rapids |

2.50% NSR |

|

Canada |

Northwest Ontario |

1-Grassroots |

$0 |

Lithium |

Pegmatite |

|

South Uchi |

100% WI |

|

Canada |

Northwest Ontario |

1-Grassroots |

$58 |

Gold |

Orogenic Vein  |

|

South Thompson |

100% WI |

|

Canada |

Thompson Belt |

1-Grassroots |

$58 |

Nickel |

Magmatic Segregation  |

|

Napolean |

1.00% NSR |

|

United States |

Alaska |

1-Grassroots |

$0 |

Gold |

Intrusion Related Gold System  |

![]() |

|

| Price: | $0.060 | Open Rec: | No |  |

| Market Cap: | $4,744,111 | WC % of Mkt Cap: | 75% |

| Working Cap: | $3,577,751 | As of: | 9/30/2023 |

| Issued: | 79,068,523 | Insider %: | 19.1% | | Diluted: | 92,039,477 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Jean-Sebastian David (CEO), Serge Savard (Chair), Anthony Glavac (CFO), |

SV Rating: Bottom-Fish Spec Value - as of December 29, 2023: NioBay Metals Inc was made a Fair Spec Value rated 2023 Favorite at $0.18 on December 30, 2022 based on early evidence a major new niobium bearing carbonatite has been discovered under a lake a few km to the west of the existing low grade Crevier syenite dyke hosted niobium-tantalum deposit located in southern Quebec about 150 km northwest of the Niobec Mine now owned by a private group called Magris which owns 27.5% of Crevier. The stock was rated a Good Spec Value Favorite in 2020 and 2021 based on the PEA completed in late 2020 for the James Bay carbonatite hosted niobium deposit in northern Ontario near the town of Moosonee. This deposit was discovered in the 1960s but never developed because of its remote location and the superior Niobec deposit in southern Quebec. NioBay acquired the James Bay project in early 2016 but could not start work because the chief of the Moose Cree First Nation, who represented an anti-mining stance with an emphasis on traditional Indigenous activities such as hunting, fishing and trapping, refused to engage in consultations with NioBay as required by Ontario's drill permitting process. She was ousted in mid 2019 tribal council elections and replaced by a new chief who engaged with NioBay in a manner that would protect community interests. This allowed NioBay to conduct a drill program in 2020 to support an updated resource and delivery of a PEA in October 2020 for a 6,600 tpd open pit mining scenario. Open pit mining was chosen over underground mining because the Moosonee community members preferred jobs operating equipment above ground rather than underground. At the base case price of $45/kg ferro-niobium James Bay has an after-tax NPV ranging from USD $638 million at 10% to $1.25 billion at 5% discount rates with an IRR of 30.4%. Wit...(see Profile for full Overview) SV Rating: Bottom-Fish Spec Value - as of December 29, 2023: NioBay Metals Inc was made a Fair Spec Value rated 2023 Favorite at $0.18 on December 30, 2022 based on early evidence a major new niobium bearing carbonatite has been discovered under a lake a few km to the west of the existing low grade Crevier syenite dyke hosted niobium-tantalum deposit located in southern Quebec about 150 km northwest of the Niobec Mine now owned by a private group called Magris which owns 27.5% of Crevier. The stock was rated a Good Spec Value Favorite in 2020 and 2021 based on the PEA completed in late 2020 for the James Bay carbonatite hosted niobium deposit in northern Ontario near the town of Moosonee. This deposit was discovered in the 1960s but never developed because of its remote location and the superior Niobec deposit in southern Quebec. NioBay acquired the James Bay project in early 2016 but could not start work because the chief of the Moose Cree First Nation, who represented an anti-mining stance with an emphasis on traditional Indigenous activities such as hunting, fishing and trapping, refused to engage in consultations with NioBay as required by Ontario's drill permitting process. She was ousted in mid 2019 tribal council elections and replaced by a new chief who engaged with NioBay in a manner that would protect community interests. This allowed NioBay to conduct a drill program in 2020 to support an updated resource and delivery of a PEA in October 2020 for a 6,600 tpd open pit mining scenario. Open pit mining was chosen over underground mining because the Moosonee community members preferred jobs operating equipment above ground rather than underground. At the base case price of $45/kg ferro-niobium James Bay has an after-tax NPV ranging from USD $638 million at 10% to $1.25 billion at 5% discount rates with an IRR of 30.4%. Wit...(see Profile for full Overview) |

| Last Corporate Change - Sep 21, 2016: 5:1 Name Change from MDN Inc (MDN-V) |

| Last KRO Comment - Apr 21, 2023: KW Excerpt: Kaiser Watch April 21, 2023: NioBay Metals Inc (NBY-V) |

| Recent News - Feb 29, 2024: Property Asset or Share Purchase Agreement |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

James Bay |

100% WI |

|

Canada |

James Bay Lowlands |

6-Prefeasibility |

$6 |

Niobium |

Carbonatite  |

|

Crevier |

72.5% WI |

|

Canada |

Central Quebec |

7-Permitting & Feasibility |

$8 |

Tantalum Niobium |

Carbonatite  |

|

Foothills |

80% WI |

|

Canada |

Quebec |

2-Target Drilling |

$7 |

Titanium |

Magmatic Intrusive  |

|

Valentine |

100% WI |

|

Canada |

James Bay Lowlands |

2-Target Drilling |

$6 |

Niobium |

Carbonatite  |

|

Gouin |

100% WI |

|

Canada |

Southern Quebec |

2-Target Drilling |

$6 |

Niobium |

Carbonatite  |

![]() |

|

| Price: | $0.140 | Open Rec: | See Strategy |  |

| Market Cap: | $26,699,486 | WC % of Mkt Cap: | 2% |

| Working Cap: | $435,859 | As of: | 9/30/2023 |

| Issued: | 190,710,613 | Insider %: | 0.0% | | Diluted: | 214,245,711 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Lauren McDougall (CFO), Tyler Caswell (VP EX), Pamela White (Sec), |

SV Rating: Bottom-Fish Spec Value - as of December 30, 2022: Northwest Copper Corp is the combination of two former KRO Favorites, Serengeti Resources Inc and Sun Metals Corp, which merged on March 5, 2021 on terms where Serengeti undertook a 2:1 rollback and Sun Metals merged with the resulting company on a 0.215 NWST share for 1 Sun Metals share. Sun Metals was a Bottom-Fish Spec Value rated 2020 Favorite at $0.23 but it was downgraded to Poor Spec Value on Oct 2, 2020 when it became apparent that the Stardust project was not delivering anything new. Serengeti, in contrast, which was started as a Bottom-Fish Spec Value rated 2020 Favorite at $0.185 was upgraded on October 8, 2020 to a Fair Spec Value rated Favorite at $0.355 based on news that the East Niv copper-gold prospect had turned into a compelling porphyry target that would be drilled for the first time in 2021 (see Tracker October 8, 2020). The merger deal was announced on November 30, 2020. Serengeti was continued as a Fair Spec Value rated 2021 Favorite at $0.39 on December 31, 2020 which adjusted to a $0.78 cost base when Serengeti and Sun Metals merged. The merger created synergies in several areas which effective May 17, 2021 justify upgrading Northwest Copper Corp to a Good Spec Value rated 2021 Favorite at $0.80. The first issue was that neither Sun Metals' Stardust nor Serengeti's Kwanika projects in central British Columbia had sufficient critical mass to be developed as standalone mines, Stardust as an underground only high grade copper-gold-silver CRD style mine, and Kwanika as a combination open-pit/underground mine most of whose output would be underground mined. Stardust, which started off with the Canyon Creek resource of 2,970,000 tonnes at 1.27% copper, 1.68 g/t gold and 32.6 g/t silver, spurred excitement in 2018 with the late season discovery of the ...(see Profile for full Overview) SV Rating: Bottom-Fish Spec Value - as of December 30, 2022: Northwest Copper Corp is the combination of two former KRO Favorites, Serengeti Resources Inc and Sun Metals Corp, which merged on March 5, 2021 on terms where Serengeti undertook a 2:1 rollback and Sun Metals merged with the resulting company on a 0.215 NWST share for 1 Sun Metals share. Sun Metals was a Bottom-Fish Spec Value rated 2020 Favorite at $0.23 but it was downgraded to Poor Spec Value on Oct 2, 2020 when it became apparent that the Stardust project was not delivering anything new. Serengeti, in contrast, which was started as a Bottom-Fish Spec Value rated 2020 Favorite at $0.185 was upgraded on October 8, 2020 to a Fair Spec Value rated Favorite at $0.355 based on news that the East Niv copper-gold prospect had turned into a compelling porphyry target that would be drilled for the first time in 2021 (see Tracker October 8, 2020). The merger deal was announced on November 30, 2020. Serengeti was continued as a Fair Spec Value rated 2021 Favorite at $0.39 on December 31, 2020 which adjusted to a $0.78 cost base when Serengeti and Sun Metals merged. The merger created synergies in several areas which effective May 17, 2021 justify upgrading Northwest Copper Corp to a Good Spec Value rated 2021 Favorite at $0.80. The first issue was that neither Sun Metals' Stardust nor Serengeti's Kwanika projects in central British Columbia had sufficient critical mass to be developed as standalone mines, Stardust as an underground only high grade copper-gold-silver CRD style mine, and Kwanika as a combination open-pit/underground mine most of whose output would be underground mined. Stardust, which started off with the Canyon Creek resource of 2,970,000 tonnes at 1.27% copper, 1.68 g/t gold and 32.6 g/t silver, spurred excitement in 2018 with the late season discovery of the ...(see Profile for full Overview) |

| Last Corporate Change - Mar 5, 2021: 2:1 Name Change from Serengeti Resources Inc (SIR-V) |

| Last KRO Comment - Sep 2, 2022: KW Excerpt: Kaiser Watch September 2, 2022: Northwest Copper Corp (NWST-V) |

| Recent News - Apr 1, 2024: Grant Sawiak Has Submitted His Resignation Together With Reasons |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Kwanika |

100% WI |

|

Canada |

Central BC |

5-PEA |

$30 |

Gold Copper Silver Molybdenum |

Porphyry  |

|

East Niv |

100% WI |

|

Canada |

Northern BC |

2-Target Drilling |

$30 |

Copper Gold Silver |

Porphyry  |

|

Stardust |

100% WI |

|

Canada |

Northern BC |

4-Infill & Metallurgy |

$30 |

Gold Copper Silver Zinc |

Carbonate Replacement  |

|

Lorraine-Top Cat |

100% WI |

|

Canada |

|

4-Infill & Metallurgy |

$30 |

Copper Gold Silver |

Porphyry  |

|

Jewel |

100% WI |

|

Canada |

Central BC |

2-Target Drilling |

$30 |

Copper Gold |

Skarn  |

|

Arjay |

100% WI |

|

Canada |

Northern BC |

2-Target Drilling |

$30 |

Copper |

Porphyry  |

|

East Copper King |

100% WI |

|

Canada |

Northern BC |

1-Grassroots |

$30 |

Copper |

Porphyry  |

|

ET West |

100% WI |

|

Canada |

Northern BC |

1-Grassroots |

$30 |

Copper |

Porphyry  |

|

Far East - LaForce |

100% WI |

|

Canada |

Northern BC |

1-Grassroots |

$30 |

Copper Silver |

|

|

Notch |

100% WI |

|

Canada |

Northern BC |

1-Grassroots |

$30 |

Copper |

|

|

TrUM |

100% WI |

|

Canada |

Northern BC |

1-Grassroots |

$30 |

Nickel Cobalt |

Ultramafic Complex  |

|

West Goldway |

100% WI |

|

Canada |

Northern BC |

2-Target Drilling |

$30 |

Copper |

Porphyry  |

|

UDS |

100% WI |

|

Canada |

British Columbia |

2-Target Drilling |

$30 |

Gold Copper |

Porphyry  |

|

Croy Bloom |

100% WI |

|

Canada |

Quesnal Trough |

2-Target Drilling |

$30 |

Copper Gold Cobalt |

Porphyry  |

|

Milligan West |

56.3% WI |

|

Canada |

Quesnal Trough |

2-Target Drilling |

$53 |

Copper Gold |

Porphyry  |

|

OK |

100% WI |

|

Canada |

Southwest BC |

4-Infill & Metallurgy |

$30 |

Copper Molybdenum |

Porphyry |

![]() |

|

| Price: | $0.150 | Open Rec: | See Strategy |  |

| Market Cap: | $16,030,787 | WC % of Mkt Cap: | -2% |

| Working Cap: | ($395,207) | As of: | 9/30/2023 |

| Issued: | 106,871,913 | Insider %: | 37.5% | | Diluted: | 150,451,971 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Joseph J. Ovsenek (CEO), Grant Bond (CFO), Tom S.Q. Yip (CFO), Kenneth C. McNaughton (VP EX), |

SV Rating: Bottom-Fish Spec Value - as of December 22, 2023: P2 Gold Inc was made a Bottom-Fish Spec Value rated 2021 Favorite at $0.40 on December 31, 2020 based on its new role as the post-Pretium exploration vehicle for Joe Ovsenek and Ken MacNaughton, the former CEO and Exploration VP for Pretium and its high grade Brucejack gold project in the Golden Triangle. On February 23, 2021 P2 Gold expanded the focus with the acquisition of an all-season advanced project in Nevada's Walker Lane called Gabbs which hosts several copper-gold porphry style deposits. This is an expensive acquisition whose closing is contingent on P2 Gold completing a $16 million private placement consisting of 32 million shares at $0.50. Gabbs will become the new flagship project for P2 Gold which in the worst case will function as a copper-gold optionality story with the existing resource, but will initially be the focus of a major system rethink by the Ovsenek/MacNaughton team which will assess the deeper potential of what they believe is a gold dominated alkaline porphyry system different from the copper porphyries at Yerington. The Golden Triangle projects optioned during the summer of 2020 have heavy vesting obligations that kick in after the second year, so these will be subjected to make or break exploration programs over the next year. P2 Gold remains Bottom-Fish Spec Value rated while we wait for the $16 million financing to close, of which USD $5 million will go to close the Gabbs acquisition, and the rest will fund 2021 exploration programs. Along with several associates Joe Ovsenek and Ken MacNaughton purchased founder stakes through a 10 million share private placement at $0.10 (no warrants) in April 2020 following a 6:1 rollback of Central Timmins Exploration Corp, a mediocre junior which went public by IPO through PI Financial on Oct 16, 201...(see Profile for full Overview) SV Rating: Bottom-Fish Spec Value - as of December 22, 2023: P2 Gold Inc was made a Bottom-Fish Spec Value rated 2021 Favorite at $0.40 on December 31, 2020 based on its new role as the post-Pretium exploration vehicle for Joe Ovsenek and Ken MacNaughton, the former CEO and Exploration VP for Pretium and its high grade Brucejack gold project in the Golden Triangle. On February 23, 2021 P2 Gold expanded the focus with the acquisition of an all-season advanced project in Nevada's Walker Lane called Gabbs which hosts several copper-gold porphry style deposits. This is an expensive acquisition whose closing is contingent on P2 Gold completing a $16 million private placement consisting of 32 million shares at $0.50. Gabbs will become the new flagship project for P2 Gold which in the worst case will function as a copper-gold optionality story with the existing resource, but will initially be the focus of a major system rethink by the Ovsenek/MacNaughton team which will assess the deeper potential of what they believe is a gold dominated alkaline porphyry system different from the copper porphyries at Yerington. The Golden Triangle projects optioned during the summer of 2020 have heavy vesting obligations that kick in after the second year, so these will be subjected to make or break exploration programs over the next year. P2 Gold remains Bottom-Fish Spec Value rated while we wait for the $16 million financing to close, of which USD $5 million will go to close the Gabbs acquisition, and the rest will fund 2021 exploration programs. Along with several associates Joe Ovsenek and Ken MacNaughton purchased founder stakes through a 10 million share private placement at $0.10 (no warrants) in April 2020 following a 6:1 rollback of Central Timmins Exploration Corp, a mediocre junior which went public by IPO through PI Financial on Oct 16, 201...(see Profile for full Overview) |

| Last Corporate Change - Aug 31, 2020: 1:1 Name Change from Central Timmins Expl Corp (CTEC-V) |

| Last KRO Comment - Oct 21, 2022: KW Excerpt: Kaiser Watch October 21, 2022: P2 Gold Inc (PGLD-V) |

| Recent News - Mar 28, 2024: Option Grants |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Gabbs |

100% WI |

|

United States |

Nye County |

4-Infill & Metallurgy |

$23 |

Gold Copper |

Porphyry  |

|

BAM |

100% WI |

|

Canada |

Golden Triangle |

4-Infill & Metallurgy |

$23 |

Gold Silver Copper |

Intermediate Sulphidation Epithermal  |

|

Todd Creek |

70% WI |

|

Canada |

Golden Triangle |

2-Target Drilling |

$32 |

Copper Gold |

Porphyry  |

|

Natlan |

100% WI |

|

Canada |

Northern BC |

1-Grassroots |

$23 |

Silver Lead Zinc Gold |

Carbonate Replacement  |

|

Silver Reef |

100% WI |

|

Canada |

Northern BC |

2-Target Drilling |

$23 |

Silver Lead Zinc Gold |

Carbonate Replacement  |

|

Lost Cabin |

100% WI |

|

United States |

Oregon |

2-Target Drilling |

$23 |

Gold |

Epithermal  |

![]() |

|

| Price: | $8.460 | Open Rec: | See Strategy |  |

| Market Cap: | $542,484,438 | WC % of Mkt Cap: | 0% |

| Working Cap: | ($935,804) | As of: | 12/31/2023 |

| Issued: | 64,123,456 | Insider %: | 40.8% | | Diluted: | 67,364,003 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Jonathan Cherry (CEO), Marcelo Kim (Chair), Jessica Largent (CFO), Darren Morgans (CFO), Heather Ennis (Sec), |

SV Rating: Bottom-Fish Spec Value - as of December 30, 2022: Perpetua Gold Corp, the new name for Midas Gold Corp effective Feb 18, 2021 following a 10:1 rollback on Jan 29, 2021 to allow a NASDAQ listing where it now trades with the symbol PPTA, has been a KRO Fair or Good Spec Value rated recommendation since September 6, 2013 based on its 100% owned gold-antimony Stibnite project in Idaho. On December 31, 2020 Perpetua was continued as a 2021 Favorite at $1.22 ($12.22 after adjusting for the 10:1 rollback) following the filing of a Draft Environmental Impact Statement by the USFS on Aug 14, 2020 and the company's delivery of a positive feasibility study on December 22, 2020. We are now waiting for the USFS to release a Final EIS in Q2 of 2021 followed by a draft Record of Decision in Q3 and a Final Record of Decision in Q4 which becomes the basis for ROD dependent permits and a construction decision in 2022 with production beginning in 2026 if CapEx of $1.3 billion can be raised. On April 5, 2021 Perpetua Gold Corp was confirmed as a Good Spec Value rated Favorite at $7.97 in Tracker Apr 5, 2021 which includes NPV and NPV/share based graphics for the Stibnite project using a close approximation of the parameters in the feasibility study's technical report and showing sensitivity to a gold price as high as $2,500. The feasibility study envisions a 15 year 20,000 tpd open-pit operation that mines three deposits whose refractory ore will be processed through a milling and pressure-oxidation complex that would yield 4,284,000 oz gold and 118 million lbs of antimony with a minor silver by-product. CapEx and Sustaining Capital were USD $1.292 billion and $295 million with OpEx at $26.45 per tonne. At base case prices of $1,600/oz gold, $20/oz silver and $3.50/lb antimony the after tax NPV was $1.347 billion at a 5% discount rate and...(see Profile for full Overview) SV Rating: Bottom-Fish Spec Value - as of December 30, 2022: Perpetua Gold Corp, the new name for Midas Gold Corp effective Feb 18, 2021 following a 10:1 rollback on Jan 29, 2021 to allow a NASDAQ listing where it now trades with the symbol PPTA, has been a KRO Fair or Good Spec Value rated recommendation since September 6, 2013 based on its 100% owned gold-antimony Stibnite project in Idaho. On December 31, 2020 Perpetua was continued as a 2021 Favorite at $1.22 ($12.22 after adjusting for the 10:1 rollback) following the filing of a Draft Environmental Impact Statement by the USFS on Aug 14, 2020 and the company's delivery of a positive feasibility study on December 22, 2020. We are now waiting for the USFS to release a Final EIS in Q2 of 2021 followed by a draft Record of Decision in Q3 and a Final Record of Decision in Q4 which becomes the basis for ROD dependent permits and a construction decision in 2022 with production beginning in 2026 if CapEx of $1.3 billion can be raised. On April 5, 2021 Perpetua Gold Corp was confirmed as a Good Spec Value rated Favorite at $7.97 in Tracker Apr 5, 2021 which includes NPV and NPV/share based graphics for the Stibnite project using a close approximation of the parameters in the feasibility study's technical report and showing sensitivity to a gold price as high as $2,500. The feasibility study envisions a 15 year 20,000 tpd open-pit operation that mines three deposits whose refractory ore will be processed through a milling and pressure-oxidation complex that would yield 4,284,000 oz gold and 118 million lbs of antimony with a minor silver by-product. CapEx and Sustaining Capital were USD $1.292 billion and $295 million with OpEx at $26.45 per tonne. At base case prices of $1,600/oz gold, $20/oz silver and $3.50/lb antimony the after tax NPV was $1.347 billion at a 5% discount rate and...(see Profile for full Overview) |

| Last Corporate Change - Feb 18, 2021: 1:1 Name Change from Midas Gold Corp (MAX-T) |

| Last KRO Comment - Nov 3, 2022: KW Excerpt: Kaiser Watch November 3, 2022: Perpetua Gold Corp (PPTA-T) |

| Recent News - Apr 8, 2024: Receives Indication for up to $1.8 Billion Financing from Export Import Bank of the United States for Stibnite Gold Project |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Stibnite |

100% WI |

|

United States |

Idaho |

7-Permitting & Feasibility |

$570 |

Gold Antimony |

Epithermal Vein / Stockwork  |

![]() |

|

| Price: | $0.930 | Open Rec: | No |  |

| Market Cap: | $48,982,843 | WC % of Mkt Cap: | -34% |

| Working Cap: | ($16,868,000) | As of: | 12/31/2023 |

| Issued: | 52,669,724 | Insider %: | 20.1% | | Diluted: | 55,402,343 | Story Type: | Resource: Producer |

| Key People: | Cristiano Veloso (CEO), Felipe B. Paolucci (CFO), Lucas Brown (VP CD), |

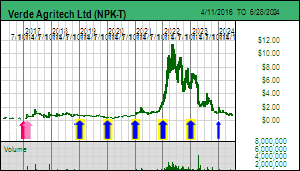

SV Rating: Bottom-Fish Spec Value - as of December 29, 2023 SV Rating: Bottom-Fish Spec Value - as of December 29, 2023 |

| Last Corporate Change - Aug 2, 2022: 1:1 Name Change from Verde Agritech Plc (NPK-T) |

| Last KRO Comment - Sep 29, 2023: KW Excerpt: Kaiser Watch September 29, 2023: Verde Agritech Ltd (NPK-T) |

| Recent News - Mar 28, 2024: Q4 and FY 2023 Results |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Cerrado Verde |

100% WI |

|

Brazil |

Minas Gerais |

9-Production |

$52 |

Potash |

Sediment-hosted  |

|

Calcario |

100% WI |

|

Brazil |

Minas Gerais |

5-PEA |

$52 |

Limestone |

Sediment Hosted |

![]() |

|