| |

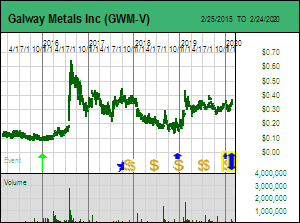

Tracker - February 25, 2020: Galway delivers new evidence that grades get better at depth for Clarence Stream

Galway Metals Inc attracted market action on February 25, 2020 with the latest batch of assays from Clarence Stream which included the best intersection yet. Hole #20-87, drilled at 82 degrees into the Richard zone, yielded 25.6 m of 10.6 g/t gold after adjustment for true width between 153-200 m. This interval included a high grade spike of 495 g/t gold over 0.3 m at 189 m, but there were 6 additional short intervals of 0.3-0.5 m true width with grades of 35.7-67.8 g/t gold so this is not an example of grade smearing. While the news release makes your head spin with its welter of hole descriptions, the key observation is that in the Richard zone area several multiple gold bearing structures appear to be converging at depth, an important development if underground mining is to be considered. Although the stock traded 1.9 million shares it closed unchanged at $0.355 which was largely due to investors stepping back from the juniors on the second day of coronavirus related steep declines in senior equity markets. Galway Metals Inc attracted market action on February 25, 2020 with the latest batch of assays from Clarence Stream which included the best intersection yet. Hole #20-87, drilled at 82 degrees into the Richard zone, yielded 25.6 m of 10.6 g/t gold after adjustment for true width between 153-200 m. This interval included a high grade spike of 495 g/t gold over 0.3 m at 189 m, but there were 6 additional short intervals of 0.3-0.5 m true width with grades of 35.7-67.8 g/t gold so this is not an example of grade smearing. While the news release makes your head spin with its welter of hole descriptions, the key observation is that in the Richard zone area several multiple gold bearing structures appear to be converging at depth, an important development if underground mining is to be considered. Although the stock traded 1.9 million shares it closed unchanged at $0.355 which was largely due to investors stepping back from the juniors on the second day of coronavirus related steep declines in senior equity markets.

Galway Metals is conducting a 25,000 m drill program with three rigs focused on the 2.5 km segment defined by the Jubilee zone at the southwestern end and the George Murphy zone at the northeastern end. Hole 87 was drilled into the Richard zone which sits in the middle between the other two zones. The goal is to show that the gaps between have similar mineralization which Galway is tackling with 100 m stepouts while the other rigs conduct infill drilling in the established mineralized zones to support a maiden resource estimate by Q3 of 2020. The drill plan above shows how the strike of this 2.5 km target tracks that of a Devonian granite that intruded the metasediments which host the mineralized quartz veins. These so far have not been shown to extend into the intrusive body that is viewed as the heat engine for the gold system. The deposit model is one called "intrusion related gold system" which implies proximity to a heat engine pushing gold bearing fluids through cracks and fissures within the surrounding country rock.

The Clarence Stream project has an existing M+I+I resource of 9,586,000 tonnes at 2.17 g/t within the North and South Zones first discovered by Freewest in 2000 and updated by Galway in October 2017. That amounts to about 667,000 ounces gold, most of which is within open-pittable range. The goal in 2020 is to deliver an initial resource estimate for the Jubilee-Richard-George Murphy segment that pushes the global resource past 1 million ounces. The results so far indicate that Galway is on track toward achieving this goal which will attract a broader audience to the real story, the district scale potential of this part of New Brunswick as shown in the regional map below. This potential is divided into two blocks of which the southwestern block covering 40 km of trend is the current focus. What intrigues me about Clarence Stream is that the Jubilee-Richard-GM segment lines up with the South Zone, a 7 km trend that is not the subject of the highest gold in soil geochemical anomalies, the best of which are offset from this trend and which have not been the focus of exploration drilling. The combination of a rising gold price fueled bull market and Galway clearing the 1 million ounce hurdle should enable Galway to attract substantially bigger financing that enables the junior to engage in much more aggressive exploration of the district potential. The stock represents Fair Speculative Value because the $54 million implied project value allows 5-10 times upside potential which would put Galway Metals' valuation on a par with that of Great Bear Resources Ltd which at $9 is carrying an implied project value of $462 million for its Dixie project south of Red Lake, almost what Evolution Mining Ltd paid Newmont for Goldcorp's Red Lake mining district. Galway Metals is a KRO Favorite because as a junior its story is at the waking up stage and the liquidity provided by the 152.4 million fully diluted shares provides a gradual on-ramp for new audiences.

|