Home / Works Archive / Trackers

Trackers

| | Thu Dec 27, 2018

Tracker: Spec Value Rating for PJX Resources Inc (PJX-V)

Publisher: Kaiser Research Online

Author: Copyright 2018 John A. Kaiser

|

| |

Tracker - December 27, 2018: Spec Value Rating for PJX Resources Inc (PJX-V)

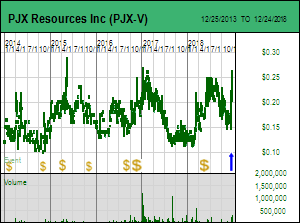

PJX Resources Inc has a Bottom-Fish Spec Value rating based on its large property portfolio in southeastern British Columbia which is prospective for the Sullivan Two Hunt or the search for the origin of placer gold in the Wildhorse, Perry and Moyie Creek drainages. PJX went public by IPO on Sept 14, 2011 with Dewdney Trail northeast of Cranbrook as its flagship but shifted its attention 40 km southwest where the Zinger and Eddy properties plus the recently acquired Gold Shear have become the subject of exploration for shear and quartz vein hosted orogenic gold deposits. Heading into 2019, however, PJX has shifted its attention to the Sullivan Two Hunt projects, all 3 of which sit close to the Moyie Fault, an area where Teck, former operator of Sullivan, is a large landholder. The southernmost property is the DD claim optioned up to 75% to Teck in 2016 for up to $8 million exploration by 2024. PJX in turn acquired DD in 2015 from several of the Sullivan illuminati that now serve as consultants to PJX and its CEO John Keating. DD has a history of exploration that has never yielded the Sullivan Time Horizon which is believed to be 1,000 m plus deep. Teck drilled a 1,425 m hole in Q3 of 2018 for which no results have yet been reported; it is not a question about a discovery but rather whether the STH has finally been found. Of much greater importance heading into 2019 is the Vine property which sits to the northeast of the Monroe project of Highway 50 where the Leasks have zeroed in on their quarry but have been frustrated by drilling problems. PJX also owns the West Basin property to the southwest of Monroe which hosts the FORS lead-zinc zone, a failed feeder vent that never developed meaningful tonnage. The Vine property has also been a source of frustration, with drilling mostly in the area of the Vine zone found in 1976, a high grade vein now believed to represent remobilization of metal from a much deeper Sullivan scale deposit. Kokanee/Ramrod mounted the last big Sullivan Two promotion on this target during the nineties. Keating as an ex-Noranda guy is keen on geophysics as an exploration tool and in 2014 conducted a gravity survey which established the East and West gravity targets in the northeastern half of the Vine property. These targets were drilled in 2015 with West explained by massive sulphides without zinc-lead, possibly peripheral to the real thing. The 1,100 m hole into East also failed but churned up enough new geology with anomalous zinc-lead to make it the current focus. A magnetotellurics survey in November 2018 revealed a large plunging target starting at 600 m depth as well as an untested shallow target close to the Moyie fault. PJX now believes it is dealing with a Broken Hill model, a SEDEX deposit that has been metamorphosed and remobilized by folding. In December 2018 PJX raised $1.3 million at $0.17-$0.19 towards a drill program scheduled for mid January 2019 to test the shallow and deep MT targets. The fallback plan is to continue work on the gold plays. PJX Resources Inc has a Bottom-Fish Spec Value rating based on its large property portfolio in southeastern British Columbia which is prospective for the Sullivan Two Hunt or the search for the origin of placer gold in the Wildhorse, Perry and Moyie Creek drainages. PJX went public by IPO on Sept 14, 2011 with Dewdney Trail northeast of Cranbrook as its flagship but shifted its attention 40 km southwest where the Zinger and Eddy properties plus the recently acquired Gold Shear have become the subject of exploration for shear and quartz vein hosted orogenic gold deposits. Heading into 2019, however, PJX has shifted its attention to the Sullivan Two Hunt projects, all 3 of which sit close to the Moyie Fault, an area where Teck, former operator of Sullivan, is a large landholder. The southernmost property is the DD claim optioned up to 75% to Teck in 2016 for up to $8 million exploration by 2024. PJX in turn acquired DD in 2015 from several of the Sullivan illuminati that now serve as consultants to PJX and its CEO John Keating. DD has a history of exploration that has never yielded the Sullivan Time Horizon which is believed to be 1,000 m plus deep. Teck drilled a 1,425 m hole in Q3 of 2018 for which no results have yet been reported; it is not a question about a discovery but rather whether the STH has finally been found. Of much greater importance heading into 2019 is the Vine property which sits to the northeast of the Monroe project of Highway 50 where the Leasks have zeroed in on their quarry but have been frustrated by drilling problems. PJX also owns the West Basin property to the southwest of Monroe which hosts the FORS lead-zinc zone, a failed feeder vent that never developed meaningful tonnage. The Vine property has also been a source of frustration, with drilling mostly in the area of the Vine zone found in 1976, a high grade vein now believed to represent remobilization of metal from a much deeper Sullivan scale deposit. Kokanee/Ramrod mounted the last big Sullivan Two promotion on this target during the nineties. Keating as an ex-Noranda guy is keen on geophysics as an exploration tool and in 2014 conducted a gravity survey which established the East and West gravity targets in the northeastern half of the Vine property. These targets were drilled in 2015 with West explained by massive sulphides without zinc-lead, possibly peripheral to the real thing. The 1,100 m hole into East also failed but churned up enough new geology with anomalous zinc-lead to make it the current focus. A magnetotellurics survey in November 2018 revealed a large plunging target starting at 600 m depth as well as an untested shallow target close to the Moyie fault. PJX now believes it is dealing with a Broken Hill model, a SEDEX deposit that has been metamorphosed and remobilized by folding. In December 2018 PJX raised $1.3 million at $0.17-$0.19 towards a drill program scheduled for mid January 2019 to test the shallow and deep MT targets. The fallback plan is to continue work on the gold plays.

|

| |

| | You can return to the Top of this page

|

|