|

SVH Tracker - September 12, 2017: Stark's tom tom has been confiscated but not his snare drum

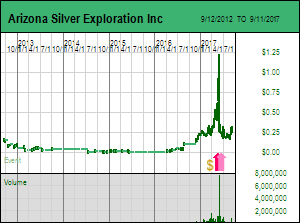

After escaping the heat by hiding under a rock all summer Chairman Mike Stark and CEO Greg Hahn of Arizona Silver Corp are returning to the Ramsey project in Arizona with a 6 hole drill program to test two new targets. One target is the Western Deep IP anomaly into which one deep hole of at least 300 metres will be drilled. The hope is that the sulphides are part of a major blind hydrothermal system of which the Ramsey silver vein is a distal expression. A best case outcome would be that the sulphides are the tip of a hypogene enriched copper deposit such as San Manuel. Such an outcome would be a classic case of exploration serendipity because such a discovery would never have emerged as a drill target if it were not for the Ramsey Extension Hypothesis. The second target is the eastward extension of the Ramsey Vein where drilling in late spring showed that the vein had unexpectedly flattened and thickened, albeit without the high grade core the old-timers mined. Five holes will probe this extension eastward to see if a thick tabular body of at least 3 opt silver is present at a depth that allows open pit mining. In a sense this is a revival of the Ramsey Extension Hypothesis for which I visualized a possible outcome of 60 million tonnes grading 125 g/t silver. In my May 18, 2017 SVH Tracker I had recommended Arizona Silver at $0.61 as a Good Relative Spec Value Buy while drilling of the Ramsey Extension Hypothesis was underway. After that drilling program delivered a bust that dropped Arizona Silver over 80% from a $1.25 peak I decided to maintain Arizona Silver as an SVH buy (see SVH Tracker June 14, 2017) because at a price below $0.30, with a 100% net interest and only 30 million shares fully diluted, the project offered substantial upside should either of these two new targets deliver expectations. Drilling is expected to resume mid-September. If Arizona Silver has no problems completing road access to the Western Deep IP target, this will be the first hole drilled. Otherwise Arizona Silver will start with the Ramsey East Extension drilling. Don't expect a speculative run-up this time without results in hand. Mike Stark is marching back onto the field with a snare drum, his tom tom safely stored in the garage next to the bass drum he has in reserve should the Western Deep IP anomaly deliver a new discovery. After escaping the heat by hiding under a rock all summer Chairman Mike Stark and CEO Greg Hahn of Arizona Silver Corp are returning to the Ramsey project in Arizona with a 6 hole drill program to test two new targets. One target is the Western Deep IP anomaly into which one deep hole of at least 300 metres will be drilled. The hope is that the sulphides are part of a major blind hydrothermal system of which the Ramsey silver vein is a distal expression. A best case outcome would be that the sulphides are the tip of a hypogene enriched copper deposit such as San Manuel. Such an outcome would be a classic case of exploration serendipity because such a discovery would never have emerged as a drill target if it were not for the Ramsey Extension Hypothesis. The second target is the eastward extension of the Ramsey Vein where drilling in late spring showed that the vein had unexpectedly flattened and thickened, albeit without the high grade core the old-timers mined. Five holes will probe this extension eastward to see if a thick tabular body of at least 3 opt silver is present at a depth that allows open pit mining. In a sense this is a revival of the Ramsey Extension Hypothesis for which I visualized a possible outcome of 60 million tonnes grading 125 g/t silver. In my May 18, 2017 SVH Tracker I had recommended Arizona Silver at $0.61 as a Good Relative Spec Value Buy while drilling of the Ramsey Extension Hypothesis was underway. After that drilling program delivered a bust that dropped Arizona Silver over 80% from a $1.25 peak I decided to maintain Arizona Silver as an SVH buy (see SVH Tracker June 14, 2017) because at a price below $0.30, with a 100% net interest and only 30 million shares fully diluted, the project offered substantial upside should either of these two new targets deliver expectations. Drilling is expected to resume mid-September. If Arizona Silver has no problems completing road access to the Western Deep IP target, this will be the first hole drilled. Otherwise Arizona Silver will start with the Ramsey East Extension drilling. Don't expect a speculative run-up this time without results in hand. Mike Stark is marching back onto the field with a snare drum, his tom tom safely stored in the garage next to the bass drum he has in reserve should the Western Deep IP anomaly deliver a new discovery.

The Western Deep IP anomaly emerged in early 2017 when the crew conducting an IP survey over the magnetic anomaly underpinning the Ramsey Extension Hypothesis noticed the signal increasing as they neared the limit of the contracted line and took it upon themselves to extend the survey an extra 400 metres. The hole will be spotted on Line 1 at the southern end of the 600 m by 300 m chargeability anomaly where it starts at about 100 m depth compared to 200 m at the northern end.

With regard to the Ramsey East Extension, what caught management's attention was holes R1706 and R1707 which intersected mineralization at a shallower depth than expected. Unfortunately the interval was missing the 60 opt high grade interval that the old-timers mined, which would drag the average for a bulk mining scenario to the 4 opt plus level where it becomes interesting.

Arizona Silver is testing the Ramsey East Extension because the area 700 m eastwards does exhibit alteration and the Creosote Vein, although with different mineralogy and orientation, may be related.

If this were the first time I was recommending Arizona Silver Corp I would recommend it at as a bottom-fish accumulation target in the $0.20-$0.29 range, not a Good Relative Spec Value Buy. The difference is that upside for a "bottom-fish" is contingent on a positive development in the fundamentals, whereas in an SVH recommendation I think the stock is under-valued even as a contingent exploration play. The Ramsey project still lacks a discovery worthy of delineation drilling. But in the case of Arizona Silver one has to keep in mind that Mike Stark can be formidable even when just equipped with a snare drum.

|