| |

Bottom-Fish Comment - April 11, 2017: Highway 50 thinks it got a nibble from Sullivan II

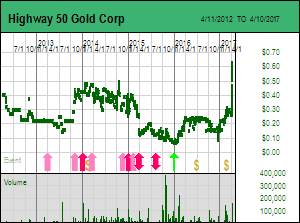

Highway 50 Gold Corp, which I demoted from a Spec Value Hunter pick to a bottom-fish accumulation target below $0.10 on December 31, 2015, may finally be on the threshold of a significant discovery. The junior's efforts to find a Carlin type gold deposit near Quito in Nevada bombed out in 2015 when long awaited drill permits translated into disappointing results. Highway 50 changed lanes on May 3, 2016 when it optioned 50% of the Monroe project in southeastern British Columbia from a private company controlled by Highway 50's key insiders, John and Gordon Leask. The Monroe project was the subject of a Nov 9, 2014 bottom-fish recommendation of Sonoro Metals Corp which had optioned the property 50% from the Leasks' private company. Sonoro drilled one hole to 1,114 m depth which killed one half of a geological hypothesis the Leask brothers had developed. They failed to persuade Gary Freeman to test the other half of the hypothesis and Sonoro dropped the option. With the focus now on the area between Monroe Lake and Moyie Lake they drilled 2 holes in 2016 which did not deliver a discovery on August 2, 2016, but which did provide evidence that a hydrothermal system was active during "Sullivan Time" in what the Leasks call the "Eastern Domain". In what may be the shortest news release ever penned by the Leasks, on March 14, 2017 Highway 50 started a third hole about 500 m south of the first two with a target depth of 500 m. This hole blazed through the target depth and was shaping up to be a bust when alteration with disseminated zinc-lead sulphide mineralization started showing up at 742-785 m depth where the hole was stopped to allow for a spring thaw related six week break. The stock has doubled to about $0.60 where the next challenge is to get 7,027,025 warrants exercisable at $0.60 which expire Feb 28, 2018 exercised. The company states that it has about $500,000 working capital left, enough to deepen hole #3 and drill several more at a cost of $120,000-$150,000 each. The map below shows the location of these holes. Highway 50 Gold Corp, which I demoted from a Spec Value Hunter pick to a bottom-fish accumulation target below $0.10 on December 31, 2015, may finally be on the threshold of a significant discovery. The junior's efforts to find a Carlin type gold deposit near Quito in Nevada bombed out in 2015 when long awaited drill permits translated into disappointing results. Highway 50 changed lanes on May 3, 2016 when it optioned 50% of the Monroe project in southeastern British Columbia from a private company controlled by Highway 50's key insiders, John and Gordon Leask. The Monroe project was the subject of a Nov 9, 2014 bottom-fish recommendation of Sonoro Metals Corp which had optioned the property 50% from the Leasks' private company. Sonoro drilled one hole to 1,114 m depth which killed one half of a geological hypothesis the Leask brothers had developed. They failed to persuade Gary Freeman to test the other half of the hypothesis and Sonoro dropped the option. With the focus now on the area between Monroe Lake and Moyie Lake they drilled 2 holes in 2016 which did not deliver a discovery on August 2, 2016, but which did provide evidence that a hydrothermal system was active during "Sullivan Time" in what the Leasks call the "Eastern Domain". In what may be the shortest news release ever penned by the Leasks, on March 14, 2017 Highway 50 started a third hole about 500 m south of the first two with a target depth of 500 m. This hole blazed through the target depth and was shaping up to be a bust when alteration with disseminated zinc-lead sulphide mineralization started showing up at 742-785 m depth where the hole was stopped to allow for a spring thaw related six week break. The stock has doubled to about $0.60 where the next challenge is to get 7,027,025 warrants exercisable at $0.60 which expire Feb 28, 2018 exercised. The company states that it has about $500,000 working capital left, enough to deepen hole #3 and drill several more at a cost of $120,000-$150,000 each. The map below shows the location of these holes.

Monroe is part of a grand Canadian resource junior tradition called the Hunt for Sullivan II, a sister to the Sullivan deposit discovered in 1892 and operated as a 10,000 tpd underground mine until 2001. Sullivan was a world class Sedex deposit of 160 million tonnes of 5.86% zinc, 6.08% lead and 67 g/t silver plus a number of other minor metals. The Sullivan deposit is located about 40 km north of the Monroe project within the sedimentary Purcell Basin which is the subject of multiple sub-basins (grabens) created through rifting which also helped bring on gabbroic intrusions which are believed to have served as the heat engines for the hydrothermal systems that convected in this setting, with the best fluid flow taking place via the graben margins. The Sullivan deposit was created by a smoker system which exhaled metal laden solutions into a marine environment with the metals gradually precipitating down-current from the smoker vent. Sedex deposits start out as laterally extensive pancakes which eventually get broken up, moved around and folded by later tectonic activity. Generally where there is one smoker system there will be more, and, given the intensity of the one that created Sullivan, the view is that there just have to be more and if they are only half the size of Sullivan they will still qualify as world class deposits. Finding a smaller version of Sullivan by drilling deep holes, reconstructing the stratigraphy, and using alteration evidence to vector in on a smoker vent is the obsession of geologists like John and Gordon Leask who study the Purcell Basin.

If you visit Highway 50's web site you will not even find a Monroe project section, nor a presentation outlining the Monroe story. In a rather out-of-character burst of minimalism John and Gordon Leask have done a terrible job communicating the Monroe story, perhaps because they are embarrassed about the farmout deal where they effectively asked a public company they controlled to derisk a high risk high reward exploration play they privately owned. In my view they should have given Highway 50 the option to go to 70% or even 80% by funding advanced work, leaving the vendor with a funded through production minority interest that they could later trade to the junior for a pro-rata equity stake. The current deal structure is a poison pill in favor of the Leask brothers because no major will want to buy out only 50% through a hostile bid for the junior. The option news release only specified that Highway 50 was operator until vested for 50% at which stage a JV would be formed. There is no mention of a right of first refusal on the private company's 50% interest, nor any other mechanism whereby Highway 50 can aggressively drill off a discovery. Highway 50 does not yet have a discovery, so nobody cares, but everybody should be aware that if Sullivan II is found on Monroe, the deal structure is a problem harmful to the interests of Highway 50 minority shareholders that the Leask brothers hopefully move to resolve quickly in an equitable manner.

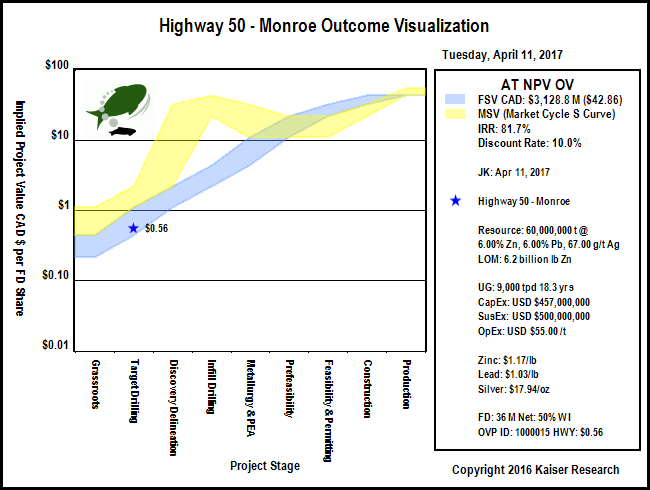

Despite my misgivings about the deal structure, the Monroe play does intrigue me, and to better understand its upside potential, and why the deal structure could unleash a hornet nest of pain, I have conducted an outcome visualization for Monroe based on the PEA Arizona Mining Inc published for the Hermosa-Taylor project last week: SVH Tracker - PEA for Hermosa-Taylor. Both "deposits" would require underground mining to produce a zinc and lead concentrate that would have to be shipped to a smelter. While a ramp may be possible for Monroe, I have assumed a shaft for comparison sake. After all, the Monroe "discovery" does not yet exist. Based on my projected outcome, Monroe would have an after-tax NPV of CAD $3.2 billion at 10% discount rate, with an IRR of 81.7% using $1.17 zinc, $1.03 lead and $17.94 silver as base case prices. After adjusting for a 50% net interest and 36 million shares fully diluted, this represents an ultimate target price of $42.86 for Highway 50. In the context of the rational speculation model the fair speculative value of such an outcome would be in the range of 1.0%-2.5% of the ultimate outcome, which translates into a stock price range of $0.43-$1.07 for Highway 50. What this means is that the market is pricing Highway 50 at the low end of the fair value range relative to what one might consider the best case outcome for a Sullivan II Hunt. If we were in a glass half-full bull market S Curve market behavior would be in action and we would already see a stock price in the $1.07-$2.14 range, which is where the stock should rationally end up if the deepened hole intersects massive sulphide zinc-lead-silver mineralization indicative of a stratiform Sedex system. However, as the Fair Speculative Ladder shows in the Highway 50 - Monroe OV, S Curve action could drive the stock as high as $32 per share if discovery delineation gives shape to the sort of deposit imagined in my Monroe OV. The downside is that the disseminated sulphide mineralization evident at the hole's current depth may dissipate as the drill passes below the Sullivan Time horizon, or intersect a vein like structure such as exists on the adjacent Vine project of PJX Resources Inc. Market interest in the Monroe project would evaporate.

The lack of useful information on the Highway 50 web site caused me to check out the web sites of other juniors with property in the vicinity, and lo and behold, I discovered John Keating's PJX Resources Inc which not only has the biggest land position in this region, but which is best positioned to benefit from a major discovery on the Monroe property, especially through the 100% owned Vine property to the northeast. The West Basin property to the southwest hosts the small FORS deposit whose vicinity has been swiss-cheesed by past operators including a junior once controlled by the Leask brothers. Farther to the southwest Teck controls most of the land and has optioned up to 75% of the DD property from PJX. The area south of the Moyie Fault is open ground because that is the location of dead sediments 10,000 metres thick. This ground will be map-staked by life-style juniors if the Leasks deliver something that looks like a possible Sullivan II. The Dewdney Trail, Eddy and Zinger properties are prospects where the goal is to find the source of local placer gold. The stock is currently suffering from about 15 million units of flow-through stock done at $0.15-$0.17 that came free trading in late March. Unless Highway 50 can do a financing at current levels before drilling resumes, I expect its stock to hold until drilling resumes. Unlike past Sullivan II Hunters who were inclined to provide near daily updates about the stratigraphy traversed by the drill, the Leask brothers tend to keep a lid on drilling progress. If one day the news is good, you will not be able to buy the stock, and if it is bad you will not be able to sell. PJX Resources Inc (PJX-V: $0.18) is an ideal hedge on the outcome of the Monroe drilling program because if Monroe is a dud, nothing happens to the current price of PJX, but if Monroe delivers a discovery hole, there will be a lot of market interest in the adjoining ground.

*JK owns shares in Highway 50 Gold Corp

|