| Kaiser Watch May 8, 2024: Uranium, Gold and Phosphate at MIF |

| Jim (0:00:00): Why do you believe this is a pivotal year for CanAlaska Uranium? |

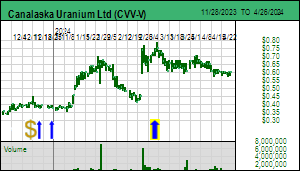

CanAlaska Uranium Ltd, headed by CEO Cory Belyk and Exploration VP Nathan Bridge, has a potentially world class uranium discovery at the Pike zone of its West McArthur project on the eastern flank of Saskatchewan's Athabasca Basin. In mid 2022 CanAlaska intersected high grade basement hosted mineralization within the C10 South corridor, but efforts to find the unconformity through followup wedge drilling eluded the junior until Q1 of 2024 when hole 82-4 intersected McArthur River equivalent grades at the unconformity between basin sandstone and basement granite (up to 40.3% U3O8 over 4.7 m). Two more holes were drilled to establish local geometry and set the stage for delineation drilling in July 2024. The Pike zone is located at a depth of 800 m, with target mineralization expected within a 700-900 m depth range. CanAlaska currently owns 83.3% with partner Cameco diluting through non-contribution; the $7.5 million budget for West McArthur in 2024 out of $14 million working capital will further increase CanAlaska's stake. The goal is to outline a series of very high grade deposits along the C10 South Corridor at the unconformity like a string of pearls comparable to McArthur River's 1 million tonnes at 16% U3O8 representing 350 million lbs of uranium. CanAlaska is also a substantial landholder along the eastern flank of the Athabasca Basin well beyond the limits of the sandstone cover. Some of these projects are already farmed out while others are still available for farmout as interest in the Athabasca Basin heats up. |

Canalaska Uranium Ltd (CVV-V)

Good Spec Value |

|

|

| West McArthur |

Canada - Saskatchewan |

3-Discovery Delineation |

U |

Plan and Section views of Pike zone at unconformity |

What a McArthur River clone would be worth today |

| Jim (0:06:04): What do you believe Forum Energy Metals will accomplish this year? |

Forum Energy Metals Corp, headed by CEO Rick Mazur and Exploration VP Rebecca Hunter, owns 100% of the Aberdeen uranium in Nunavut which surrounds the Kiggavik project controlled Orano, the French nuclear energy company. The Kiggavik project hosts three deposits containing 133 million lbs at an average grade of 0.54% U3O8. Orano spent over $150 million on Kiggavik taking it within striking range of a production certificate in 2011 which was conditional on a development timeline. In light of the uncertainty created by Fukushima Orano declined to agree to a specific timeline and the project has been on care and maintenance since then. Cameco held much of the ground now owned by Forum and discovered the Tatiggaq and Qavvik deposits but dropped its claims, allowing Forum to stake Aberdeen in 2022. The area is part of the Thelon Basin, sandstone covered granite similar in scale to the Athabasca Basin and host to the same style of unconformity associated deposits that can achieve very high grades. Aberdeen straddles sandstone and granite where the basin's sandstone has eroded away. Orano's deposits and Tatiggaq are basement hosted. The Main zone at Tatiggaq has a tonnage footprint of about 2.5 million tonnes at a depth of 80-180 m which at 0.5%-1.0% has a resource potential of 25-50 million lbs U3O8, too small for standalone development. Forum will start a 10,000 m drill program of 30-40 holes in June 2024 on targets revealed by an ANT survey at a similar depth along the same fault structure. The goal in 2024 is to scale up the tonnage potential of Aberdeen and the stage for delineation drilling in 2025. A part of the program is earmarked for the Ned and Bjorn gravity lows along a structure in the sandstone covered northern part of Aberdeen where the presence of the unconformity creates potential for much higher grade deposits. Forum also has substantial holdings in the Athabasca Basin, some of them 100% owned and farmout candidates. At $9.5 million working capital Forum is fully funded for its 2024 plans. |

Forum Energy Metals Corp (FMC-V)

Bottom-Fish Spec Value |

|

|

| Abderdeen |

Canada - Nunavut |

3-Discovery Delineation |

U |

Relative locations of Athabasca and Thelon Basins |

Unconformity-style associated uranium deposit model |

Aberdeen Property Map |

Plan View of Tatiggaq Target and ANT survey grid |

Long Section of ANT targets relative to Tatiggaq Main zone |

Targets to be tested by 2024 10,000 m drill program at Aberdeen |

| Jim (0:11:50): Why do you see West Vault Mining as a leveraged bet on the price of gold? |

West Vault Mining Inc, headed by CEO Sandy McVey and Chairman Peter Palmedo, has positioned itself as a gold optionality play by completing a prefeasibility study and most of the permitting needed to develop the Hasbrouck and Three Hills gold deposits in Nevada to the southwest of Tonopah as open-pit heap leach operations. West Vault, which underwent a reorganization in 2020, has invested CAD $48 million to acquire and advance Hasbrouck project since 2014. The PFS updated in early 2023 indicates an after-tax NPV of USD $206 million at 5% and an IRR of 51.4% using a $1,790/oz base case price for gold that would yield 561,000 oz gold over 8 years from two nearby open pit mines. With CapEx at USD $66.2 million the project clears development hurdles but West Vault is in no hurry to put Hasbrouck into production. The stock offers good speculative value because the market is skeptical a producer would seek to acquire an asset that can produce only 71,000 ounces annually over a short mine life. However, Hasbrouck has resource expansion potential and would be the ideal starter mine for a producer seeking to consolidate and develop deposits in the Tonopah district. Although gold has hit $2,400, the market does not yet believe $2,000 is the new floor that will lead to a much higher real price as the conflict between Global East and West escalates. With $4 million working capital West Vault is in excellent position to wait for a buyout when a producer undertakes a district consolidation. |

West Vault Mining Inc (WVM-V)

Favorite

Good Spec Value |

|

|

| Hasbrouck |

United States - Nevada |

7-Permitting & Feasibility |

Au Ag |

West Vault's Hasbrouck AT NPV (USD) at various gold prices |

West Vault's Hasbrouck AT NPV per share (CAD) at various gold prices |

Daily Change in GLD ETF gold ounce holdings |

| Jim (0:18:07): What is Nevada Organic Phosphate trying to accomplish? |

Nevada Organic Phosphate Inc, headed by CEO Robin Dow, is waiting for the BLM to approve its Murdock Mountain phosphate lease applications in the northeastern corner of Nevada. Uplift of the Leach Mountain range has exposed a 2-4 m thick phosphorite bed that grades in the 10%-20% P2O5 range. These beds represent the western edge of the giant Western Phosphate Field from which 20%-35% beds in Idaho have been mined for the past century. The Murdock Mountain phosphorite has been historically ignored because its low grade cannot compete with the higher grade Idaho phosphorite which is chemically processed to make MAP and DAP phosphate fertilizer. The processing is necessary in order to reduce the heavy metal content below government limits, but this processing prevents MAP and DAP fertilizer from being classified as "organic". The growing interest in organic fertilizers has turned the Murdock Mountain phosphorite into a commercial opportunity because its heavy metal content is a tenth of the limit. The resource footprint potential is 100 million tonnes plus. The business strategy will be to underground mine the beds like a coal seam, grind up the phosphorite and ship a whole rock phosphate product to the organic fertilizer market. The next key steps are BLM approval of the leases expected this year, followed by drill confirmation of the bed's grade, continuity, and consistent low heavy metal content. Once a resource is established the goal is to secure a buyout by a major fertilizer company seeking what will be close to a unique supply of organic phosphate. |

Nevada Organic Phosphate Inc (NOP-CSE)

Bottom-Fish Spec Value |

|

|

| Murdock Mtn |

United States - Nevada |

3-Discovery Delineation |

P2O5 |

Relationship of Murdock Mtn to Western Phosphate Field |

Deposit Model for Murdock Mtn phosphorite beds |

Murdock Mtn heavy metal grades - the key to "organic" |

Leach Mtn Range potential phosporite tonnage footprint |

Proposed Drilling if initial phosphate leases are granted |

| Disclosure: JK owns shares in Nevada Organic; Canalaska and West Vault are Good Spec Value rated Favorites; Forum Energy and Nevada Organic are Bottom-Fish Spec Value rated |