| Kaiser Watch March 22, 2024: Will James Bay Lithium thrive in 2024? |

| Jim (0:00:00): What is the status of the takeover bid for Azure Minerals and what will it mean for Patriot Battery Metals? |

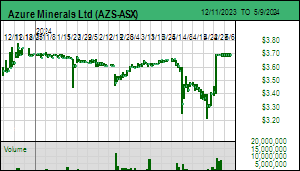

Despite the dampened sentiment with regard to the lithium sector the takeover of Azure Minerals Ltd by SQM and Hancock (Gina Reinhardt) is still proceeding with the shareholder vote taking place on April 8, and if the AUD $3.70 offer is approved, it will be implemented on April 18, 2024. Since drilling started in March 2023 Azure has drilled 248 core holes for 83,219 m and 97 RC holes for 19,267 m in three target areas within the the 9 km by 5 km pegmatite dyke swarm at the Andover project in the western Pilbara region of Australia. So far only 40% of the identified pegmatite targets have been drilled. Target Area 1 is estimated to have a tonnage range potential of 55-105 million tonnes of 1.0%-1.5% Li2O while the more recently tested Target Area 3 has a 25-75 million tonne potential at 1.0%-1.5% Li2O. Azure hopes to release a maiden resource estimate in Q2 of 2024 and a scoping study (PEA) in Q4 of 2024, though we may never see these documents, especially not the PEA, because Azure will have been privatized as a 50:50 JV between SQM and Hancock controlling 60% of Andover while the Mark Creasy group will have the other 40%.

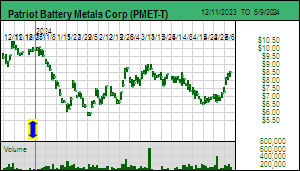

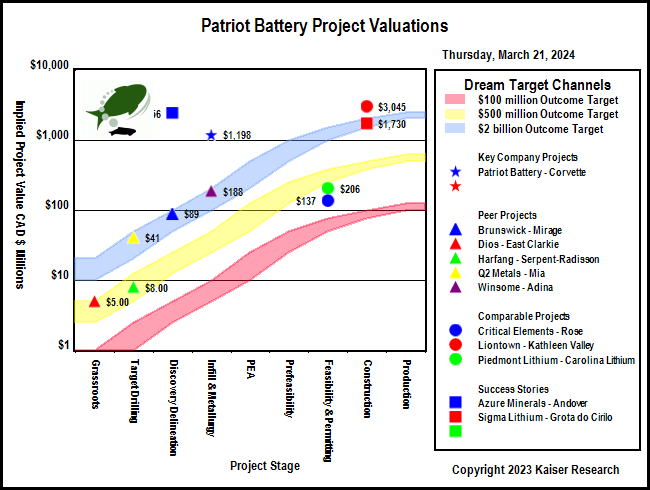

If the acquisition closes at $3.70 per share cash it will value the Andover project at AUD $2.5 billion on a 100% basis, and will inject about AUD $945 million into the pockets of Azure shareholders excluding SQM and Hancock. At the current AUD:CAD exchange rate of about 1.116 that valuation amounts to CAD $2.2 billion compared to the CAD $1.2 billion valuation for Patriot Battery Metal's 100% owned Corvette project at CAD $8.30 per share. On July 31, 2023 PMET released a maiden resource estimate for the CV5 pegmatite in Quebec's James Bay region that came in at 109.2 million inferred tonnes at 1.42% Li2O, pretty much the upper end of the target range that Azure has projected for Target Area 1 of the Andover project. Combining Target Area 1 and 3 Azure is proposing a range of 80-180 million tonnes of 1.0%-1.5% Li2O.

PMET has potential to deliver an updated resource in the 150-200 million tonne range, partly by including a resource for the 4,400 m strike of CV5 of which the maiden resource estimate was based on only 3,750 m strike, marching CV5 another 3.1 km to the southwest where it is expected to join up with the CV13 pegmatite, and a maiden resource estimate for the CV13 pegmatite which has been traced for 2,300 m. This does not include the CV9 pegmatite discovered in late 2023 near the western end of the Corvette property 14 km from CV5 for which initial assays are still pending. And it does not include the CV8, 10, 11 and 12 pegmatite outcrops that will be drilled in 2024. PMET hopes to release an updated resource estimate in Q3 of 2024 and a PFS by the end of 2024.

The fact that SQM and Hancock have stood firm with their $3.70 per share bid for Azure Minerals despite the melt-down in lithium carbonate prices sends us a signal that SQM, a major lithium producer, and Hancock, a new entry in the lithium sector, firmly believe those IEA projections for a required 600% supply expansion by 2030 if the EV component of net zero emission goals are to be met. Those projections, by the way, exclude the possibility of a solid state lithium ion battery becoming reality. Toyota claimed in May 2023 that it had achieved a major manufacturing cost breakthrough for a solid state LIB where substitution of lithium metal for graphite in the anode could double demand. In fact, this doubling in demand is a necessary aspect of the EV future, because unless a carmaker like Toyota can offer an affordable Camry equivalent EV with 1,200 km range on a ten minute charge, the masses in at least North America will never adopt electric vehicles.

For PMET's Corvette project to have a valuation comparable to Azure's Andover project the stock would have to double to $16, just above the $15.29 price at which Albemarle was more than happy to invest $109 million within a week of the CV5 maiden resource estimate. Albemarle, which failed in its effort last year to take over Liontown and its Kathleen Valley project in Australia, has cooled its near term demand projections in light of the slowdown in EV sales, but remains confident about the long term growth of lithium demand. PMET bottomed at $5.77 on February 5 from which it has recovered to $8.30, and I believe it will make a new high ($17.74 was high on June 16) by the end of the year, provided that the rebound of lithium carbonate prices continues. |

Azure Minerals Ltd (AZS-ASX)

Unrated Spec Value |

|

|

| Andover |

Australia - Western Australia |

3-Discovery Delineation |

Li Ni Cu |

Patriot Battery Metals Corp (PMET-T)

Favorite

Fair Spec Value |

|

|

| Corvette |

Canada - Quebec |

4-Infill & Metallurgy |

Li |

Map of Azure's Andover project |

Map of Azure's Andover dyke swarm |

Map of PMET's Corvette project |

Map of pegmatite clusters in PMET's Corvette project |

Timeline for PMET's Corvette project |

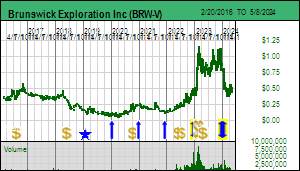

IPV Chart for Patriot Battery Metals |

| Jim (0:10:30): When, if ever, will the James Bay Lithium Index develop an uptrend? |

The James Bay Lithium Index was designed to include all companies with exposure to the James Bay region of Quebec on the premise that because of the novelty of the idea that LCT-type pegmatites could have a world class value any junior could make a major discovery simply by putting boots on the ground. The 2023 summer fire closure prevented the biggest prospecting boom in Canada's history from unfolding, with only a portion of the juniors getting any work done, often with only a few weeks in the field. Meanwhile the lithium carbonate price slump, slowing EV sales, and a general market aversion to the resource sector has vaporized market interest in the idea of Lithium Mania 2.0.

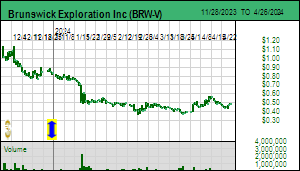

Only a handful of James Bay juniors mounted winter drill programs, including the three I made 2024 Favorites: Brunswick Exploration Ltd, Patriot Battery Metals Corp and Winsome Resources Ltd. All three suffered major declines in January when the market feared another coming lithium winter like 2018-2021 when lithium carbonate prices crashed below $3/lb. Winsome and PMET have recovered some of their declines, but Brunswick has yet to rebound. The winter drilling season ends at the end of April and no work will be done in May while the exploration sector pauses for the annual First Nations goose hunting season. The JBLI bottomed on February 13, 2024 when it was down 46% from its start on August 1, 2023. It has recovered modestly but is still down 40%.

I do not expect the JBLI as a whole to show any major improvement until perhaps September because it has 71 members and many of them are either lifestyle juniors who jumped onto the lithium bandwagon or are down and out toiling geologist type juniors like Dios Exploration Inc. We are in a very poor funding environment and we need leaders such as my three Favorites to develop sustained uptrends to breathe life back into the rest. The big question mark hanging over the market is whether or not Quebec and much of Canada will suffer another hot summer of forest fires that shuts down exploration. Many juniors have claims in areas where there is nothing left to burn, but if fires erupt elsewhere airplanes and helicopters will be requisitioned to fight those fires. There will thus not be an anticipatory buildup ahead of the summer exploration season.

PMET I believe can double because it has already demonstrated solid lithium assets that will support a $2 billion plus valuation once the market is comfortable lithium carbonate prices have stabilized. Winsome will benefit when we see the fruit of the winter drilling at Adina, helped out by the drilling efforts of others in this area - a big question mark about Winsome's Adina is whether it will achieve critical mass for standalone development or need to be consolidated with other pegmatites in the area.. Brunswick is the most important bellwether for the James Bay lithium area; it needs to show that drilling has made Mirage bigger and better, and ideally find the source of the spodumeme boulder field which is not explained by the current focus of their winter drill campaign. For the rest to get any upside movement the overall sentiment with regard to the future of pegmatite sourced lithium supply needs to improve.

There has been a lot of negative press about the slowing EV sales, and the Republican Party has made hostility toward electric vehicles and the energy transition a major talking point, but the shift is still happening. Toyota, which steered clear of electric vehicles while developing its hybrid fleet while quietly working on solving the problems needed to offer a truly desirable and affordable EV, is looking like a genius right now. President Biden's recent increase of emission reduction goals does not ban ICE car sales; it merely forces carmakers to lower their average emission footprint. The growing popularity of hybrids among consumers will help companies like Toyota achieve those lower emission goals while it races to deliver a Tesla killer EV for the masses.

On March 5, 2024 Toyota announced a decision to buy out Panasonic's 49% stake in their Prime Planet Energy & Solutions JV they have operated since 1996. This JV has made batteries for Toyota's hybrid and plug-in hybrid vehicles and is moving into making batteries for electric vehicles, a sector Toyota has so far largely shunned. Last October Toyota announced it would invest an additional $8 billion in its North Carolina battery manufacturing facility into which it had already invested $5.9 billion. Although Toyota is a Japanese company, it builds the cars it sells to American consumers in the United States. The American carmakers are going to have to roll up their sleeves over the next five years if they do not want Toyota and Tesla to eat their lunch.

Nissan and Honda, Japan's second and third largest carmakers after Toyota and normally rivals, have already read the writing on the wall and this week announced they are teaming up to develop an EV for the masses. Lithium Mania 2.0 has merely stalled, but the underlying logic that will drive it not only remains intact, but is becoming stronger as carmakers focus on delivering a solid state lithium ion battery powered EV by 2030. For the Canadian hardrock lithium explorers this is a welcome development, because it will take until 2030 to delineate, permit and construct the mines needed to meet demand set to skyrocket at the start of the next decade. PMET, which has $100 million working capital courtesy of Albemarle, will lead the turnaround. |

Brunswick Exploration Inc (BRW-V)

Favorite

Fair Spec Value |

|

|

| Mirage |

Canada - Quebec |

3-Discovery Delineation |

Li |

Long term lithium carbonate price chart |

James Bay Lithium Index Chart |

Jasmesd Bay Lithium Index Daily Performance |

| Disclosure: JK owns shares of Brunswick; Brunswick, Patriot Battery, Winsome Resources are Fair Spec Value rated Favorites |